In the second half of August, Chinese equities have been under heavy selling pressure as a fear over China’s slowing economy and worries that Beijing may allow the Yuan to continue to depreciate have weighed on investors’ sentiment. Moreover, disappointing economic data fuelled that fears, which resulted in a sharp decline on China's stock market. In less than two weeks, the Shanghai Composite declined from (almost) 4,000 below the next psychologically important barrier of 3,000, hitting fresh 2015 lows. That situation raised concerns that the plunge could spread to other parts of the Chinese economy, triggering fears that Chinese demand for oil will decline (China imports more than 5.65 million barrels of crude oil per day, which makes the country the world's second-largest importer of oil beyond the U.S.). Thanks to these circumstances, light crude hit a fresh multi-year low of $37.75 and the XOI approached the barrier of 1,000, but is the worst behind oil bulls? Let’s take a look at the charts below and try to answer these questions (charts courtesy of http://stockcharts.com).

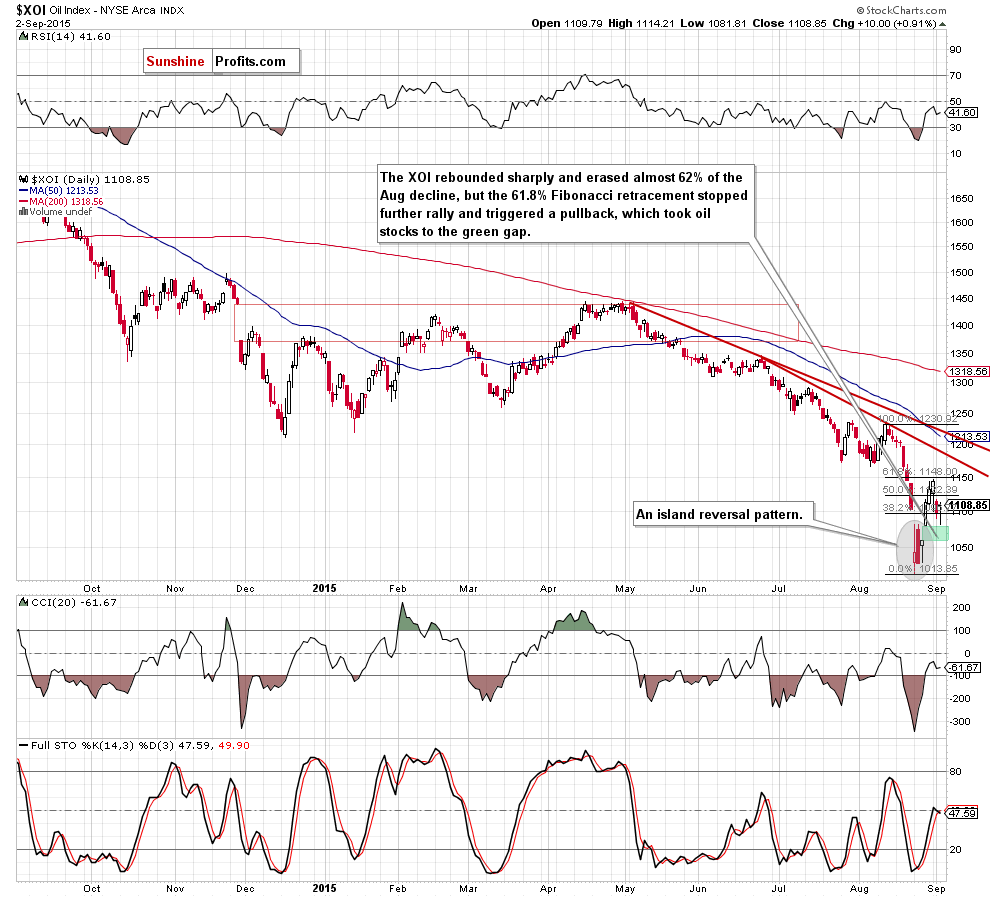

Looking at the daily chart we see that oil stocks rebounded sharply after sizable declines and erased almost 62% of them. However, the 61.8% Fibonacci retracement encouraged oil bears to act, which resulted in a pullback. With this downward move, the XOI slipped to the green gap (it serves as the nearest support), which suggests that we’ll likely see a rebound from here in the coming days. Additionally, at this point, we would like to draw your attention to the island reversal pattern, which suggests that the final bottom may be already in.

Are there any other technical factors that could confirm the above? Let’s check the weekly chart and find out.

From this perspective, we see that oil stocks extended losses and approached the psychologically important barrier of 1,000 in the previous week (an intraweek low of 1,015). As you see, the proximity to this level encouraged oil bulls to act and resulted in a sharp rebound that took the XOI to slightly below the previously-broken resistance line based on the Nov 2012 low. What’s next? Taking into account the short-term picture and the current position of the weekly indicators, it seems that oil bulls will try to push the index higher in the coming week(s).

However, to have a more complete picture of oil stocks, let’s focus on the long-term chart. What can we infer from it?

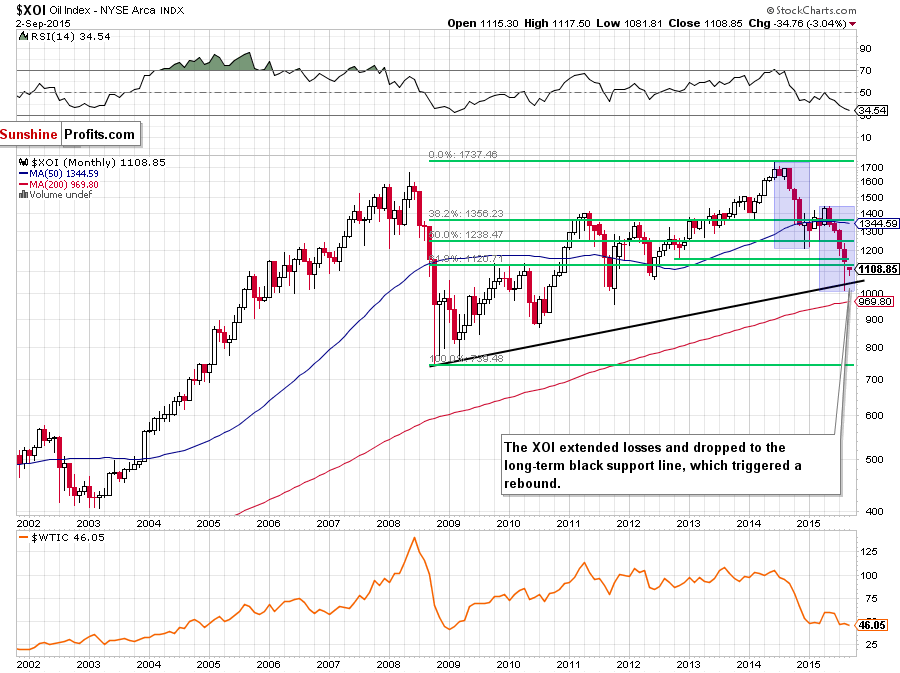

The first thing that catches the eye on the monthly chart is a drop to the long-term black support line based on the Oct 2008 and Mar 2009 lows. As you see, this solid support triggered a sharp rebound, which suggests that even if oil stocks move lower once again, this key support line will likely stop oil bears once again. On top of that, the Apr-Aug decline is almost the same as declines between June and December 2014, which increases the probability of reversal and higher values of the XOI in the coming weeks (or even months).

Summing up, oil stocks extended losses and declined to very important support zone created by the long-term black support line (based on the Oct 2008 and Mar 2009 lows) and the barrier of 1,000. This area triggered a sharp rebound, which created the island reversal pattern on the daily chart and erased almost 62% of the Aug declines. All the above suggests that higher values of oil stocks are just around the corner (even if oil stocks moves lower once again, the above-mentioned key support zone will be strong enough to stop oil bears and further deterioration).

The above article is based on our latest Oil Investment Update. Its full version includes much more details and is accompanied by scenario analysis and summary of key factors that are likely to affect crude oil and oil stocks in the coming weeks. If you enjoyed it, we encourage you to sign up for Oil Investment Updates or the Fundamental Package that includes it.

Moreover, today's Oil Trading Alert includes our long-term price prediction for crude oil. It is rarely the case that multiple factors point to the same price, but we see exactly that. If you want to profit from the upcoming major move in crude oil, we strongly encourage you to subscribe read today's Oil Trading Alert.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD remains under pressure above 0.6400

AUD/USD managed to regain some composure and rebounded markedly from Tuesday’s YTD lows in the sub-0.6400 region ahead of the release of the Australian labour market report on Thursday.

EUR/USD holds above 1.0650 amid renewed selling pressure in US Dollar

The EUR/USD pair edges higher to 1.0672 on Thursday during the early Asian session. The recovery of that major pair is bolstered by renewed selling pressure in the US Dollar and a risk-friendly environment.

Gold retreats as lower US yields offset the impact of hawkish Powell speech

Gold prices retreated from close to weekly highs during the North American session on Wednesday amid an improvement in risk appetite. The bullish impulse arrived despite hawkish commentary by US Federal Reserve officials.

Bitcoin price uptrend to continue post-halving, Bernstein report says as traders remain in disarray

Bitcoin price is dropping amid elevated risk levels in the market. It comes as traders count hours to the much-anticipated halving event. Amid the market lull, experts say we may not see a rally until after the halving.

Australia unemployment rate expected to rise back to 3.9% in March as February boost fades

Australia will publish its monthly employment report first thing Thursday. The Australian Bureau of Statistics is expected to announce the country added measly 7.2K new positions in March after the outstanding 116.5K jobs created in February.