Highlights

- Market Movers: Weekly Technical Outlook

- EURUSD: Is Parity Back on the Cards?

- US Payrolls Data Adds to Dollar’s Luster

- Look Ahead: Equities

- Look Ahead: Commodities

- Global Data Highlights

Market Movers: Weekly Technical Outlook

Technical Developments to Watch:

- EUR/USD at a new 12-year low under 1.09, more weakness favored below 1.1100

- GBP/USD following euro lower, key psychological support sits at 1.50

- USD/JPY bulls eyeing 7-year high at 121.80

- NZD/USD in play, bears may push for a drop to .7200 depending on RBNZ

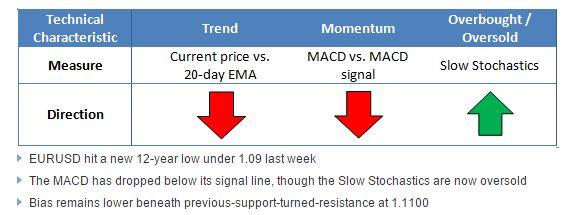

EUR/USD

It was a rough week for the world’s most heavily-traded currency pair. EURUSD fell sharply on the last three trading days of the week, propelled lower by the continued divergence between US and European monetary policy and a strong US jobs report. From a technical perspective, the pair hit a new 12-year low under 1.09, opening the door for more weakness in the days to come. The MACD has rolled over and is now trending lower back below its signal line, though the oversold Slow Stochastics raise the chances of a short-term bounce this week. Nonetheless, EURUSD’s bias will remain lower beneath previous-support-turned-resistance at 1.1100.

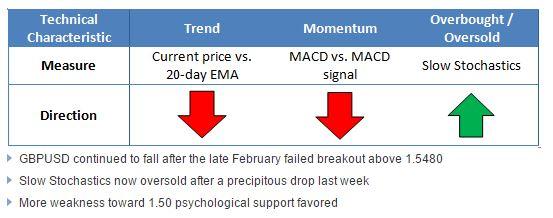

GBP/USD

GBPUSD continued to sell off last week, propelled by the failed breakout above key resistance at 1.5480 at the end of February. As of writing, the pair has broken below previous support/resistance line at 1.5200, and with the Slow Stochastics falling into oversold territory, a bounce early this week wouldn’t be surprising. That said, as long as rates remain below previous-support-turned-resistance at 1.5200, GBPUSD bears could seek to press the pair back down toward previous psychological support at 1.50.

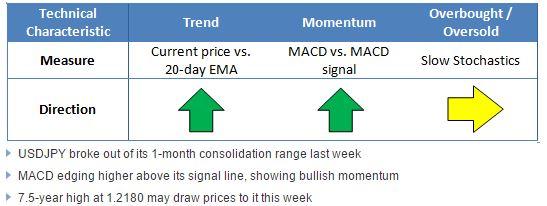

USD/JPY

Volatility finally picked up a bit in USDJPY last week, with the strong NFP report driving the pair out of its 1-month consolidation range. At the same time, the MACD has turned higher above the “0” level, signaling a shift back to bullish momentum after weeks of lackluster trade. In the coming week, the 7.5-year high at 121.80 may serve as a magnet and draw prices to it as long as rates hold above support at the 20-day EMA (119.40).

NZD/USD

NZDUSD is our currency pair in play this week due to a number of high-impact economic reports out of New Zealand, China and the US (see “Data Highlights” below for more). Last week, the pair stalled out directly at a major level of previous support (.7625) as the RBNZ said that it was exploring macroprudential policies that make an interest rate hike less likely. With the secondary indicators both in the neutral territory, price could still fall further toward the recent lows at .7200, especially if the RBNZ is dovish in its meeting in ahead of Thursday’s Asian session.

EUR/USD: Is Parity Back on the Cards?

Last week was another week of records for EURUSD, which fell below the critical 1.10 support level to its lowest rate in 12 years at 1.0844 (at the time of writing), after a stronger-than-expected payrolls report for February.The US economy created 295k payrolls, and the unemployment rate fell to 5.5%, its lowest level since June 2008. There had been some caution over the February payrolls number because of the recent bout of bad weather across the US, which may have disrupted the numbers. However, a weather-related miss was not to be, and the better than expected number was another nail in the coffin for EURUSD. Below here, we would target 1.0765 – a key support level from 02/09/2003.

Although we are still some way from EURUSD reaching parity, there are some fundamental reasons that could support another move lower in EURUSD:

This large NFP number could make the Fed less patient when it comes to raising rates, at the same time as the ECB is starting its QE program. This could accelerate a move to parity.German 30-year bond yields fell to a record low on Friday, in contrast US 2 year Treasury yields rose to their highest level of the year so far, which may also weigh on EURUSD.ECB QE has boosted European stocks and bonds (yields have fallen), which is weighing on the EUR.But, there are a couple of things the EUR bears need to watch out for:

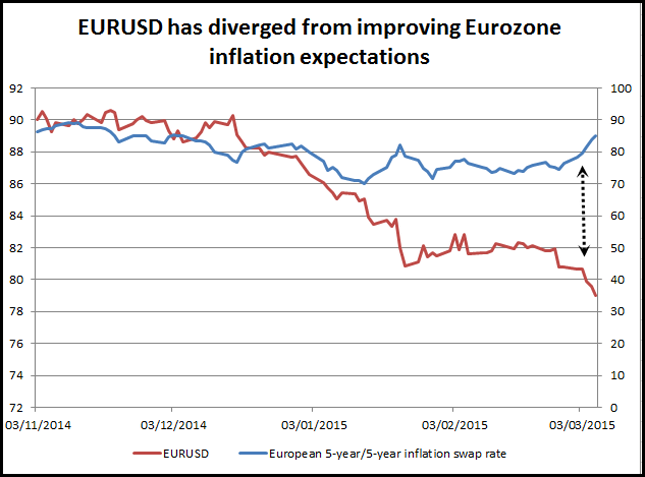

European economic data has been picking up of late, but this hasn’t helped to stem the decline in the EUR. How long will the market ignore it?Also, there are signs that deflation in the currency bloc could be coming to an end. The 5-year/5-year EUR inflation swap rate is an indication of the market’s future expectations for prices in the currency bloc. This measure has risen sharply in recent days and surged to its highest level since early December 2014 on Friday.We think that it is worth watching European inflation expectations closely. As you can see in figure 1 below, which shows EURUSD and the 5-yr/5-yr EUR inflation swap rate normalized to show how the two move together. The EUR and future inflation expectations tend to move in the same direction, but have diverged sharply this month. If inflation expectations continue to pick up, then maybe the ECB’s QE program, which has fuelled the EUR weakness, could be cut short?

For now, the downtrend in the EUR is strong and broad-based. It would take a brave trader to stand in its way. But even with the strong payrolls number, the market could still overshoot to the downside. If EURUSD declines to 1.0765 or lower in the coming days, then we could get a short squeeze as the market may start to book some profit.

But a short squeeze doesn’t mean the end of the euro’s downtrend is nigh; it usually only means a brief respite, perhaps back to 1.10 or slightly higher. It will take a big effort to change sentiment towards the EUR at this stage. If this is to happen in the short-term then we may need to see the focus shift from the strong US labor market data to the better tone to European data, especially the pick-up in the inflation data.

The market has been happy to sell EUR for the past 8 months, but after such a strong, sustained downtrend, the road to parity may not be a straight line. It relies on strong US data, and the market continuing to ignore the better tone to European data and inflation expectations. Even if the EUR looked vulnerable last week, it could encounter a sharp short squeeze in the coming days and weeks, especially if the Eurozone looks like it is turning a corner.

US Payrolls Data Adds to Dollar’s Luster

The dollar made multi-year highs across the board last Friday and was up against all members of the G10, as well as all emerging market currencies bar the Russian ruble and some Asian currencies. Momentum had been on the side of the dollar earlier this week then the dollar index made a fresh 11-year high, however the buck enjoyed another leg higher after a strong jobs report for February.

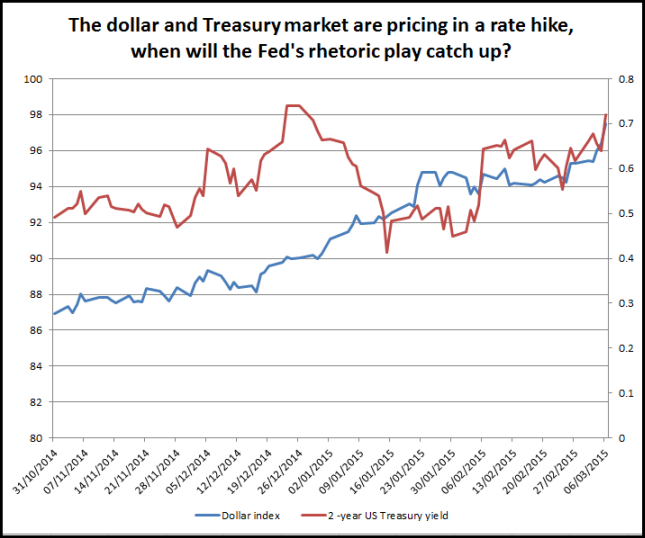

The US labor market is tightening much faster than expected, however productivity and wage growth are yet to play catch up. US wage data for February picked up a mere 0.1% last month, the annual rate fell to 2% from 2.2%. Although the Fed has sounded cautious over the lack of wage growth in the past, the market is ignoring the weak spots of last month’s report. Instead it is re-pricing in the prospect of a rate hike, potentially as early as June. This is reflected in the sharp move higher in the 2-year US Treasury yield, which jumped by 12 basis points in the aftermath of the data release.

As we stand now, the Fed’s rhetoric is what needs to play catch up, as the dollar and Treasury market are now pricing in a rate hike. Will another huge NFP print be enough for the Fed to change its stance from “patient” to actively considering a rate hike? The next statement from the Fed, released on 18th March, will be scrutinized closely to see if the Fed takes a step closer to hiking rates. We could see the dollar rally into the next FOMC meeting, as the world apart from the US is bereft of yield, making the dollar the world’s most attractive currency right now. The data has delivered, the market has priced it in, and the only part of the puzzle we don’t have is whether the Fed will pull the trigger and raise rates. We should find out more on 18th March.

From an FX perspective, USDJPY is close to former 7.5-year highs at 121.85, and EURUSD made a fresh 12-year low on Friday. Even the pound gave back recent gains and moved towards the bottom of the most recent range at 1.5050. On a broad basis, we think that Friday’s strong payrolls number and jump in US bond yields could also lead to weakness in the Aussie and Kiwi, which had managed to consolidate in recent weeks and now could join the JPY and the EUR and come under further pressure.

Look Ahead: Equities

The stock market rotation is in full swing by the looks of it. In the immediate aftermath of Friday’s strong US jobs report, US index futures dropped sharply as the data increased speculation that the Fed may increase interest rates earlier than was previously priced in. In contrast, European markets remained elevated and some indices hit fresh multi-year or all-time highs. The market’s reaction suggests that investors are showing preference for stocks in the euro zone where the central bank is turning dovish. That however is not to say that the US stock market has topped; rather, that it may underperform Europe going forward.The ECB provided details of its €60 billion a month of monetary stimulus program this week, announcing that it would start on Monday 9 March and will continue until at least September 2016. This quashed some market speculation that the central bank may delay the program or reduce its duration following the release of some decent Eurozone data. As a result, European shares rallied sharply.

While the euro zone is about to embark on a large scale QE program, the timing of the Fed’s first rate hike is a hotly debated topic in the US. The strong US jobs report is just likely to increase calls for an earlier rate hike. Indeed, even the Fed’s John Williams has said that “by mid-year it will be the time to have a serious discussion about starting to raise rates”. He has pointed out that the lags in the transmission mechanism of monetary policy argue for raising rates sooner rather than later. However when the Fed does eventually start the rate hiking cycle, it will most likely be gradual at best. So the US stock market rally may have further momentum left in it.

But we would still prefer the European over US stocks, for they have potentially a lot of catching up to do. That said, some of these indices, such as the Euro Stoxx 50, look extremely overbought now and a small pullback should not come as a surprise early next week. As can be seen on the chart, the RSI is at the overbought threshold of 70. Meanwhile the index itself is testing some key Fibonacci extension levels around 3633/46 (which are derived from the previous price swings AB and CD). However just because the RSI is at 70 it doesn’t necessarily mean a pullback is imminent. The RSI being at this level actually shows the bullish trend is extremely strong. So, if the index goes on to clear the aforementioned Fibonacci resistance area then there is not much resistance seen until the next Fibonacci target at 3835 (200% of AB). Further targets are at 3870 (261.8% of CD) and 3970, with the latter being the 78.6% retracement level of the bear trend from the 2007 peak. Meanwhile the old resistance levels such as 3605 and 35030 could now turn into support.

Look Ahead: Commodities

Ahead of the US monthly jobs report on Friday, gold was hovering just above the $1190 handle and was looking a little bit oversold after being down for five consecutive sessions. Most market participants were seemingly anticipating the jobs report to moderate slightly following the release of some mixed-bag labour market indicators for last month. For example, the employment component of the services sector PMI had surged nearly five points last month to 56.4 from 51.6 the previous month, while that of the manufacturing PMI had edged lower to 51.4 from 54.1 in January. The ADP employment report meanwhile had showed a moderate gain of 212,000 in non-farm private sector payrolls, which was more or less in line with the expectations. Thus taking all of these indicators into consideration, it would have not been unwise to expect a NFP print of around 240,000.However the gain in nonfarm employment was significantly better. Some 295,000 jobs were added into the economy which pushed the rate of unemployment to just 5.5% from 5.7% previously. Although the growth in earnings was not as strong as had been expected, the dollar nonetheless rallied hard as speculators adjusted their expectations about the first rate hike from the Fed. As gold is priced in US dollars, the shiny metal plunged and broke though some key support levels.

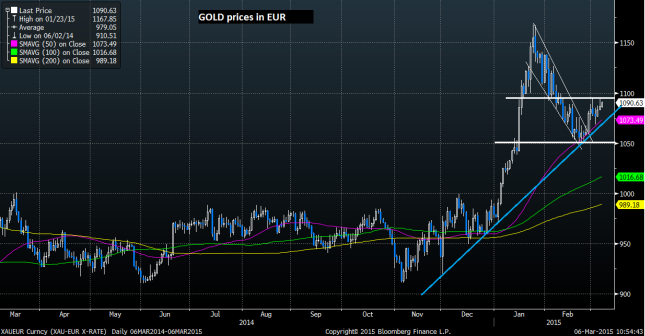

If calls for an earlier Fed rate hike increase, then so too could the buying pressure on dollar. This in turn may weigh further on the buck-denominated gold next week. But the dollar actually conceals the underlying strength in gold, for the metal has actually put on a decent performance against the euro lately (see the chart in figure 3). With the ECB about to embark on a potentially open-ended QE from Monday, the single currency could lose further ground. This may boost the appeal of gold as an attractive alternative to fiat currency. In the long-term, once inflation returns, demand for gold as a hedge against rising prices should increase too. Meanwhile demand for jewellery purchase in countries such as India and China is only set to grow. So, although gold may appear doomed in the short-term, our long-term view is still pretty much bullish on the shiny metal.

Whereas gold in euro terms is holding above all of its main moving averages, against the dollar, it is a completely different story. Therefore any pause in the dollar rally could see a corresponding bounce in gold prices. The opposite is obviously also true. At the time of this writing on Friday afternoon, gold was holding below the long-term support around $1180 and was only a few bucks off $1170 which is where a couple of Fibonacci levels converge (78.6% of AB and 161.8% of CD). If it goes on to break below the $1170 level next week then a pullback towards the November’s low of 1130 could be on the cards. Meanwhile the key resistance levels to watch are at $1190, $1200 and $1220 – levels that were previously support and/or resistance. A potential closing break above $1200 would put an end to the bearish trend.

Global Data Highlights

Sunday, March 8, 201523:50 GMT Japanese Final Gross Domestic Product (Q4)

When the preliminary release of this economic measure was revealed, there was a giant sigh of relief as it didn’t register with negative numbers. While it still missed consensus expectations of around 0.9% with the 0.6% print, the reaction was mainly positive. As long as everything goes according to plan and there isn’t a large revision to the downside, this release may not have that large of an impact. If there are revisions lower though, thoughts of more stimulus from the Bank of Japan may propel JPY crosses higher.

Monday, March 9, 2015

All Day Eurogroup and ECOFIN Meetings

The chances of these meetings being as exciting as the last meetings that took place during the most recent Greek crisis are slim; however, there may be some interesting developments that come from them. The German contingent, specifically Wolfgang Schäuble, seemed the most resistant to anything that Greece brought to the table outside of what was previously agreed upon. So there may be some hard feelings that haven’t yet been given time to settle, and it appears the Greek people still aren’t happy with the outcome. The Greek reporter who essentially castigated Mario Draghi at the European Central Bank press conference this past week could simply be the first frustrating outburst seen. Any further strife could depress the euro even further.

Tuesday, March 10, 2015

1:30 GMT Chinese Consumer Price Index (February)

The People’s Bank of China has been very active of late by adjusting a variety of monetary policy tools to help boost their economy as well as inflation. Like most central banks, they want to get their CPI closer to 2.0%, and the 0.8% figure they most recently experienced isn’t good enough. Consensus may be tricky to achieve as well, as they haven’t been able to better that figure since the June 2014 release. To make matters more difficult, consensus is calling for an improvement to 0.9%; that’s challenging due to the fact that improvements have been rare, happening only twice over the last year. Another miss could send the NZD even lower as the Reserve Bank of New Zealand seems to be engaging in a bit of macroprudential policy to calm real estate speculation, and tangentially weaken their currency.

Wednesday, March 11, 2015

9:30 GMT UK Industrial and Manufacturing Production (February)

Many of the economic figures out of the UK have been decent of late, but these two figures haven’t joined the party. Industrial Production in particular has had three straight declines and consensus is expecting there to be a fourth. If both can merely slip in to positive territory the recent lack of strength in the GBP could potentially be reversed as it has been following the EUR more than its own economics.

20:00 GMT Reserve Bank of New Zealand’s Interest Rate Decision and Policy Statement

As mentioned earlier, the RBNZ has waded in to the macroprudential pool in an effort to ease their housing market, which means they likely won’t be raising rates any time soon. The big shock would be if they sound hawkish, but with the recent rumors coming out of the organization, that won’t likely come to fruition.

Thursday, March 12, 2015

0:30 GMT Australian Employment Change and Unemployment Rate (February)

Last month’s employment figures were an utter disaster for Australia as unemployment rose 0.3%, and the employment change was -12.2k. This was the first negative result in 4 months, and the AUD took a hit because of it. However, the Reserve Bank of Australia hesitated in cutting rates this past week, but they left the door open to potentially cutting rates more in the near future. Another miss in employment could give them more than enough reason to cut rates next time, and that would surely be a depressing thing for the AUD.

9:30 GMT UK Trade Balance (January)

Much like in the US, the Trade Balance in the UK isn’t widely considered to be a significant market mover. However, markets typically would like to see this heading in the positive direction, and if it is then the GBP benefits, marginal as it may be.

10:00 GMT European Industrial Production (January)

This data is a little baked in already as it comes from January, and the machinations of the ECB and their QE program has taken more precedent. The recent trend is more negative than positive, but European data on the whole has been surprisingly strong of late. If this were able to improve, it may be enough to boost the EUR from some very depressed levels.

12:30 GMT US Retail Sales (February)

There has been a lot of hullabaloo surrounding the US and its economic superiority of late, but Retail Sales apparently failed to get the memo. The last two months have declined by 0.8% and 0.9% respectively, but have been largely overshadowed by all the other good US data points. On that front, good US data seems to be bordering on old hat, so only REALLY good figures have a profound impact. Therefore, this release may have more of a chance of disappointing than providing any kind of a boost to the USD.

Friday, March 13, 2015

12:30 GMT Canadian Net Change in Employment and Unemployment Rate (February)

The employment situation in Canada reversed course last month after witnessing two straight months of declining figures and posted a 35.4k increase. The Bank of Canada appeared more confident in their assessment of their economy this past week and employment may go right along with that optimism. Oil has leveled out, so there may not be a monumental increase in energy layoffs to be seen. One thing to watch out for though is that Canadian employment tends to swing heavily from month to month from positive to negative over the last couple years. It is only recently that we have seen consecutive months of good or bad data and if that new trend continues, look for a figure that is better than the 21.3k consensus.

12:30 GMT US Producer Price Index (February)

This is one of the lesser watched inflationary indicators, but could have a profound impact as it appears at least half of the Fed’s mandate is being fulfilled, that being employment. The other half is stable prices, which the central bank would prefer to be around 2%, but last month’s PPI fell all the way down to 0% YoY. Brutal? Yes. Surprising? Not really. The decline in oil prices had a large say in that figure and if Yellen takes a similar stance to Bernanke, she could view much of the lack of inflation on the transitory effects of oscillating oil prices. Nonetheless, a rise in this figure could increase the likelihood of an interest rate increase in June as inflation begins to move in the preferred direction.

13:55 GMT UM/Reuters US Preliminary Consumer Sentiment Index (March)

After such a blockbuster NFP report this past week and continued low prices at the gas pump, consumer sentiment may begin to nudge higher once again. This being the preliminary release, it is the first major indication of sentiment for the American public for the month, and if it indicates that opinion on the economy is continuing to increase, the USD could continue to enjoy the run it has had over the last few months.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD favours extra retracements in the short term

AUD/USD kept the negative stance well in place and briefly broke below the key 0.6400 support to clinch a new low for the year on the back of the strong dollar and mixed results from the Chinese docket.

EUR/USD now shifts its attention to 1.0500

The ongoing upward momentum of the Greenback prompted EUR/USD to lose more ground, hitting new lows for 2024 around 1.0600, driven by the significant divergence in monetary policy between the Fed and the ECB.

Gold aiming to re-conquer the $2,400 level

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

Bitcoin price defends $60K as whales hold onto their BTC despite market dip

Bitcoin (BTC) price still has traders and investors at the edge of their seats as it slides further away from its all-time high (ATH) of $73,777. Some call it a shakeout meant to dispel the weak hands, while others see it as a buying opportunity.

Friday's Silver selloff may have actually been great news for silver bulls!

Silver endured a significant selloff last Friday. Was this another step forward in the bull market? This may seem counterintuitive, but GoldMoney founder James Turk thinks it was a positive sign for silver bulls.