Highlights

- Market Movers: Weekly Technical Outlook

- Is the Dollar Rebound Here to Stay?

- Have China and Japan Been Holding Back the Dollar?

- Look Ahead: Stocks

- Look Ahead: Commodities

- Global Data Highlights

Market Movers: Weekly Technical Outlook

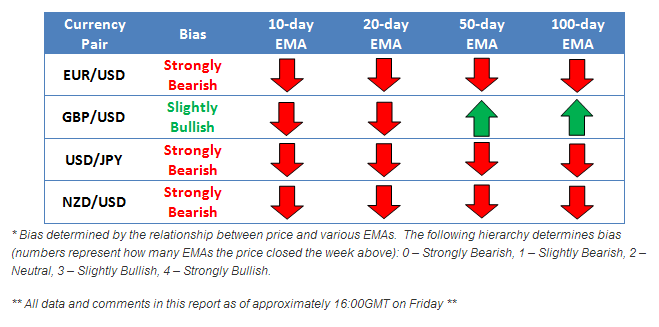

Technical Developments to Watch:

- EUR/USD barely holding above key 1.3475-1.3500 support zone

- GBP/USD bullish above 1.7040-60 support, but break below would shift bias

- USD/JPY testing the bottom of its multi-month range around 101.00

- NZD/USD in play, all eyes on RBNZ decision and statement

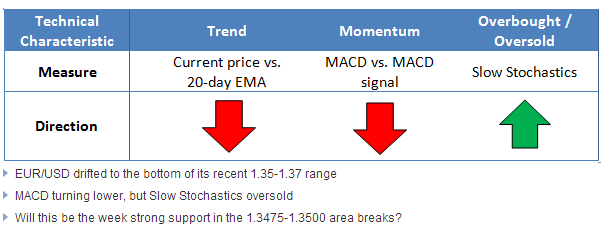

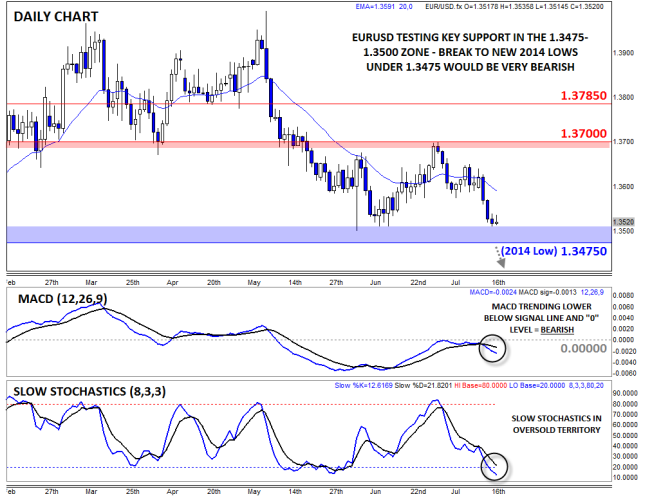

EUR/USD

The EUR/USD drifted generally lower last week, but stalled out ahead of key previous support in the 1.3475-1.3500 range. The drop was attributed to a perceived hawkish speech by Fed Chair Yellen and general risk-off trading in the wake of a series of geopolitical threats on Thursday. The pair’s MACD shifted lower in the wake of the downdraft, but the Slow Stochastics have now dipped into oversold territory, raising the probability of a bounce this week. The latest developments out of Ukraine, Russia, and the Middle East will be critical this week; if we see the safe haven bid for the greenback strengthen, the EUR/USD could break below key support in the 1.3475-1.3500 zone.

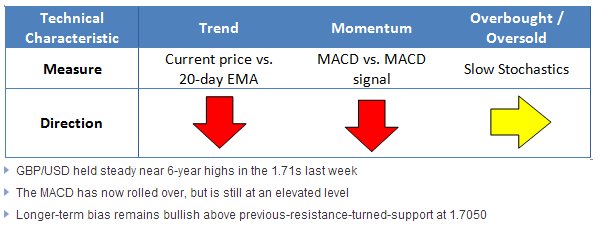

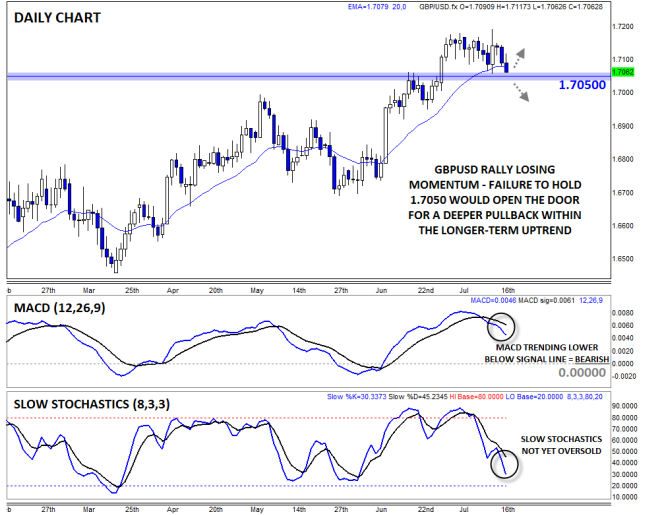

GBP/USD

The GBP/USD had another generally trendless week, barring the brief spike on Tuesday’s UK employment report. The pair continues to find support in the upper-1.70s, but has been unable to tack on further gains after breaking out to a new 6-year high three weeks ago. Looking to the secondary indicators, both the MACD and its signal line have turned lower, indicating that the recent bullish momentum is moderating, while the Slow Stochastics are far from overbought or oversold territory. For this week, we maintain a cautiously bullish outlook as long as the 1.7050 level holds as support, but a break below that area would point to a more substantial pullback within the context of the long-term bullish trend.

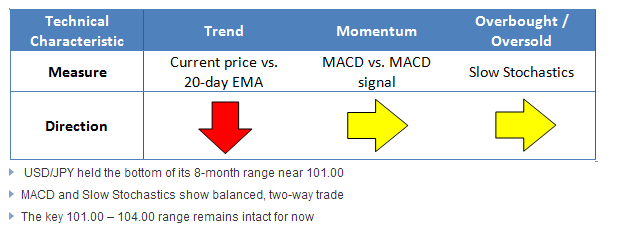

USD/JPY

The USD/JPY traded sharply lower on Thursday of last week as news that a Malaysian Airlines flight had been shot down over Ukraine hit the wires, increasing demand for the safe-haven yen. Just as we’ve seen numerous times this year though, buyers stepped in to defend critical support at the 101.00 level. As of writing on Friday afternoon, rates have recovered back to the mid-101.00s and there is potential for a more substantial bounce heading into this week. Neither the MACD nor the Slow Stochastics are giving a clear signal, so this week’s trade may hinge on headlines out of Ukraine and the Middle East, as well as the market’s overall risk appetite more than any technical levels.

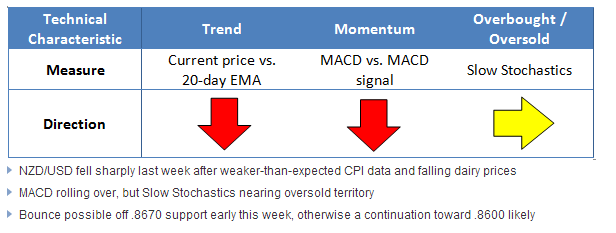

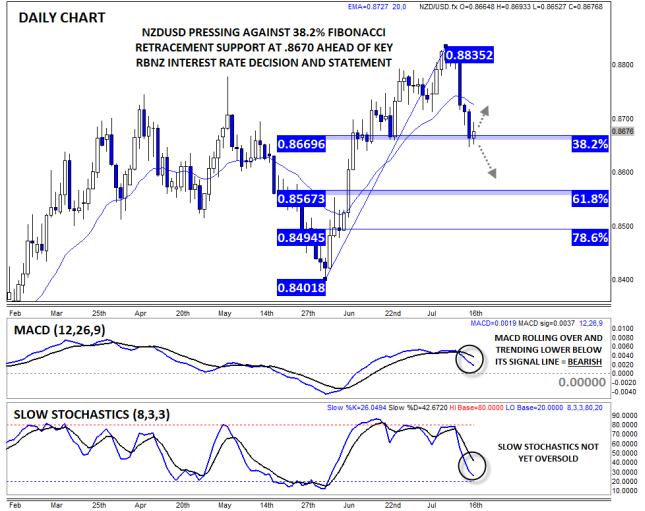

NZD/USD

The NZD/USD is our currency pair in play due to a number of high-impact economic reports out of the New Zealand and the US this week (see “Data Highlights” below for more). From a technical perspective, the pair traded sharply lower last week as weak CPI data and falling dairy prices ratcheted down interest rate expectations in the island nation. Given the relatively low level in the Slow Stochastics indicator, the pair may bounce from 38.2% Fibonacci support early this week, but if that floor at .8670 breaks, rates may fall toward .8600 next.

Is the Dollar Rebound Here to Stay?

One of the most frustrating trades of the year so far has been the decline in the dollar, but stories of the greenback’s demise might be greatly exaggerated after comments from Fed chairwoman Janet Yellen last week prompted a dollar rebound. The dollar index, or the dollar against a basket of its largest trading partners, broke above a key level of resistance at 80.26 – the 200-day moving average – triggering a move back to the highest level for a month.

During her semi-annual testimony to Congress last week, Janet Yellen said: “If the labour market continues to improve more quickly than anticipated… then increases in the federal funds rate target would likely occur sooner and be more rapid than currently envisioned.” This suggests that the Fed is happy with the current level of jobs growth, and if that can be maintained, then interest rates may need to rise before the end of summer 2014, which is what the market had expected prior to her testimony. A dovish stance from the Fed was one of the factors underpinning dollar weakness for most of this year, so if this rally is to be sustained then we may need to see a shift to a neutral stance by Yellen and the rest of the FOMC in the coming weeks.

The market seems to be divided into two camps about Yellen’s comments last week. On one side those who think she has woken up and smelt the roses and is taking job gains and inflation increases seriously at last, while the other view is that Yellen’s testimony could be designed to deliberately wrong-foot the market so it doesn’t get too complacent about the Fed’s accommodative policy stance.

One cannot deny that jobs growth has been pretty spectacular in recent months: we’ve now seen five consecutive +200k readings for payrolls and a fall in the unemployment rate to its lowest level since 2008. At the same time inflation has been rising, with core PCE, an inflation measure looked at by the Fed, rising to its highest level in 15 months. Thus, last week’s performance was necessary to reinforce to the market that the Fed is watching the fundamentals after her flippant remark during the June post-FOMC press conference that inflation pressure was just “noise.”

While it is easy to assume that there could be glimmers of hawkishness in Yellen’s comments, we are not so sure that she was signaling a policy shift at the Federal Reserve. Instead she may have wanted to evolve forward guidance to become more balanced while simultaneously pledging to keep monetary policy accommodative for some time.

This may sound contradictory. However, in a paper produced by the St. Louis Fed at the end of 2012, economists found that central banks that have used forward guidance, including the Scandinavian central banks and the Reserve Bank of New Zealand, tended to keep policy looser than the economic data may justify. Thus, don’t expect the Fed to start hiking rates any time soon.

Interestingly, although the US dollar rallied on the back of Yellen’s comments, Treasury yields actually moderated last week, with the 10-year yield falling back to 2.5% at one stage and 2-year yields also backing away from recent highs at 0.48%. Likewise, stock markets rallied, which may not have occurred if investors thought that it was realistic to expect a more hawkish Fed going forward.

FX is the lone asset class that seems to be pricing for a more hawkish Fed, which could leave the dollar vulnerable to a pullback. However, countering this could be weakness elsewhere. The dollar may well be able to sustain a move higher if the EUR continues to come under pressure as growth in the Eurozone moderates, and the pound continues to look a little stretched as we get close to 1.72. Thus, while we don’t think that the dollar is a full-fledged member of the higher yielders club, the greenback’s time to shine may have arrived if it can capitalize on weakness elsewhere in the G10 FX space.

One of the most frustrating trades of the year so far has been the decline in the dollar, but stories of the greenback’s demise might be greatly exaggerated after comments from Fed chairwoman Janet Yellen last week prompted a dollar rebound. The dollar index, or the dollar against a basket of its largest trading partners, broke above a key level of resistance at 80.26 – the 200-day moving average – triggering a move back to the highest level for a month.

During her semi-annual testimony to Congress last week, Janet Yellen said: “If the labour market continues to improve more quickly than anticipated… then increases in the federal funds rate target would likely occur sooner and be more rapid than currently envisioned.” This suggests that the Fed is happy with the current level of jobs growth, and if that can be maintained, then interest rates may need to rise before the end of summer 2014, which is what the market had expected prior to her testimony. A dovish stance from the Fed was one of the factors underpinning dollar weakness for most of this year, so if this rally is to be sustained then we may need to see a shift to a neutral stance by Yellen and the rest of the FOMC in the coming weeks.

The market seems to be divided into two camps about Yellen’s comments last week. On one side those who think she has woken up and smelt the roses and is taking job gains and inflation increases seriously at last, while the other view is that Yellen’s testimony could be designed to deliberately wrong-foot the market so it doesn’t get too complacent about the Fed’s accommodative policy stance.

One cannot deny that jobs growth has been pretty spectacular in recent months: we’ve now seen five consecutive +200k readings for payrolls and a fall in the unemployment rate to its lowest level since 2008. At the same time inflation has been rising, with core PCE, an inflation measure looked at by the Fed, rising to its highest level in 15 months. Thus, last week’s performance was necessary to reinforce to the market that the Fed is watching the fundamentals after her flippant remark during the June post-FOMC press conference that inflation pressure was just “noise.”

While it is easy to assume that there could be glimmers of hawkishness in Yellen’s comments, we are not so sure that she was signaling a policy shift at the Federal Reserve. Instead she may have wanted to evolve forward guidance to become more balanced while simultaneously pledging to keep monetary policy accommodative for some time.

This may sound contradictory. However, in a paper produced by the St. Louis Fed at the end of 2012, economists found that central banks that have used forward guidance, including the Scandinavian central banks and the Reserve Bank of New Zealand, tended to keep policy looser than the economic data may justify. Thus, don’t expect the Fed to start hiking rates any time soon.

Interestingly, although the US dollar rallied on the back of Yellen’s comments, Treasury yields actually moderated last week, with the 10-year yield falling back to 2.5% at one stage and 2-year yields also backing away from recent highs at 0.48%. Likewise, stock markets rallied, which may not have occurred if investors thought that it was realistic to expect a more hawkish Fed going forward.

FX is the lone asset class that seems to be pricing for a more hawkish Fed, which could leave the dollar vulnerable to a pullback. However, countering this could be weakness elsewhere. The dollar may well be able to sustain a move higher if the EUR continues to come under pressure as growth in the Eurozone moderates, and the pound continues to look a little stretched as we get close to 1.72. Thus, while we don’t think that the dollar is a full-fledged member of the higher yielders club, the greenback’s time to shine may have arrived if it can capitalize on weakness elsewhere in the G10 FX space.

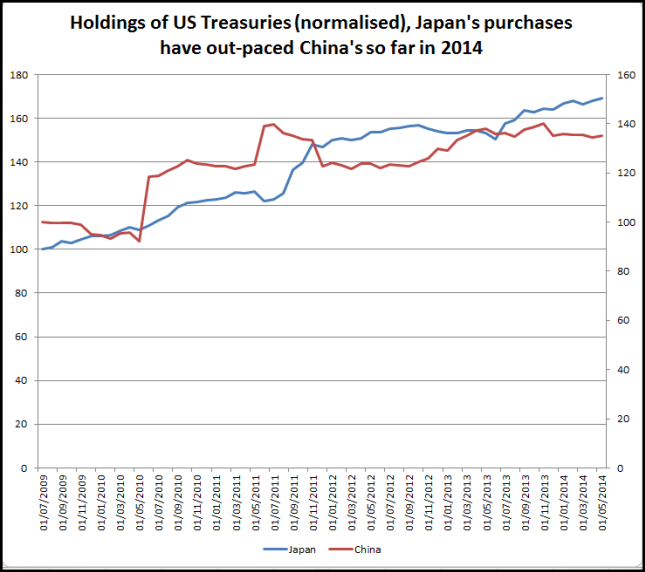

Have China and Japan Been Holding Back the Dollar?

As we discussed above, the stubborn weakness in the dollar has been one of the biggest conundrums in the FX space so far in 2014. One factor underpinning this weakness has been in the US Treasury market, where 10yr yields have fallen from 3% at the start of the year to a low of 2.44%, and at the time of writing they are trading at 2.5%.

However, data last week from China and the US offers one explanation for the decline in yields. A US report on foreign holders of Treasuries found that Japan’s holdings of US government debt rose to a record high of $1.22 trillion in May, up $10.4 billion on the month. Japan is now a close second to China, who also increased its holdings of Treasuries last month by $7.7 billion, bringing its total to $1.27 trillion. This was China’s first increase in Treasury holdings since January, and comes after China announced that foreign exchange reserves jumped to their highest ever level in June to a touch below $4 trillion.

So why are China and Japan buying Treasuries when some in the market think that US government debt looks expensive? It could be because they don’t think that debt is that expensive and anticipate a dovish Fed to keep rates low even in the face of improving economic data, or it could be because of a lack of investment options elsewhere. Geopolitical risks have risen in 2014, and Treasuries are still considered the safest asset class out there. China also buys Treasuries to keep the Yuan’s value low, in a bid to support exports. Thus, this data suggests that currency market liberalization from Beijing is still not top of the agenda.

What does this mean for markets? Firstly, the bond rally that has flummoxed many on the financial markets could be here to stay if Japan and China continue to park their money at the US Treasury. Going forward, Treasuries may not be an accurate reflection of shifts in Fed policy this year, as bond yields could stay lower than one would expect if the Fed continues to hint that rate increases may come sooner rather than later. Secondly, since yield is a key pillar of a currency’s value, if US yields are artificially low the dollar could struggle to rally.

Although Fed policy may be close to a crossroads, the global dynamics of the Treasury market could have a bigger impact on financial markets. Thus, China and Japan could determine the timing of the next dollar rally, and not the Fed.

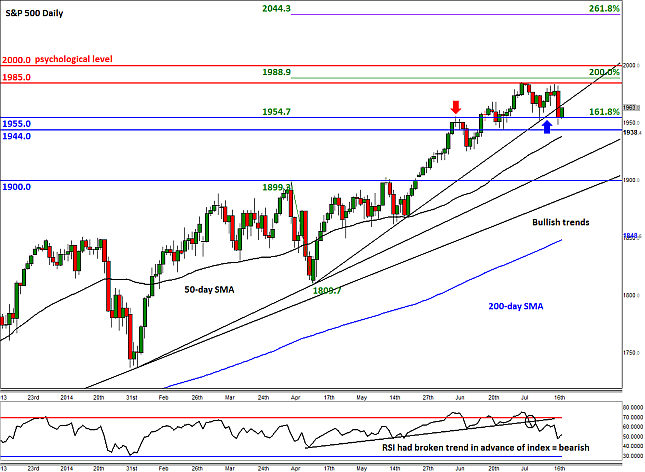

Look Ahead: Stocks

On Friday morning the S&P 500 had managed to bounce back a little but still looked set to close lower for a second straight week. The release of mostly better-than-expected corporate earnings results so far have been overshadowed by mixed-bag US data and geopolitical risks stemming from the Middle East and North Africa (MENA) and Ukraine. The focus of the attention has shifted from the troubles in Iraq to the Israel-Palestine conflicts. Following several days of deadly air strikes, the Israeli military has begun a ground offensive against the militants in Gaza. Although the conflicts there are unlikely to cause any disruptions to oil supply from MENA, the markets are nonetheless growing worried about the region’s instability. There have also been renewed worries over the possibility of retaliatory action from Russia after it was slapped with fresh sanctions by the US over its involvement in the crisis in Ukraine. Sentiment turned really sour after the unfortunate news of the Malaysian airline crash in Ukraine on Thursday. Gold prices and the Volatility Index (VIX) both jumped as complacent investors decided it was better to play it safe.

Rescuers have reportedly found the second flight recorder from the Malaysia Airlines Flight MH17. Thus, soon it will hopefully become clear who was responsible for the plane’s crash, which could either add to or take away some of the uncertainty hanging over the markets. If it was indeed brought down by a ground-to-air missile, as many expect that was the case, then it would solidify the claims it was the pro-Russian rebels, who some suggest may have done it by mistake. If this is the case then everyone will point the finger at Russia and they will come under extreme pressure to help de-escalate the situation in Ukraine. In other words, this unfortunate incident might actually turn out to be a good thing for risk assets over the coming weeks. In the short-term, however, it may cause further uncertainty as it would undoubtedly increase calls for further sanctions on Russia. As a result, it will not just be energy prices that may rise but other commodities too such as copper, palladium and gold.

But worryingly for the stock markets bulls, there are other signs to suggest a bigger correction may be on the way. For example, as we reported last week, there’s been some evidence of possible sector rotation taking place whereby safe haven stocks such as utilities, energy and health care have all gained ground while riskier cyclical, financial, and industrial stocks had weakened. This week, we also pointed out the recent underperformance of small-cap stocks, which are more vulnerable to the domestic economic activity than their large cap peers. Both of these factors, combined with some valuation methods such as the elevated price to earnings (PE) ratio suggest the market may be overpriced and that a correction could be on the way soon.

Nevertheless, the S&P 500 and the other major US indices continue to defy gravity and remain near record levels. Although the VIX spiked as result of the Malaysian plane crash, it remains near historical lows which either suggests that the market bulls are extremely complacent or that they are not worried about the geopolitical and other risks. We continue to think that it is the low-interest-rate environment which is providing the biggest support to equities, above all. On top of this, sentiment has been supported by improving signs about China’s economy as well as the solid US corporate earnings results that we have seen so far, especially from the banking sector. Although compared to a year-ago period some financial sector earnings may have fallen, most of them have managed to top expectations and that is ultimately the deciding factor for some short-sighted speculators. Meanwhile technology companies have also begun reporting their results with the likes of eBay, Google and IBM all reporting mostly positive numbers. Next week, the earnings season will kick into a higher gear and once again there are plenty of tech companies scheduled to report their quarterly results. On Monday, for example, we will hear from Netflix, followed by Apple and Microsoft on Tuesday and Facebook a day later on Wednesday. These are all S&P 500 companies.

Ahead of those and other earnings results, and despite Thursday’s selling pressure, the technicals are still looking solid for the S&P 500 from a bullish point of view. As can be seen from the daily chart, the index is comfortably above both its 50- and 200-day moving averages, which suggests the trend is still very strong. Although a short-term bullish trend line has been broken as a result of Thursday’s sell-off, the longer term trends are still intact. We expect the S&P to at least take a short-term bounce around those trend lines, should it get there at all. Ahead of those is the 50-day moving average at 1938 and a support level at 1944. On the upside, the prior all-time high of 1985.5 remains the main reference point. If and when this gets broken then the only notable technical level standing on the way to 2,000 is 1989 which corresponds with the 200% extension level of the corrective move from 1899 to 1809.

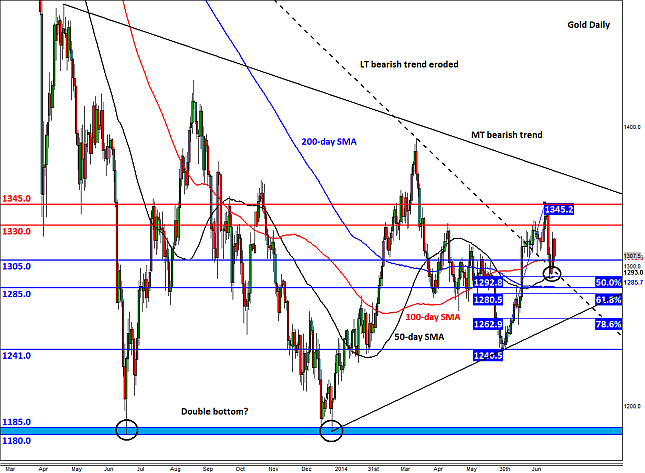

Look Ahead: Commodities

On Thursday, gold managed to trim a big chunk of the losses it had suffered earlier in the week but following Friday’s weakness it was still set to close sharply lower on the week. Much of Thursday’s gains occurred in the space of a few hours, likely a direct result of raised geopolitical concerns after a Malaysian passenger plane was shot down over Ukraine. Speculators rushed to buy gold as they sought safety while stocks sold off. If the pro-Russian rebels turn out to have played a part in this, there’s a risk sanctions on Russia will increase significantly. This may possibly lead to further short-term price gains for gold and other commodities that Russia produces. However, it can also be argued that Russia will come under extreme pressure from world powers to help de-escalate the situation in Ukraine. Therefore, this unfortunate incident might actually turn out to be a good thing for risk assets over the slightly longer term, and bad for gold. Time will tell.

Meanwhile ETF investors took advantage of the firmer gold prices in mid-week and withdrew nearly 5.4 tons of the metal from the world’s largest gold ETF, the SPDR Gold Trust. This came after notable increases in the first two weeks of July, and suggests two things. Firstly, the sharp increase in the price of gold this week was driven almost entirely by short-term financial speculators so some ETF investors, who are deemed to be more longer-term market participants, don’t expect the rally to last; hence they withdrew from the market. Second, the withdrawals were not as significant as the inflows earlier in the month. This means that ETF net flows have still been positive, which is bullish.

The technical picture however is looking much less bullish than it did last week. Although gold managed to bounce back at the key technical juncture of $1292/3, it has yet to show a clear bullish signal. This $1292/3 area corresponds with the upper side of the broken long-term trend line, the 50-day moving average and the 50% retracement level of the upswing from the June low. So, there’s still a chance for price to head further lower next week, with the next support levels coming in at $1285 and $1280. These levels correspond with the 200-day SMA and 61.8% Fibonacci level, respectively. The main resistance level is the July peak of $1345, and if/when that is cleared then we could well see some sharp gains. Ahead of that, there is resistance at $1325 and $1330.

Global Data Highlights

Sunday, July 20, 2014

- 23:01 GMT UK Rightmove House Price Index

Since the Bank of England’s next move could be determined by house prices, this is an important data release at the start of the week. There are various measures of house prices, but overall they show house prices moderating, but remaining at lofty levels. It is normal to see a slowdown in house sales during the summer months, so we would not be surprised to see prices fall a notch from the 7.7% annual rate recorded in June. We doubt this report will have much of an impact on sterling, although a sharp drop of 1% or more could weigh on the pound as the market assesses whether a rate rise is needed later this year to cool the housing market.

Tuesday, July 22, 2014

- 8:30 GMT UK Public Sector Net Borrowing

Public finance data for May showed a deterioration in national accounts, with public sector net borrowing for May at GBP 13.3bn, GBP 0.7bn higher than in May 2014. With the government planning a series of spending plans ahead of next year’s General Election, these monthly figures may get worse later this year. We don’t expect today’s data to have a major impact on the pound, as the market is likely to focus more on Wednesday’s BOE minutes.

- 10:00 GMT UK CBI Industrial Trends Survey

CBI industrial data is a timely survey of the health of the industrial sector. It looks at selling prices, optimism and total orders. In recent months, total orders have risen to their highest level since the start of this year, while business optimism has risen to its highest level since 1973. We think these surveys may have gone too far too fast, and so may be due a pullback. If that happens then GBP could have a kneejerk reaction lower.

- 12:30 GMT US Consumer Price Index

SHHHH! Did you hear that noise? If you didn’t, don’t feel bad, most people didn’t; but Federal Reserve Chair Janet Yellen did. The “noise” she heard was last month’s CPI reading that climbed a little higher than the Fed’s 2.0% ideal inflation figure up to 2.1% that she described as being on the “high side.” Fear not though as she also said, “We would not willingly see a prolonged period in which inflation persistently runs below our objective or above our objective, and that remains true.” So the Fed isn’t panicking at this point, but if CPI prints much higher than 2.1%, pressure to raise interest rates sooner than the market anticipates could become a much louder noise.

- 14:00 GMT US Existing Home Sales

Ah, the confusion of the US homebuyer and the data that surrounds him/her: This past week, we learned that home builders are viewing the market in a favorable light with the NAHB Housing Market index climbing above the 50 boom/bust level for the first time since January of this year, but both Building Permits and Housing Starts declined for the third month in a row and failed to breach the 1.0M psychologically significant guidepost. Perhaps all those new homes are taking a break to wait for all the existing homes to sell as Existing Home Sales have increased for two months straight and could join the “three months in a row” club, just in the opposite direction.

Wednesday, July 23, 2014

- 1:30 GMT Australian Consumer Price Index

Unlike the US’ Federal Reserve, the Reserve Bank of Australia is relatively comfortable with inflation going above the 2.0% figure and conveniently prefers their inflation to be somewhere between 2%-3%. This is convenient because it has been between those two figures since Q3 of 2012, but is getting perilously close to the high end of that range. Last quarter’s 2.9% could be the last of the acceptable results if it were to sneak above the 3% threshold. Therefore, much like the Fed, the RBA may have to either classify rising inflation as “noise” or shift their neutral monetary policy stance to one of hawkishness.

- 8:30 GMT Bank of England Meeting Minutes

This is the master data release for this week. The minutes from the June meeting triggered another leg higher in the pound as the market weighed up the prospect of a rate hike as soon as the end of this year. These minutes will be worth watching to see if any member breaks ranks and voted for a rate hike at the July meeting. If this doesn’t happen then we still expect to see some members itching for a rate hike sooner rather than later, which could boost the pound and help GBPUSD get above 1.7200, which has acted as stubborn resistance so far.

- 8:30 GMT UK BBA Mortgage Loans

Mortgage loans have been falling since January, and we could see another decline for June as the housing market tends to cool down in the summer months. We don’t think this report will have a major bearing on sterling’s performance this morning, with BOE minutes stealing the limelight.

- 10:00 GMT UK CBI Retail Sales Report

This is a good indicator of sentiment in the retail sector, and comes a day before the official retail sales report. In June this survey fell to its lowest level since November 2013, suggesting a slowdown in consumption in the UK. We have seen retail sales pull back in recent months, which suggests that low wage growth, a mere 0.7% for June, could be making the famous UK consumer a little more cautious before they part with their cash. Due to the importance of the BOE minutes, we think that this survey may not have a major impact on GBP.

- 12:30 GMT Canadian Retail Sales

I’ve written about the proclivity for Canadian data to play the switcheroo game by going from good to bad and back again multiple times in these updates before, so allow me to continue the theme. Canadian Retail Sales have traded off hitting consensus or missing consensus consecutively since late 2013, with only one exception (when consensus was spot on in April). So starting with the October 2013 reveal we’ve seen: miss, beat, miss, beat, miss, beat, spot on, miss, and beat. Recognize the pattern? As I go to print, consensus hasn’t been calculated, but I wouldn’t be surprised to see this fail to live up to expectations if the pattern continues to bear fruit.

- 14:00 GMT Eurozone Consumer Confidence

It’s a quiet start on the macroeconomic front for Europe; however, the data will start to get more interesting as we progress through the week. Consumer confidence for July is a timely indictor of sentiment after a tumultuous month that has seen economic data soften and peripheral fears start to mount as Portugal’s banking sector came under greater scrutiny. Consumer confidence had risen to its highest level since before the financial crisis in recent months. It came off the boil in June, and we expect a sharper moderation in July, although it is likely to remain high relative to recent years. We expect a softening in this consumer confidence number to add to recent downward pressure on the EUR.

- 21:00 GMT Reserve Bank of New Zealand Interest Rate Decision

Inflation is becoming kind of a big deal around the world as some areas like Europe and Japan are battling the lack of it while others like the US, Australia, and New Zealand are trying to keep it near their happy place. New Zealand’s CPI was released this past week and surprised quite a few market participants by actually failing to achieve the consensus expectation of 1.8% by tallying a 1.6%. Granted, it was higher than the 1.5% seen at the previous quarter, but due to the interest rate hiking the RBNZ has been doing; many expected it to accelerate faster. That is putting a tiny splash of doubt on the psyche of traders as the RBNZ could pause their hiking parade and wait to see what happens, causing the NZD to sell off. At this point, the majority still expects another hike at this meeting, but watch for RBNZ Governor Graeme Wheeler to hint they may pause at this level.

Thursday, July 24, 2014

- 1:45 GMT Chinese HSBC Flash Manufacturing PMI

After spending all of 2014 mired below the 50 boom/bust level, this report finally showed growth last month by rebounding to a 50.8. The trend is heading higher as it has improved each of the last three months, and assuming it can continue to perform, it could provide some strength to the AUD and NZD.

- 8:00 GMT Eurozone Flash Manufacturing, Services, and Composite PMIs

We expect these early July PMI figures to confirm that the Eurozone economy continues to expand, albeit at a slower pace. The composite PMI peaked in April, and since then we have had two consecutive declines. Interestingly, peripheral PMIs have started to outpace France and Germany, with Spain a stand out performer. While we don’t get a country break down with this early reading of PMI data, any weakness could add to downside pressure on the single currency.

- 8:30 GMT UK Retail Sales

Retail sales data has been fairly erratic in 2014: in April sales rose 1.7%, but in May they fell 0.5%. The June figures will be interesting to see if summer sales enticed shoppers to buy or if they stayed at home and watched the World Cup instead! Interestingly, the January sales didn’t boost retail sales, which fell 2.6% at the start of this year. Another weak number could weigh on the pound, particularly if we see a large move higher on the back of the BOE minutes.

- 14:00 GMT US New Home Sales

Considering the drop in Housing Starts and Building Permits I mentioned earlier (in the Existing Home Sales section) this measure may not be too pretty. The typical assumption would be that fewer new homes being built equal fewer new homes being sold; however, it’s not always that easy. Last month, Starts and Permits didn’t live up to the hype either, but New Home Sales were up almost 80k, well above estimates. Assuming there are no geopolitical risks ongoing from the downed passenger plane in Ukraine, another positive surprise here could quickly erase memories of Starts and Permits misses.

- 23:30 GMT Japanese Consumer Price Index

Have I mentioned yet that inflation is becoming a hot topic around the globe? Nowhere more so than in Japan, which has been fighting a lack of inflation since the 1990s. Recently, though, inflation has begun to swing violently higher, rising over 2% since the beginning of the year up to 3.7% last month. While the point of Quantitative and Qualitative Easing from the Bank of Japan was intended to goose inflation higher, I’m not sure they intended for it to rise so high so fast. If it continues on its torrid pace, whispers of hyperinflation may begin to permeate and the JPY crosses just might break out of the frustrating ranges they have been mired in for the last few months.

Friday, July 25, 2014

- 12:30 GMT US Durable Goods Orders

While not as vital to the measurement of the US recovery as US Retail Sales, Durable Goods Orders often times incites just as much volatility and reaction to the release. Much of that volatility comes from the lack of ability to predict it as consensus is often way off base with the actual. At the time of this writing, consensus is predicting a 0.7% increase, but that might change as more data is released during the week.

General Risk Warning for stocks, cryptocurrencies, ETP, FX & CFD Trading. Investment assets are leveraged products. Trading related to foreign exchange, commodities, financial indices, stocks, ETP, cryptocurrencies, and other underlying variables carry a high level of risk and can result in the loss of all of your investment. As such, variable investments may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall Witbrew LLC and associates have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to investment trading or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold rebounds to $2,320 as US yields turn south

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.