Highlights

FX return analysis

Fundamental wrap: Eurozone

Fundamental wrap: US

Japan expected to make headway on its inflation target

The Aussie takes a beating ahead of important CAPEX data

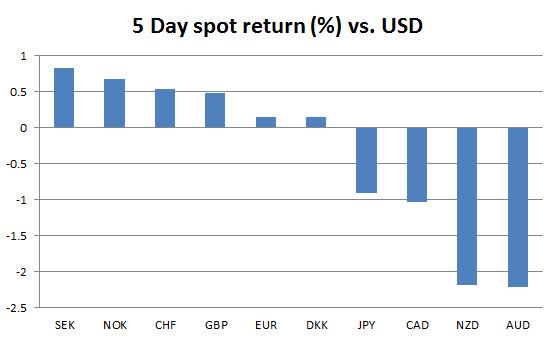

FX return analysis

The dollar is mixed on the week against its G10 counterparts. It is notably firmer against the commodity currencies (AUD, NZD, CAD) and has gained significantly against the JPY. Scandies are higher on the week, led by the SEK. The rebound in the krona comes after strong confidence data out of Sweden and comments by Riksbank officials that indicated krona strength is supported by weakness in the rest of the world and that the SEK level is fairly reasonable.

AUD underperformed following comments from the International Monetary Fund that that currency is overvalued and as Reserve Bank of Australia Governor Stevens said the Bank is open-minded about intervention.

The EUR experienced choppy price action as the currency fell sharply after reports that the European Central Bank is mulling a negative deposit rate, however the pair rebounded after ECB President Draghi denied an imminent cut. He said that there is no news on negative deposit rate since last meeting and urged market participants not to infer a negative deposit rate. The Japanese yen is broadly weaker as the trade deficit widened and after the Bank of Japan policy left policy unchanged. Governor Kuroda said that the BOJ has room for policy action and reassured markets that the Bank won’t hesitate to make policy adjustments if needed.

Figure 1:

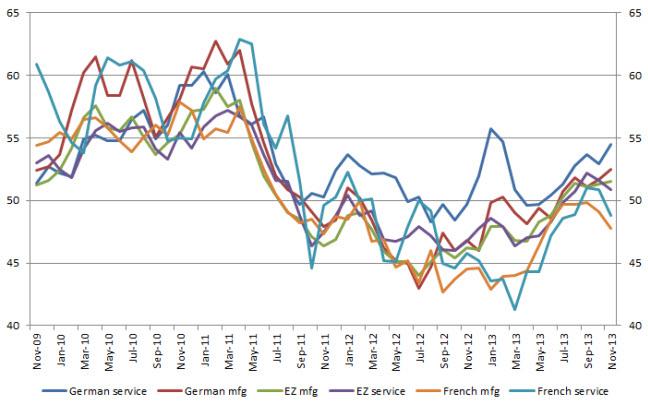

Fundamental wrap: Eurozone

Economic data out of the Eurozone this week was mixed and the common currency has responded similarly as it has traded mixed against its major counterparts. PMI’s were released and indicated a slowing in the pace of overall growth. The Euro area composite PMI unexpectedly slowed to 51.5 in November from the prior month’s 51.9 reading (cons. 52.0). German PMI’s rose by more than anticipated in November with the manufacturing index at 52.5 from 51.7 and service index at 54.5 from 52.9. French PMI’s moved in the opposite direction as with readings below 50 to signal contraction in both manufacturing and services. The key takeaway is that Germany continues to keep Europe’s fragile recovery barely afloat while the situation in France has been deteriorating with negative growth, a cut in ratings, and PMI’s that point to continued weakness.

German 3Q final GDP figures were in line with the initial estimates, however details showed that private consumption and net exports contributed less, which was made up by increases in government spending as well as capital and construction investment. Looking ahead, Germany’s sentiment indicators were largely positive with November ZEW expectations rising to 54.6 from 52.8 while the three main components of the IFO survey advanced by more than expected. However, Eurozone consumer confidence unexpectedly deteriorated to -15.4 from -14.5 on the preliminary readings, with the final results due next week.

Key data releases in the week ahead are inflation figures with Euro area CPI forecasted to increase by 0.8% in November on a yearly basis, which is only slightly higher than the previous 0.7% y/y reading. Eurozone unemployment is expected to remain at a record high 12.2% and German retail sales are due out next week.

Figure 2:

Fundamental wrap: US

Data flow out of the US in the past week was relatively light and mostly positive. Retail sales were stronger than anticipated with a monthly increase of 0.4% on the headline reading in October. Core retail sales were also above consensus, suggesting a pickup in consumption at the start of Q4. Housing market activity was soft as homebuilder confidence remained at the 54 level in November while existing home sales fell by slightly more than expected to a rate of 5.12M (cons. 5.14M).

High frequency labor data showed continued improvement as weekly initial jobless claims fell by 21K to 323K. The data helped to strengthen the USD as markets speculate on the timing of QE tapering, however broader measures of employment are insufficient to prompt tapering, in our view. Inflation data supported the view of continued accommodation by the Fed as headline consumer prices in October fell by -0.1% m/m. Core prices rose +0.1% m/m and +1.7% y/y as expected.

FOMC minutes from the October meeting were released and showed that members said tapering is likely in coming months on better data. The minutes indicated that policy makers saw the economy as “continuing to expand at a moderate pace” with “further improvement” in the labor market. FOMC participants also said that a cut to the IOER is worth considering, which suggests that policy makers are looking at a mix of tools to keep policy accommodative when tapering. We have also noted the possibility of the Fed strengthening forward guidance to offset potential rate increases that may be associated with tapering. US treasury yields are moderately higher on the week with the 10-yr yield currently around 2.76%.

There is a significant amount of data due next week despite the Thanksgiving holiday. Key housing releases include pending home sales, housing starts, and building permits for October. House prices will also be reported by the FHFA and S&P/Case-Shiller. Consumer confidence for November will be reported by the Conference Board and University of Michigan. Weekly initial jobless claims will be released on Wednesday rather than the usual Thursday release due to the holiday and durable goods orders for October will be released on Wednesday as well.

Japan expected to make headway on its inflation target.

Japan’s monthly data binge happens this week, with the release of unemployment, consumer prices and industrial production data, as well as a few others. This comes on the back of last week’s policy meeting at the BoJ, where the bank elected to maintain its current rate of asset purchases, as expected.

The BoJ kept monetary policy steady and maintained its view that the economy is showing some encouraging signs.

As expected, the bank elected to maintain its pledge to expand the monetary base by 60-70 trillion yen a year, while adding that it’s prepared to make policy adjustments as needed. One member, Kiushi, proposed to end the inflation target in the mid-term and to use easing as an intensive measure for two years but was voted against 8-1 – no surprise there. Overall, we think the BoJ may have to ramp-up its easing program sometime next year, partly due to the possible undesirable implications that the planned increase in the sales tax may have on the economy.

This week’s slew of economic data will give us an indication of how the economy is performing and if it is responding to the BoJ’s easing. Thus far there has been a very limited reaction from the economy. Inflation has picked up but this can largely be attributed to a weakening yen which increases the cost of imports, thus prices are only rising in specific parts of the economy. Two of Japan’s largest imports now are food and energy, and once they’re taken out of the equation, inflation is 0.0%, as opposed to 1.1% including food and energy.

Nevertheless, there may be light on the horizon. During October, Japan’s nationwide CPI is predicted to remain steady at 1.1% y/y, but the good news for the BoJ is that CPI excluding fresh food and energy is predicted to have jumped 0.2% y/y. This would represent the first time since 2008 that this measure of core inflation is in positive territory. The other good news is that the jobless rate is predicted to fall to 3.9% from 4.0% and industrial production is expected to rise 2.1% m/m. While this data would be encouraging, the Japanese economy may require further support to continue on the road to recovery.

The yen was on the back foot at the end of last week after a surge in the Nikkei sparked a sell-off in the yen, which eventually saw USDJPY punch through a resistance zone around 100.60 – September’s high. Given that daily RSI has broken into bullish territory, the pair may make a run for another resistance zone around 101.55 – high since July - and then 103.75 – high since October 2008.

Figure 3:

The Aussie takes a beating ahead of important CAPEX data

Last week the Australian dollar came under renewed pressure as the RBA continued to talk down the commodity currency and the IMF stated that it’s overvalued by around 10%. The ensuing sell-off in the Australian dollar saw it fall across the board late last week, sending AUDUSD through its 100day SMA. This week there is a limited amount of headline data out of Australia but we are expecting private capital expenditure figures for last quarter and RBA Deputy Governor Lowe is speaking. The former will be important because the RBA is looking for a lift in non-resource related investment to help counteract diminishing investment into mining-related sectors of the economy and the latter may be another chance for the RBA to talk to down the Aussie.

The RBA’s minutes from its policy meeting earlier in the month expressed concern about the detrimental impact that a higher dollar would have on the Australian economy; the IMF also admitted as much when it stated the Aussie may be overvalued by as much as 10%, reinforcing the idea that the Aussie is a major factor in the setting of monetary policy by the RBA. Later in the week RBA Governor Stevens even hinted at the possibility of intervening in the FX market to directly weaken the commodity currency. Stevens stated that intervention is part of the reserve bank’s tool kit to support the economy. The bank has shied away from the idea of intervention in the past largely because it would be fighting an uphill battle, but this hasn’t changed; thus we view the bank’s threat of intervention as another attempt to talk down the Aussie, otherwise known as verbal intervention. The negative implications and the fact that the RBA would likely be fighting an uphill battle, make intervention by the RBA unlikely, at least in the near-term.

This week RBA Deputy Governor Lowe may touch on the Australian dollar at a speech on Tuesday at 0915AEST (2215GMT) but we don’t expect him to be as aggressive as Stevens has been in talking down the commodity currency, largely because his speech isn’t scheduled to be about the Australian dollar. Nonetheless, we have seen how sensitive the Australian dollar can be to negative comments from within the RBA. Later in the week investors will shift their attention to Australia’s Q3 capital expenditure data. In the prior quarter capital expenditure jumped 4.0%, after falling 4.1% in the prior quarter, but was largely due to increased mining spending, as opposed to increased investment in non-resource sectors. This time around the market will be wary of a pullback in mining spending and continued weakness in non-resource investment, which could signal that mining investment is declining sharper than expected at that same time that other parts of the economy are failing to pick up the slack.

After breaking through its 100day SMA and the bottom of its daily Ichimoku cloud, the pressure mounted on AUDUSD and it broke a support zone around 0.9200 (at the time of writing the pair is still yet to close below this level) – 61.8% retracement level from August low around 0.8850. The break of the aforementioned support zone coincided with a break neckline support from a long-term head and shoulders pattern, and a confirmed close below this level may highlight some underlying technical weakness. In any event, we want to keep an eye on developments in the US as moves in US treasuries - which are due to tapering expectations - have been influential in driving AUDUSD lower.

Figure 4:

The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase of sale of any currency. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Recommended Content

Editors’ Picks

AUD/USD tumbles toward 0.6350 as Middle East war fears mount

AUD/USD has come under intense selling pressure and slides toward 0.6350, as risk-aversion intensifies following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY breaches 154.00 as sell-off intensifies on Israel-Iran escalation

USD/JPY is trading below 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price jumps above $2,400 as MidEast escalation sparks flight to safety

Gold price has caught a fresh bid wave, jumping beyond $2,400 after Israel's retaliatory strikes on Iran sparked a global flight to safety mode and rushed flows into the ultimate safe-haven Gold. Risk assets are taking a big hit, as risk-aversion creeps into Asian trading on Friday.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.