Highlights

FX return analysis

Is Greece turning a corner?

Fundamental wrap: UK and Europe

US government shutdown and data blackout persists

Searching for safe havens

Will the BOC take a harder stance towards CAD?

FX return analysis

The dollar was one of the weakest performers in the G10 as a government shut down and the failure to raise the debt ceiling increased the chances of a US credit default on 17th October.

Figure 1:

The pound was the worst performer versus the USD last week. There were no real fundamental drivers; however, GBPUSD has been looking stretched to the upside for a while after a 10% gain since July. Investors have been taking profit after this pair reached a high of 1.6260. We think GBP could consolidate between 1.5900 – 1.6100 this week as we wait for the BOE meeting, the caveat is a resolution to the US debt ceiling, which could trigger a relief rally in the USD.

The AUD was the strongest performer, boosted by a neutral RBA as well as dollar weakness. If this pair can maintain gains this week it may find it tough to get above 0.9550, a rumoured barrier option level.

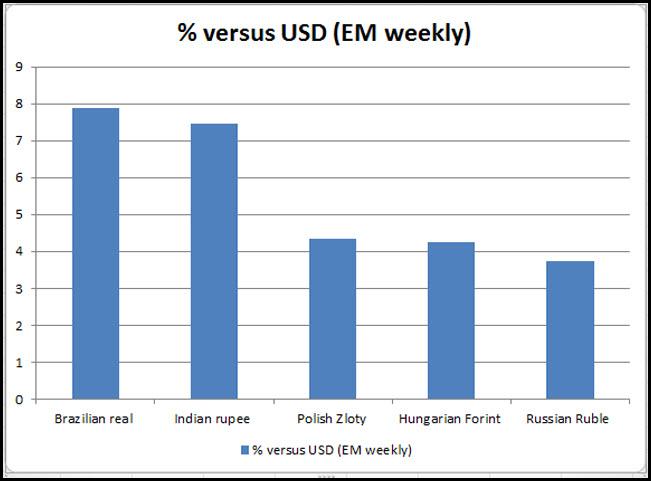

Figure 2:

Emerging markets outperformed development markets against the USD last week. As the greenback came under pressure from Fed QE expectations along with fiscal fears, EM FX managed to recover some losses. The BRL and INR were the best performers, which is no surprise as they had been the weakest performers during the summer sell-off. EM FX could be vulnerable this week if there is no deal to raise the US debt ceiling, which may cause a rise in risk aversion.

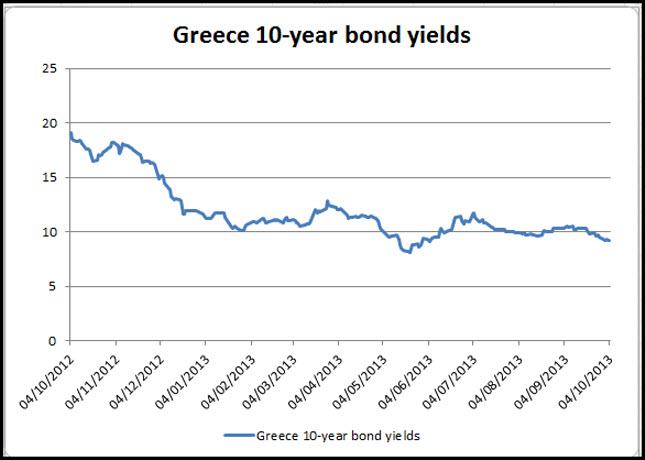

Is Greece turning a corner?

There have been growing signs that Greece may be turning a fiscal corner; its current account recorded its largest surplus in the euro-era in July and there have been some green shoots of recovery including business sentiment and manufacturing sentiment, which have been picking up from very low levels in recent months. Of course, unemployment is still painfully high and the economy has shrunk by nearly a quarter in the last 5 years, but if data can maintain its recent momentum then there is a chance that Greece may register positive growth in the second half of this year and may not need a third bailout, a line of credit may suffice instead.

Greece has an EUR 11 billion cash shortfall through to 2016 and the IMF and Germany have already come out and said a third bailout is possible. However, with more bailouts comes more austerity, which could stunt any recovery.

Thus if Greece can avoid a bailout and get a line of credit instead it could brighten the country’s future economic outlook.

A line of credit rather than a bailout may not be as outlandish as first thought. Greece may still have a rising debt-to-GDP ratio, however, by next year almost 75% of its sovereign liabilities will be held by official sources: IMF and European rescue funds. Thus, if there are further haircuts they are likely to fall on official shoulders rather than the private sector, which could open the private sector to Greece once more.

This week we get some key Greek data releases including CPI for September, industrial production for August and unemployment data for July. Further signs of stabilisation in Greece could reinforce the market’s belief that the sovereign crisis is coming to an end, which may boost the EUR.

Figure 3:

Fundamental wrap: UK and Europe

The main event in the UK this week is the MPC meeting on Thursday. We agree with consensus and do not expect any change to rates or policy. Indeed, we think that the prospect of more QE this year is receding unless we see 1, a dramatic about turn in the UK’s economic data or 2, a cataclysmic credit event in the US, which threatens the global economy. Other data to watch out for includes industrial and manufacturing production data for August. The market expects production data to pick up from July; however it still remains less impressive than the PMI surveys. It may also be worth keeping an eye on the BOE credit conditions survey; lending has been picking up of late and the market will be looking to see if this trend can be extended.

GBPUSD came under pressure last week (see FX return analysis for more). After hitting resistance at 1.6260 this unleashed a wave of selling pressure, although buyers bought the dip down to 1.6030. We think this decline was mostly caused by profit taking as the data was generally fairly strong last week. As the dollar continues its decline, other G10 currencies such as the EUR and AUD are playing catch up. 1.60 and then 1.5910 – the low prior to the 18th Sept. Fed decision – could cushion any downside this week.

Politics dominated in Italy last week, however the resounding victory for PM Letta, who easily won a confidence vote in Parliament, and the expulsion of Silvio Berlusconi from the Senate, suggests that this disruptive force in Italian politics is off the radar for now. However, that does not mean that Italy is out of the woods yet, Letta still needs to submit his Budget in time for the Brussels October 15th deadline. Of course, this is easier to do with a “stable” government; however there could be some uncomfortable measures in this budget as Letta tries to reduce the budget deficit to 1.8% from an estimated 2.9% this year. In contrast, German coalition talks have ended between the CDU and the SDP, with no breakthrough. The talks will now be suspended for a week, which could open the way for the CDU to approach the Greens. Overall, we think that Merkel will still be in a strong position whatever the outcome of coalition talks. Thus, at this stage German politics are not, as yet, triggering volatility in EUR markets.

Elsewhere in Europe, the data calendar is very light; however, there is a raft of ECB speakers. Although ECB President Mario Draghi did not comment on the elevated level of EURUSD at his meeting last week, we think there is a risk that individual ECB members could try and talk down the currency especially if it approaches the intra-day high so far this year at 1.3710. Thus, we think that the risks are tipped for potential downside for EURUSD this week after it strengthened last week. Key supports to watch include 1.3500, the low from before the ECB meeting, and then 1.3460 – last week’s overall low.

US government shutdown and data blackout persists

It is day 4 of the US government shutdown at time of writing and the political stalemate in Washington shows no signs of improvement. Key data releases have been cancelled and roughly 800,000 workers are furloughed resulting in a reduction to GDP growth of nearly 15bps per week. President Obama cancelled a planned trip to Asia to focus on getting House Republicans to vote on spending to reopen government operations.

Obama has declared that “there will be no negotiations over this” and has taken a firm stance as the Republican-led House seeks to defund the Affordable Care Act or “Obamacare” before passing a continuing resolution. More importantly, the US debt limit is fast approaching. Treasury Secretary Lew indicated that the ceiling will be hit on October 17 and that a failure to raise the debt limit and default will have catastrophic consequences.

The market response so far has been relatively muted. The benchmark US 10-year treasury yield has hovered above 2.60%, equity markets and the dollar have drifted lower. Short-term rates are the most poignant and show increasing worry over political uncertainty as the rate on 30-day T-bills has shot-up to 12bps from below 3bps earlier this week.

For now, the USD and risk sentiment is likely to remain weighed by the ongoing political uncertainty and unresolved issue of the debt limit. A blackout of official data releases, impasse in Congress, and uncertainty regarding monetary policy is likely to keep the dollar under pressure. We expect the political disruptions to be temporary and once the disruptions have passed, the USD is likely to regain some of its current losses and markets will be able to return to data watching and Fed tapering speculation.

Data releases in the week ahead are likely to be limited as the shutdown persists. The Commerce Department and Labor Department have indicated that no reports will be released during the government shutdown. This means that key reports that are scheduled to be released next week such as Tuesday’s August trade balance, Wednesday’s August wholesale inventories, Thursday’s September import prices, and Friday’s September retail sales, PPI, and August business inventories will be postponed unless Congress can come to an agreement on spending. FOMC minutes from the September meeting will be released on Wednesday and the University of Michigan’s confidence reading for October should be released next Friday as scheduled.

Searching for safe havens

With the dollar drifting lower amid heightened political uncertainty in the US and a prolonged pace of monthly asset purchases by the Fed, traders are in search of safe havens. The Swiss franc and the Japanese yen traditionally fill this role and both currencies have gained against the greenback so far this week. However, the currencies of triple-A rated countries such as Australia, Sweden, and Norway have also benefitted.

Despite limited movement in US treasury yields, USDJPY has declined significantly this past week. The pair fell below the 97.00 figure and is approaching the 200-day simple moving average (SMA) around 96.60 which is a key technical level. The Bank of Japan refrained from additional stimulus and said that current easing is probably enough to reach target inflation. A lack of additional easing from the BOJ helped the JPY retain its attractiveness as a haven. We expect further JPY strength in the near-term while the BOJ stays on the sidelines and while US political disruptions continue.

The Swiss franc is slightly higher against the USD but has underperformed the JPY. USDCHF is currently rebounding after reaching its lowest level since early 2012. Daily oscillators suggest the pair is oversold and extreme positioning may limit the CHF’s ability to extend gains.

The AUD, NOK, SEK, and CAD may also attract haven flows as the currencies belong to countries with AAA ratings. We are cautious of Canadian dollar strength (see below), but think that AUD can continue to rebound for now – especially as the Reserve Bank of Australia removed language that indicated the AUD is at a high level. The September RBA statement said that “the Australian dollar has depreciated by around 15 per cent since early April, although it remains at a high level” while this past week’s statement said “the Australian dollar rose recently, but is still below its level in April. A lower level of the currency than seen at present would assist in rebalancing growth in the economy.”

AUDUSD may find near-term resistance around the 38.2% Fibonacci retracement of the 2013 range and recent highs above the 0.95 figure. A break above this level would likely see gains extend towards the 50% retracement and weekly Kijun line just above the 0.97 figure. The key level to the downside is around 0.9260/70 where the 100-day SMA and 23.6% Fibonacci retracement converges.

Will the BOC take a harder stance towards CAD?

On Tuesday, Canada will release trade data for August and the figures are likely to show a continued trade deficit. Canada has not seen a trade surplus since 2011 and recent data is disappointing to monetary policy makers. At its most recent meeting, the Bank of Canada expressed its concern saying that “uncertain global economic conditions appear to be delaying the anticipated rotation of demand in Canada towards exports and investment.”

A strong currency is also likely to have a negative impact on trade as Canadian exports become more expensive while Canadian demand for imports may increase due to the stronger purchasing power associated with a strong currency.

Furthermore, a high exchange rate can put downward pressure on inflation which means the central bank may become more accommodative. The BOC has refrained from discussing the level of its exchange rate as the central banks in Australia and New Zealand have done recently.

However, recent comments from BOC officials may suggest that there may be increasing concern as the CAD moves higher. Bank of Canada Deputy Governor Macklem said that the exchange rate is one reason policy is still stimulative. The BOC has been mostly neutral with a slightly hawkish bias towards monetary policy indicating that a gradual normalization of policy interest rates can be expected over time. Rhetoric such as Macklem’s may keep CAD strength limited, and if it strengthens significantly so that the outlook for growth and inflation is materially affected we think that the Bank may take a more forceful stance on the currency.

Technically, USDCAD has been in a long-term bullish trend channel for just over a year and channel support lies around the 200-day SMA which is currently around 1.0230. The pair may see a decline on the back of USD weakness, however we think that a weaker than expected trade deficit could give the pair a boost toward the convergence of the 55 and 100-day SMA around 1.0360. A break below channel support would likely result in additional downside on technical weakness and a break above the 1.0360 level is likely to see the pair continue higher within the bullish channel.

Figure 4:

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

AUD/USD rises to two-day high ahead of Aussie CPI

The Aussie Dollar recorded back-to-back positive days against the US Dollar and climbed more than 0.59% on Tuesday, as the US April S&P PMIs were weaker than expected. That spurred speculations that the Federal Reserve could put rate cuts back on the table. The AUD/USD trades at 0.6488 as Wednesday’s Asian session begins.

EUR/USD holds above 1.0700 on weaker US Dollar, upbeat Eurozone PMI

EUR/USD holds above the 1.0700 psychological barrier during the early Asian session on Wednesday. The weaker-than-expected US PMI data for April drags the Greenback lower and creates a tailwind for the pair.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Ethereum ETF issuers not giving up fight, expert says as Grayscale files S3 prospectus

Ethereum exchange-traded funds theme gained steam after the landmark approval of multiple BTC ETFs in January. However, the campaign for approval of this investment alternative continues, with evidence of ongoing back and forth between prospective issuers and the US SEC.

Australia CPI Preview: Inflation set to remain above target as hopes of early interest-rate cuts fade

An Australian inflation update takes the spotlight this week ahead of critical United States macroeconomic data. The Australian Bureau of Statistics will release two different inflation gauges on Wednesday.