The GBP/USD pair witnessed a stellar 180-pip rally on Wednesday as the markets ditched the US dollars amid risk-off moves in the financial markets. The Fed came out dovish at the September meeting and the primary reason for that was the instability in the financial markets. Hence, the traders may have sold USD this week on speculation that renewed risk-off in the financial markets would force the Fed to initiate a much smaller liftoff (less than 25 basis points).

Eyes UK Trade deficit data and BOE rate decision

As noted in the morning view yesterday, the talk of the UK current account issue is gaining pace. The British Chamber of Commerce (BCC), on Tuesday, blamed weak international trade for the slowdown in the economy and also advised the BOE to delay its liftoff beyond Q3 2016. The markets expect a minor rise in the UK trade deficit in October. A bigger-than-expected jump in trade deficit will not be a good news for Sterling bulls. A rise in the trade deficit with non-EU countries will be a bad news as well.

The Bank of England rate decision and minutes are due for release later today. No one expects the bank to tweak its policy tools. The vote count is also expected to remain unchanged at 8-1. The odds of hawkish minutes are quite low since the BOE faces a major hurdle –

The UK miners are having a tough time on account of the rout in the commodity prices. Heavyweight shares like AngloAmerican fell to record lows yesterday and announced job cuts. The FTSE 350 mining index fell to record lows.

Telegraphing a rate hike/liftoff at the current juncture could hurt the economy.

Other issues - low inflation, record trade deficit, worsening current account to GDP ratio - remain intact.

Hence, nothing much is expected to come out of the BOE’s event today. However, there is always a possibility of a surprise and if the BOE minutes show an interest rate vote count of 7-2, the Sterling would spike across the board, with the highest gains against the USD and commodity dollars.

Technicals – Bullish above 1.5159

Sterling’s bearish break below falling channel seen on the daily chart on Dec 2nd was quickly undone the next day, which was followed by a three-day losing streak (which included a re-test of the channel support) and a sharp rise (yesterday) above 1.5159 (Dec 3rd high) indicates the currency could be on track to 1.5248 (50% of Apr-Jun rally+38.2% of Aug-Dec rally).

The pair also closed above the falling trendline (blue).

The intraday bias is bullish. A minor correction o 1.5159 cannot be ruled out, but a rebound from the same is likely to see the pair test 1.5248 levels. A break higher would expose falling channel resistance (black line).

The bears would regain control if the spot sees a daily close below 1.5159, in which case, the pair could see a sell-off to 1.4950 levels in the days ahead.

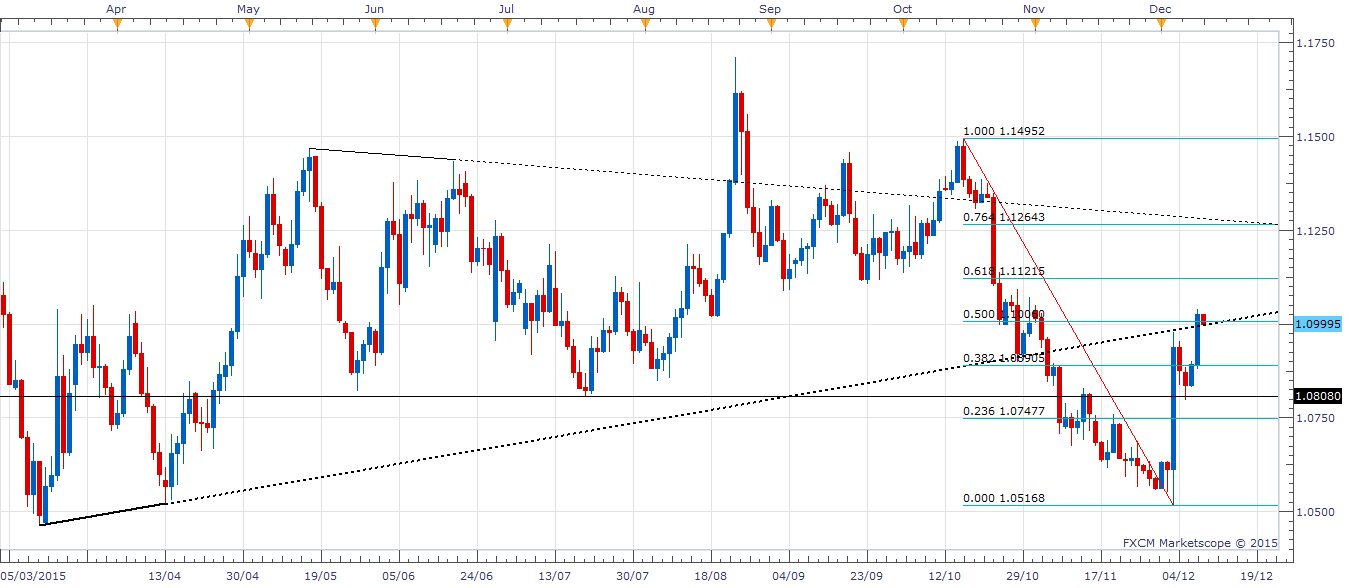

EUR/USD Analysis: And we are back inside the symmetrical triangle

The EUR/USD rose to the symmetrical triangle resistance around 1.0990-1.10 as anticipated and extended gains in the NY session to a high of 1.1043, before trimming gains to close at 1.1025. The broad based USD weakness amid risk-off in the equities helped the currency pair rally.

With no major data due out of the EU, the pair is at the mercy of the central bank rate decisions – SNB and BOE. Both banks are widely expected to keep rates unchanged. The BOE minutes and the SNB Jordan’s speech are unlikely to provide a major hawkish/dovish surprise. Nevertheless, if the banks do surprise markets, then the resulting action in the EUR/GBP and EUR/CHF shall leave their fingerprints on the EUR/USD pair.

Technicals – Strong support at 1.0994

The pair is back inside the symmetrical triangle seen on the daily chart. Consequently, a strong support is seen at 1.0994 (channel support).

The pair may dip below the same, however, the daily close above 1.1006 (50% of 1.1495-1.0517) could keep the bulls in charge and thus the pair is likely to rebound/move back above 1.0994 and extend gains to 1.1087 levels (Sep 3 low).

A daily close below 1.0994 would open doors for a fresh sell-off to 1.0890 (38.2% of 1.1495-1.0517).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD consolidates recovery below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery but remains below 1.0700 in early Europe on Thursday. The US Dollar holds its corrective decline amid a stabilizing market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD advances toward 1.2500 on weaker US Dollar

GBP/USD is extending recovery gains toward 1.2500 in the European morning on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns. Gold confirmed a symmetrical triangle breakdown on 4H but defends 50-SMA support.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price was not spared from the broader market crash instigated by a weakness in the Bitcoin market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus after witnessing significant market movements in recent weeks.