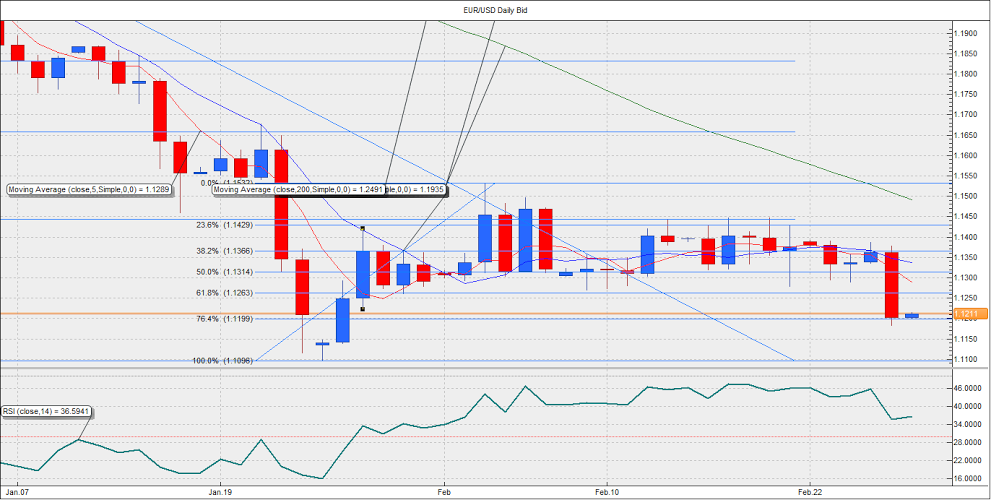

EUR/USD - At risk of a weaker-than-expected German CPI

The EUR/USD pair fell to a low of 1.1182 in the previous session on the stronger than expected US core inflation data as well as hawkish comments from Fed officials. The initial sign of weakness was evident during the European session, after the pair failed to strengthen on an upbeat German employment data. The early failure to sustain above 1.1366 (38.2% retracement of 1.1096-1.1532), coupled with failure to reposing to German data had opened doors for a sell-off towards 1.1314 levels.

A sticky core inflation number in the US, along with the upbeat durable goods data pushed the pair below 1.1263 (61.8% retracement) leading to a sharp sell-off towards 1.1182 as stops were triggered. The hawkish comments from San Francisco Fed’s John Williams and St Louis Fed’s James Bullard further added to the bearish pressure. The pair currently trades 1.1212, after having bounced-off from 1.1199 (76.4% retracement). The preliminary German CPI in Feb is seen falling 0.3%. The pair could dip below 1.1199 and extend losses to 1.1150 if the preliminary reading prints well below the expected fall of 0.3%. Meanwhile, a positive surprise could provide some scope for technical recovery, however, gains are expected to be capped around 1.1263.

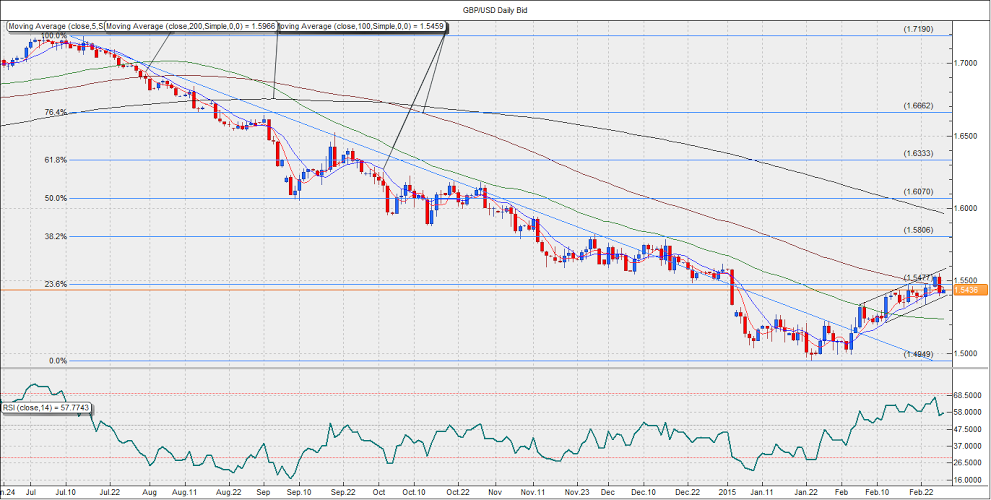

GBP/USD – Could drop to 1.5386

The GBP/USD pair fell sharply to a low of 1.5392 in the previous session, after a break below 1.5477 triggered stops leading to a sharp sell-off. A minor recovery of sorts is in process today as the pair trades 1.5447, with eyes on the 100-DMA located at 1.5459. With an empty UK economic calendar, the focus is likely to remain during the European session on the relative performance of the UK Gilt yields and UIS Treasury yields. In the last few sessions, the rally in the GBP/USD pair lacked support from the 10-year Gilt yields which remained negative and under performed the US treasury yields. The story could continue today as the hawkish comments from the Fed officials shall keep the Treasury yields higher.

The pair could dip to 1.5386 levels; rising channel support on the daily chart, if the second estimate of the US Q4 GDP prints higher than the expected growth rate of 2%. In such a case the benchmark bond yield spread could tilt further in favor of the US dollar, leading to a fresh sell-off in the GBP/USD pair. On the other hand, a weaker-than-expected print could help the pair recover to 1.5477 levels. However, it would take a daily close above 1.5477 (23.6% retracement of 1.7190-1.4949).

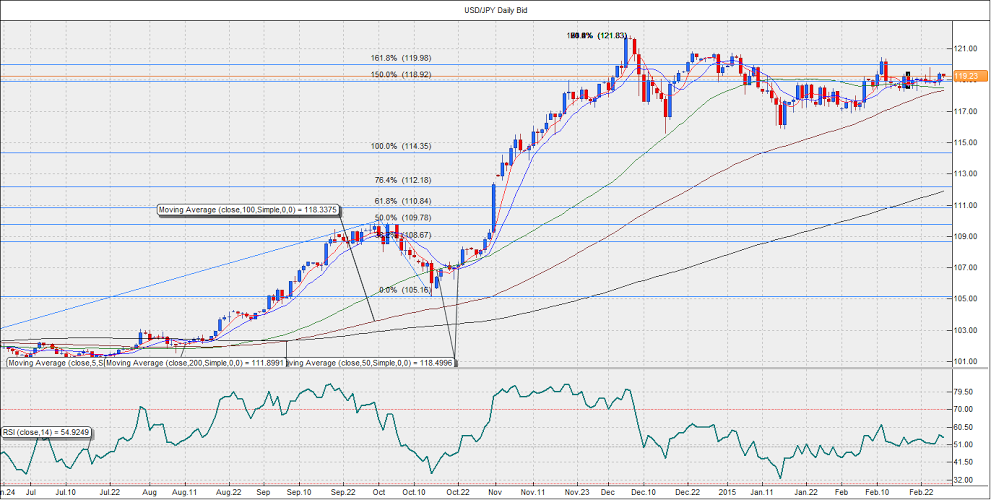

USD/JPY – Eyes 120.00 levels

The sharp recovery seen in the US Treasury yields post the releases of a sticky core inflation data in the US and an upbeat Durable goods orders pushed the USD/JPY pair to a high of 119.48 in the previous session. The hawkish comments from the Fed officials also supported gains in the Treasury yields and the USD/JPY pair. The 10-year Treasury yield in the US currently trades at 2.014%, while the USD/JPY pair hovers around 119.25 levels.

Given the recovery in the Treasury yields, the pair is likely to rise above the immediate resistance at 119.40. In such case, it could rise to 120.00 levels. A better-than-expected second estimate of the US Q4 GDP could help the pair rise to 120.00 levels. On the other hand, a surprisingly weak GDP print could reverse gains in the Treasury yields and push the USD/JPY pair below 118.90 levels, under which losses could be extended to the 50-DMA located at 118.50 levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.