EUR/USD - may stuck in a range due to upbeat German GDP and weak EZ CPI figures

The EUR/USD pair hit a low of 1.1293 in the previous session before recovering slightly to 1.1332. The pair managed to bounce back above the 50% Fib retracement level (of 1.1096-1.1532) located at 1.1314. The weaker-than-expected German IFO data did little to help the shared currency. The pair remains under pressure today after Greece missed its deadline to send the list of reforms to the Eurogroup. The Greek government said it would send reforms today morning and reviewed by Eurozone Finance Ministers in a conference call on the afternoon. Still, the EUR/USD pair is at 1.1335; well above the previous session’s low; which indicates that markets are not that worried about the Greece’s situation.

The Greek debt issue may take an ugly turn if the country fails to reach an agreement with its creditors on or Feb. 28th, post which the existing program will expire. Till then markets are likely to assume the Greek debt deal would be reached. Meanwhile, investors appear focused on both Yellen and Draghi, scheduled to speak today at 10am ET and 11:30am ET respectively. The divergent comments from both central bank heads – Yellen favors being patient with regards to interest rate hike, while Draghi sounds upbeat on Eurozone economy – could trigger a short covering rally in the EUR/USD pair.

However, the immediate gains are likely to be capped at 1.1442 (23.6% retracement of the down trend from 1.2568 to 1.1096). A daily close above the same could see the pair rise to its 50-DMA located at 1.1545. On the other hand, a break below 1.1314 could push the pair down to 1.1260 levels. An upbeat German Q4 GDP could help the pair rise to 1.1370-80 levels, although a sharp fall in the Eurozone CPI data due for release today risks sending the pair back to 1.13-1.1330 levels.

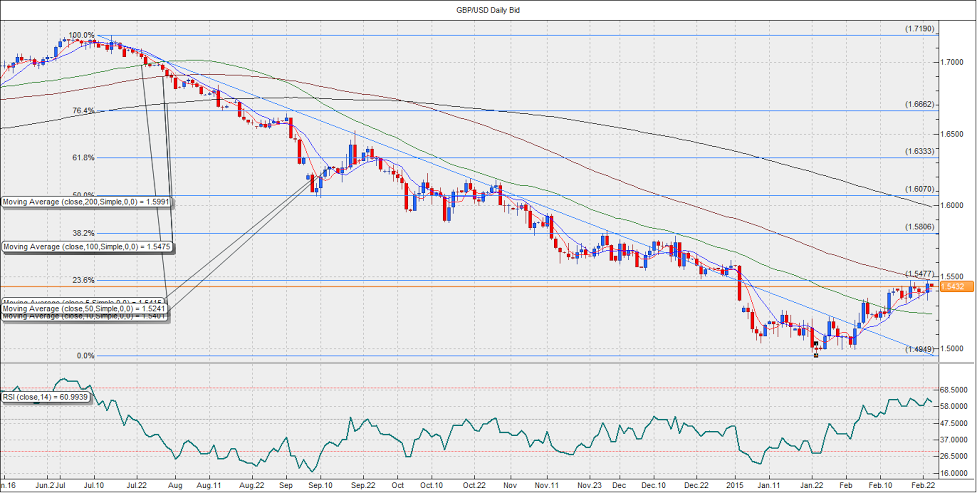

GBP/USD – Could rise to 1.5540 on Dovish Yellen testimony

The GBP/USD pair rose to a high of 1.5473 on Monday on rising UK Gilt yield spread and weakness in the US Treasury yields. The yield spread remained in favor of the British Pound despite a surprisingly weak retail sales report from the Confederation of British Industry. The consumer spending index dropped to +1 from +39 in February. However, the Pound continued to march ahead, partly aided by a weak housing data in the US. The pair currently trades slightly weak at 1.5433.

With no major economic data due out of the UK, markets are likely to remain focused on Fed chair Janet Yellen’s testimony to congress. If Yellen tilts in favor of keeping interest rate hike at record lows for a longer period, the GBP/USD pair could rise above the 23.6% retracement (of the down trend from 1.7190-1.4949) located at 1.5477 levels. Interestingly, the 100-DMA too, is located at 1.5475. Thus, a break above the same could push the pair to 1.5540-1.5580 levels. On the flip side, hawkish comments from Yellen could push the pair back to 1.5334. However, the pair is likely to remain bid so long as it trades above 1.5334.

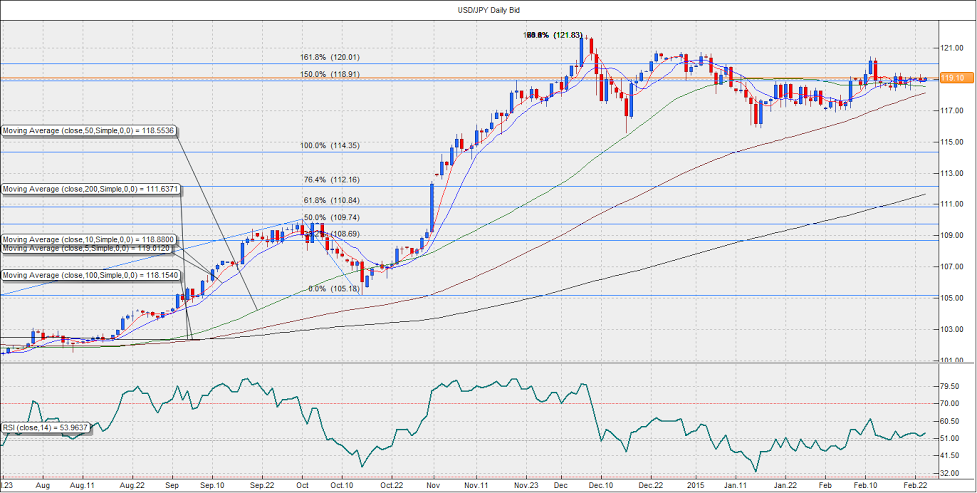

USD/JPY – Yellen could provide a breakout

The USD/JPY pair has turned dead flat in the range of 118.80-119.40 during the last couple of sessions. The weaker-than-expected US data was countered to some extent by the resilient US Treasury yields. The pair is trading above the 150% Fib expansion level of (100.81-10.06 -105.18) located at 118.91. Meanwhile, the immediate resistance is seen at 119.40 and 120.01 (161.8% Fib expansion) and a strong support is seen at 118.42 and 118.15 (100-DMA).

The pair could see a breakout depending on the Fed chair Janet Yellen’s comments on the interest rate hike in the US in her testimony to congress today. In December, Yellen set the stage for a summer rate hike when she said rates would not move in at least 2 months. However, the latest Fed minutes revealed policymakers are in no hurry to raise interest rates. Thus the June rate hike if off the table. Still markets do believe that the Fed would raise rates in 2015. Moreover, Yellen’s comments on how quickly rates will rise would shift the rate hike expectations in a big way, thereby making or breaking the USD rally. A dovish tilt could see the USD/JPY pair test 118.42-118.15 levels. On the flip side, focus on strong labor market conditions could be read as hawkish by markets and may end up pushing the pair to 120.00 levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.