Currencies

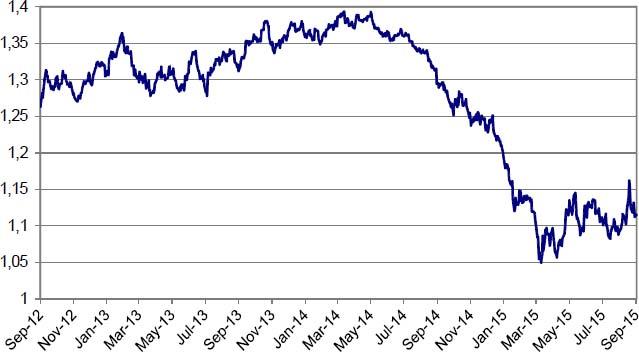

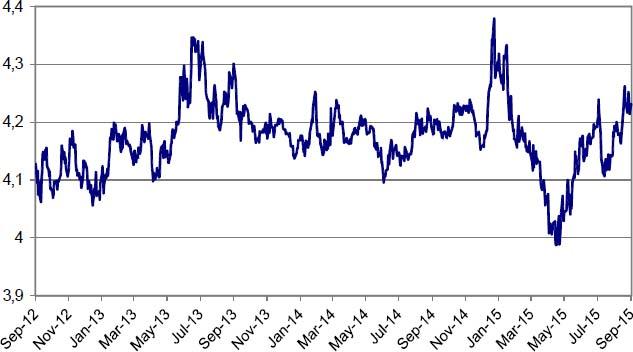

EUR/USD

Risk sentiment is the key driver for USD trading. Risk‐off sentiment pushed EUR/USD temporary north of the 1.1534 resistance. Easing global tensions and soft ECB talk finally capped the topside of the euro.

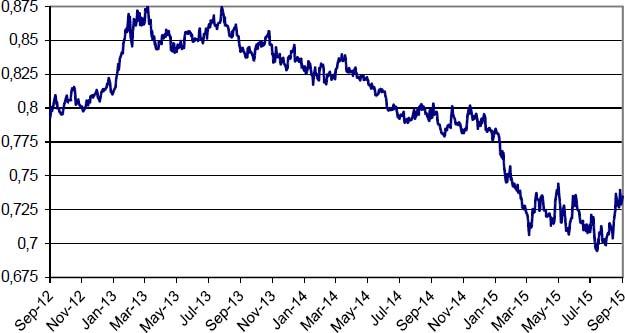

EUR/GBP

Of late, sterling entered a soft spot. UK eco data were a bit less buoyant. Global uncertainty eased BoE rate hike expectations.

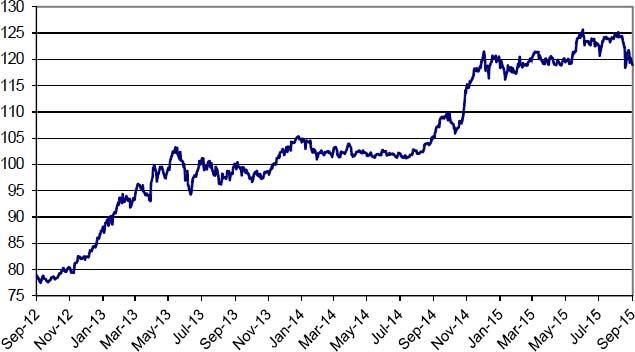

USD/JPY

USD/JPY stays under moderate pressure as global uncertainty/market volatility favoured the yen. Uncertainty on the Fed rate path weighs, too.

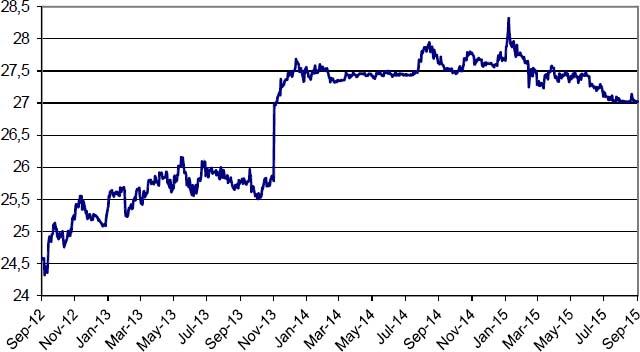

EUR/CZK

The Czech koruna settled close to the central bank’s (CNB) floor of EUR/CZK 27. The CNB intervenes in the currency market to prevent a CZK appreciation .

EUR/PLN

Global uncertainty and higher market volatility weighs on the zloty. The debate on the conversion of FX loans is a slightly negative for the zloty as well.

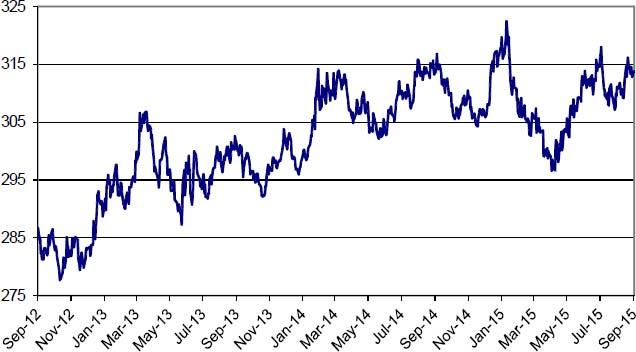

EUR/HUF

The MNB has probably reached the bottom of its rate hike cycle. Even so, the forint remains in the defensive. Global uncertainty weighs and the forint probably won’t get interest support anytime soon.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.