Currencies

The EUR/USD downturn stopped mid‐March, after the FOMC softened its stance and the string of weak US data including the payrolls continued. However, the pair’s rebound is modest and points more to consolidation than a turnaround.

EUR/GBP corrected higher following a QE‐induced decline of the euro. UK eco data weren’t as strong anymore, the BoE signalled risks from the strong currency on inflation and uncertainty surrounding the elections weighed. The upward correction didn’t yet break the downtrend yet.

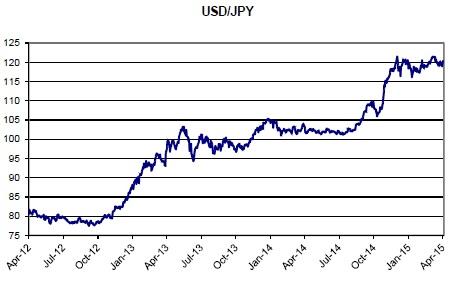

USD/JPY remains paralysed in the upper part of the 115.57/122.03 trading range. The BOJ doesn’t signal further policy stimulation in the near future, even as results from Abenomics are far from convincing.

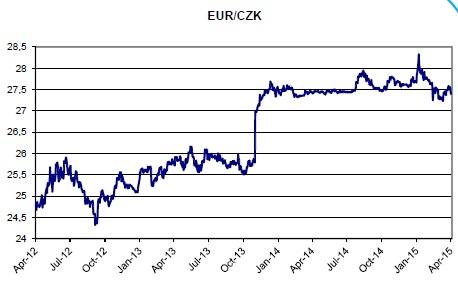

The Czech koruna returned closer to the CNB floor of EUR/CZK 27 as markets scale back chances that the CNB will ease policy further.

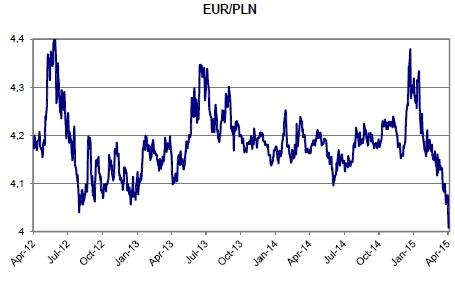

The NBP cuts its policy rate to 1.5% early February, but the zloty barely budged. However the zloty rally got more fuel from EMU QE (euro weakness) and market speculation the Fed will postpone its lift‐off. EUR/PLN 4 is now under test.

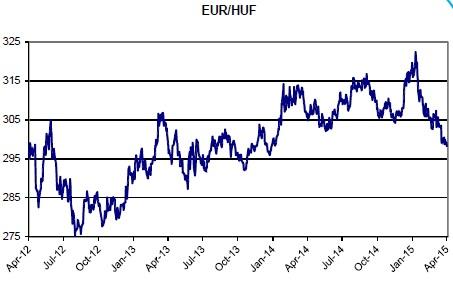

The forint remained strong in past months. On the one hand, there was euro weakness due to the ECB’s QE programme, while otherwise the Hungarian fundamentals improved sharply.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.