Currencies

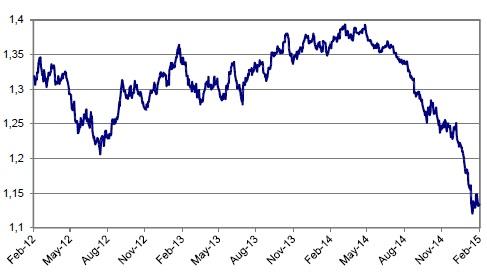

EUR/USD

EUR/USD set a cycle low in the1.11 area after SNB removed its CHF cap and as the ECB announced a full‐option QE programme. Later, the pair found a ST equilibrium in the 1.13/14 area.

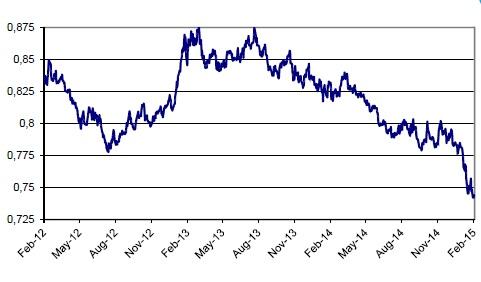

EUR/GBP

EUR/GBP extends its downtrend, in the first place due to euroweakness. Sentiment on sterling remains constructive, as the BoE sounds optimistic on growth.

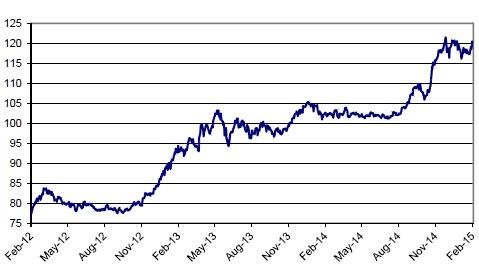

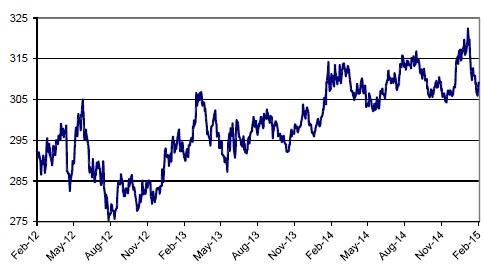

USD/JPY

USD/JPY maintains the established 115.57/121.85 trading range. Initially USD strength prevailed. However, mid‐ February, the yen became better bid on rumours that the BOJ sees further easing as potentially counterproductive.

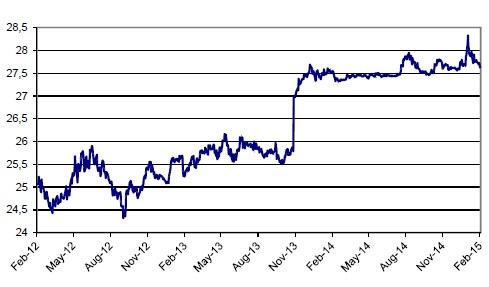

EUR/CZK

The Czech koruna weakened in January on speculation that low inflation could inspire the CNB to raise the EUR/CZK floor. However this speculation proved premature. EUR/CZK returned south of 28.00.

EUR/HUF

The forint came temporary under pressure early January (CHF decoupling and global volatility), but the loss was soon reversed as CEE currencies rose against a broadly weaker euro (QE).

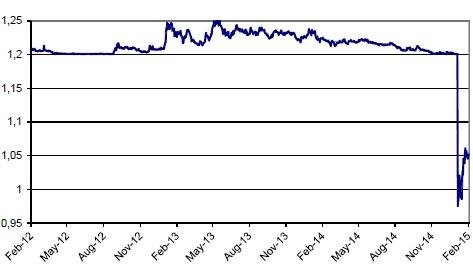

EUR/CHF

The Swiss franc settled in the 1.00/1.05 area after the SNB gave up the EUR/CHF cap to prevent further CHF strength. It is not sure yet whether this equilibrium is ‘sustainable’. There are still rumours of SNB interventions.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.