Is the part-time hiring binge that has inflated job numbers for at least two years about to come to an end?

I think so. More importantly, so do CEOs of large corporations.

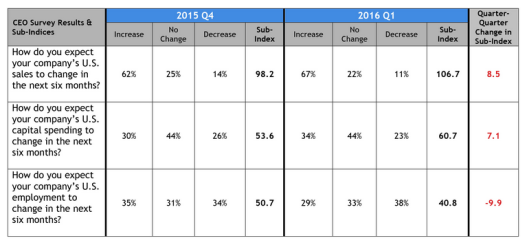

In December, a quarterly survey of large corporation CEOs showed a minuscule net of 1% (35% to 34%) of corporations expected an increase in hiring. 31% expected no change.

The latest quarterly survey shows nearly 10% (29% to 38%) of large corporation CEOs expect to reduce headcount. The remaining 33% expect no change.

CEO Economic Survey Details

Let’s dive into the Business Roundtable First Quarter 2016 CEO Economic Outlook Survey for more details.

Key Survey Results

Mixed Bag?

For the fourth quarter in a row, CEO expectations on the economy remain mixed.

CEO expectations for sales over the next six months increased by 8.5 points, and their plans for capital expenditures increased by 7.1 points, relative to last quarter. Hiring plans declined by nearly 10 points from last quarter.

Mixed Bag Not

Is that an ominous report or a mixed bag?

On the surface one can make a claim either way. The business outlook is up huge as are capital spending expectations.

However, CEOs are clueless about where the economy is headed.

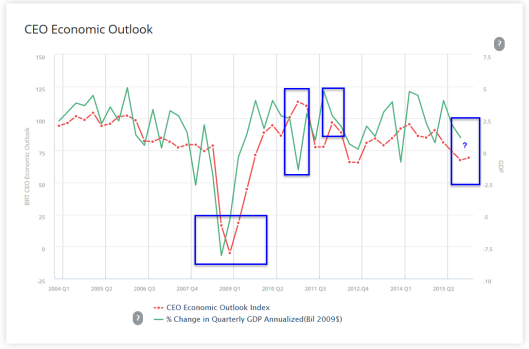

CEO Outlook

Notice the perpetually lagging nature of the CEO Economic Outlook.

GDP is a lagging indicator. The aggregate CEOs’ economic outlook is even more lagging. That’s quite a pathetic under-performance.

Jobs are also a lagging indicator.

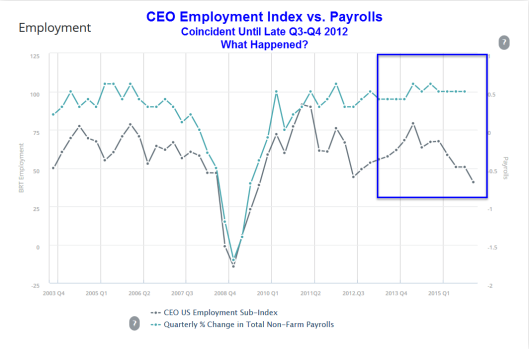

Battle of Lagging Indicators

In the battle of lagging indicators, results show the CEO hiring index was amazingly coincident with nonfarm payrolls from 2003 until late 2012.

What happened?

Obamacare!

The newly created Obamacare health insurance marketplaces opened for enrollment on October 1, 2013.

Starting 2014, citizens were required to have insurance.

Businesses with 50 or more full-time employees had to offer insurance benefits to their employees.

Obamacare reduced the number of hours to 30 that it took to be considered a full-time employee.

Employers cut hours and hired more part-time workers.

Five Consequences

The hiring binge associated with Obamacare is finally over.

US job growth will “unexpectedly” slow dramatically now that CEO hiring plans have weakened to the point of contraction.

Talk of rate hikes will morph into talk of easing.

The US dollar will sink further.

Gold, not the stock market, will be the big beneficiary of this “unforeseen” jobs weakness.

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.

Recommended Content

Editors’ Picks

EUR/USD fluctuates in daily range above 1.0600

EUR/USD struggles to gather directional momentum and continues to fluctuate above 1.0600 on Tuesday. The modest improvement seen in risk mood limits the US Dollar's gains as investors await Fed Chairman Jerome Powell's speech.

GBP/USD stabilizes near 1.2450 ahead of Powell speech

GBP/USD holds steady at around 1.2450 after recovering from the multi-month low it touched near 1.2400 in the European morning. The USD struggles to gather strength after disappointing housing data. Market focus shifts to Fed Chairman Powell's appearance.

Gold aiming to re-conquer the $2,400 level

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

US outperformance continues

The economic divergence between the US and the rest of the world has become increasingly pronounced. The latest US inflation prints highlight that underlying inflation pressures seemingly remain stickier than in most other parts of the world.