Fourth Quarter GDPNow Forecast Sinks to 1.8%

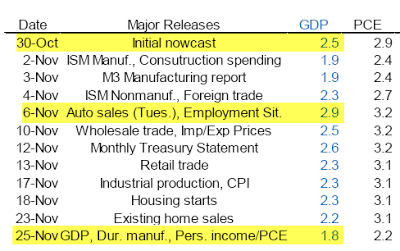

Following today's personal income report in which consumer spending rose only 0.1% month-over-month, the Atlanta Fed GDPNow Forecast for fourth quarter declined by 0.5 percent to 1.8 percent.

"The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2015 is 1.8 percent on November 25, down from 2.3 percent on November 18. The forecast for the fourth-quarter rate of real consumer spending declined from 3.1 percent to 2.2 percent after this morning's personal income and outlays release from the U.S. Bureau of Economic Analysis."

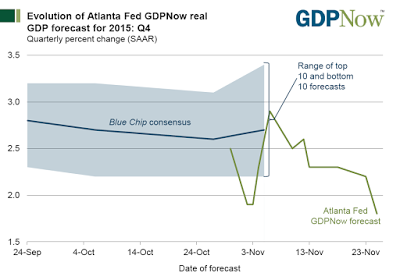

The latest Blue-Chip forecast for early November was 2.7%, a highly unlikely number at this stage unless season spending picks up big time.

Reports show stores are not discounting merchandise as much as consumers like, and consumers generally expect to spend less, so odds of a hefty jump in Christmas sales is questionable.

We may know more next week when reports on Black and Blue Friday become available.

4th Quarter GDP Trends

Consumer Exhaustion

The initial 4th quarter GDPNow forecast started at 2.5% on October 30. It rose as high as 2.9% following the auto sales and jobs reports. It's pretty much been downhill since then.

Wholesale trade, retail trade, existing home sales, all knocked off points.

Today's Personal Incomes and Outlays Report knocked off a half percentage point even though wage growth was substantial.

Many signs point to consumer exhaustion.

Back-to-school spending was weak, housing starts have been weak, existing home sales are weak, manufacturing has been weak, recent spending reports have been weak, and Christmas sales appear "tepid" at this point.

Auto sales have been the one consistently bright spot, in this otherwise treading water economy, but what cannot go on forever, won't.

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.