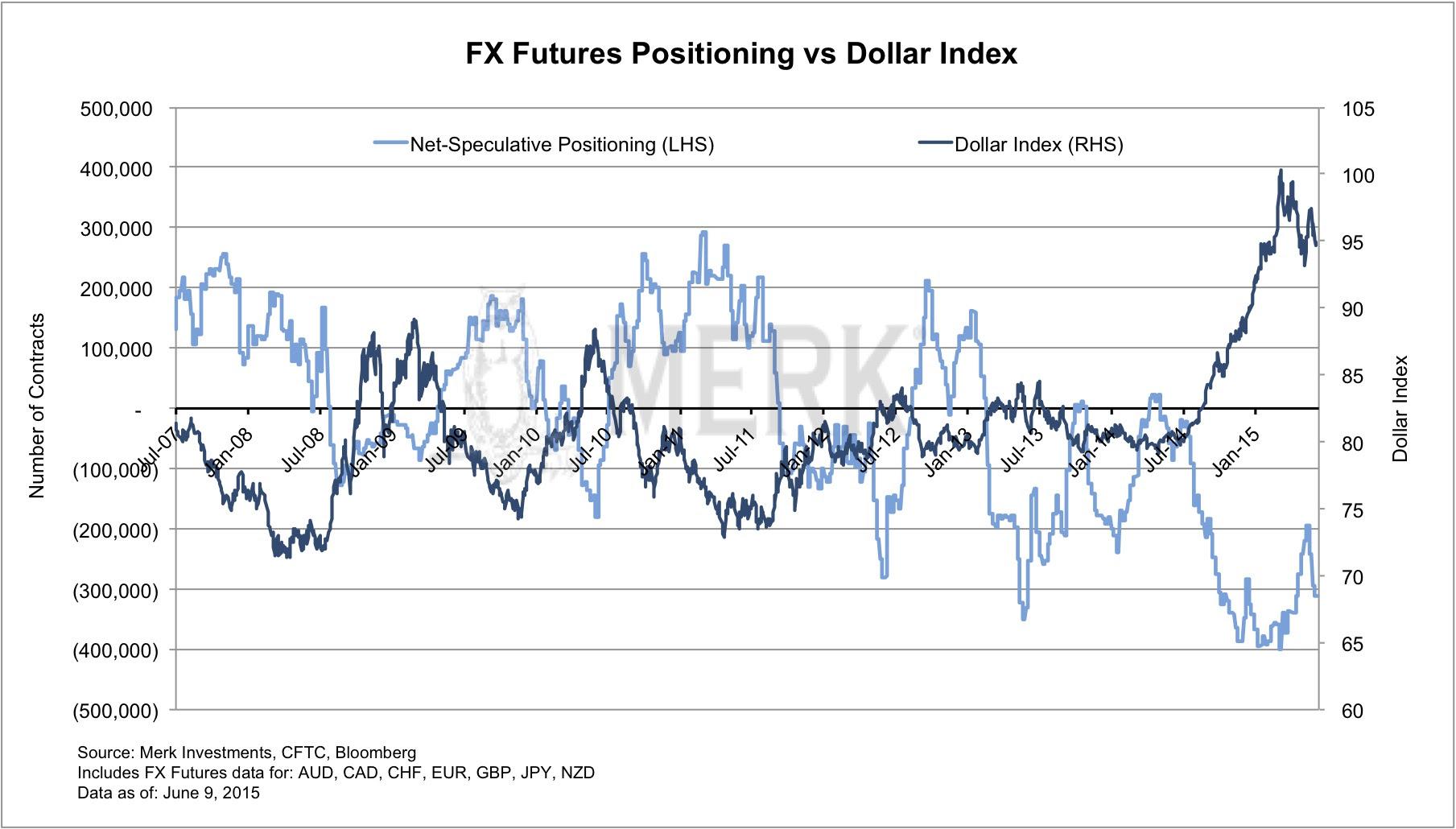

Positive sentiment on the dollar is very high (a potentially contrarian indicator)

The chart below shows net speculative positions based on CFTC data of the U.S. dollar versus other major currencies. While there's a long for every short in the futures market, the CFTC differentiates between "hedgers" and "speculators." The chart below suggests speculators are short currencies versus the U.S. dollar. "Net speculative positioning" aggregates contracts in the Australian Dollar (AUD), Canadian Dollar, Swiss Franc, Euro, Pound Sterling (GBP), Japanese Yen (JPY) and New Zealand Dollar (NZD). The dollar index is a measure of the value of the United States dollar relative to a static basket of currencies with Euro (EUR) 57.6% weight, Japanese yen (JPY) 13.6%, Pound Sterling (GBP) 11.9%, Canadian dollar (CAD) 9.1%, Swiss franc (CHF) 3.6% and Swedish krona (SEK) 4.2% weight. An investor cannot invest directly in an index.

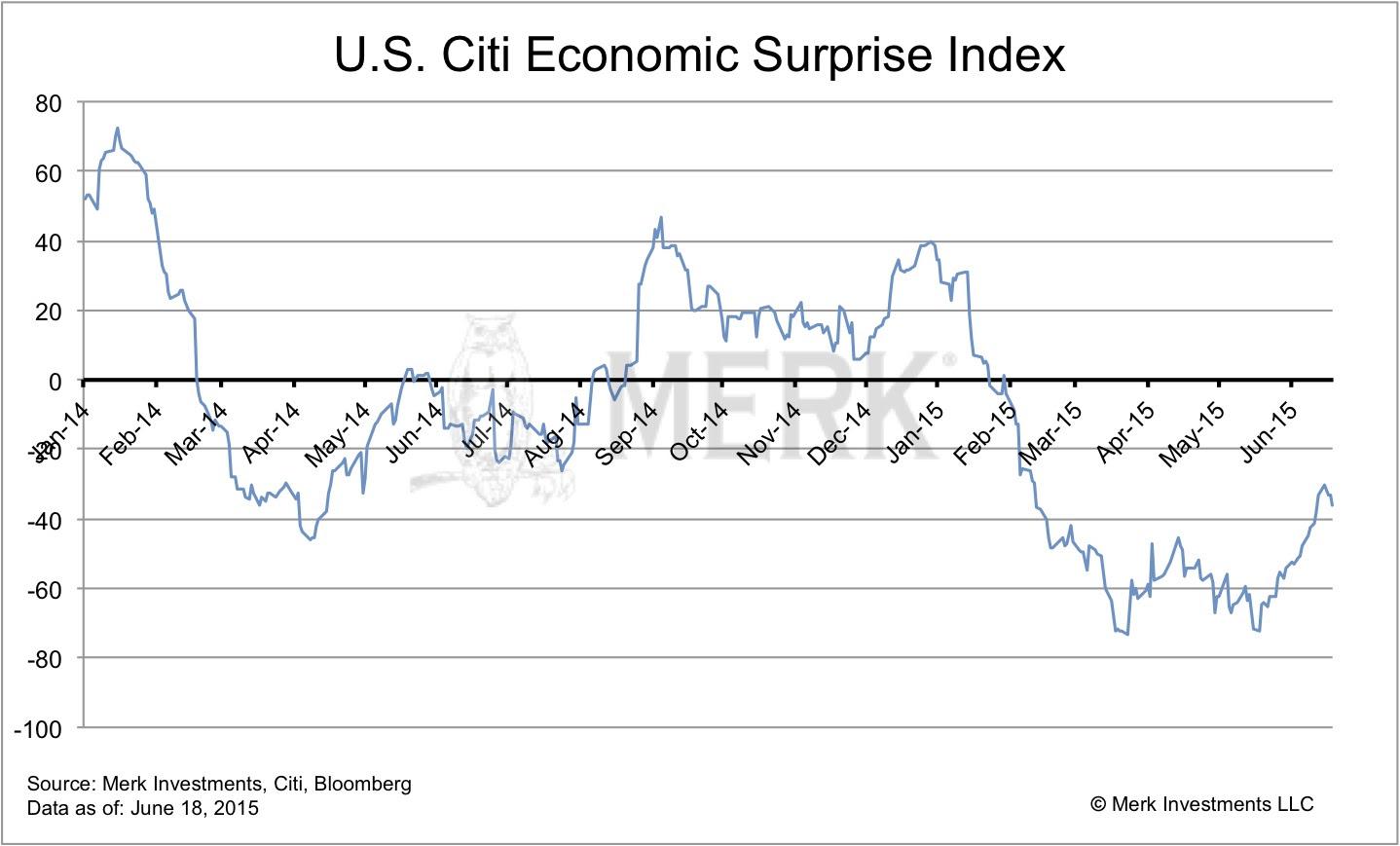

"Too much good news" may be priced into the U.S. Dollar

Please see the Citi economic surprise index for the U.S., an index showing how economic indicators have come in relative to expectations.

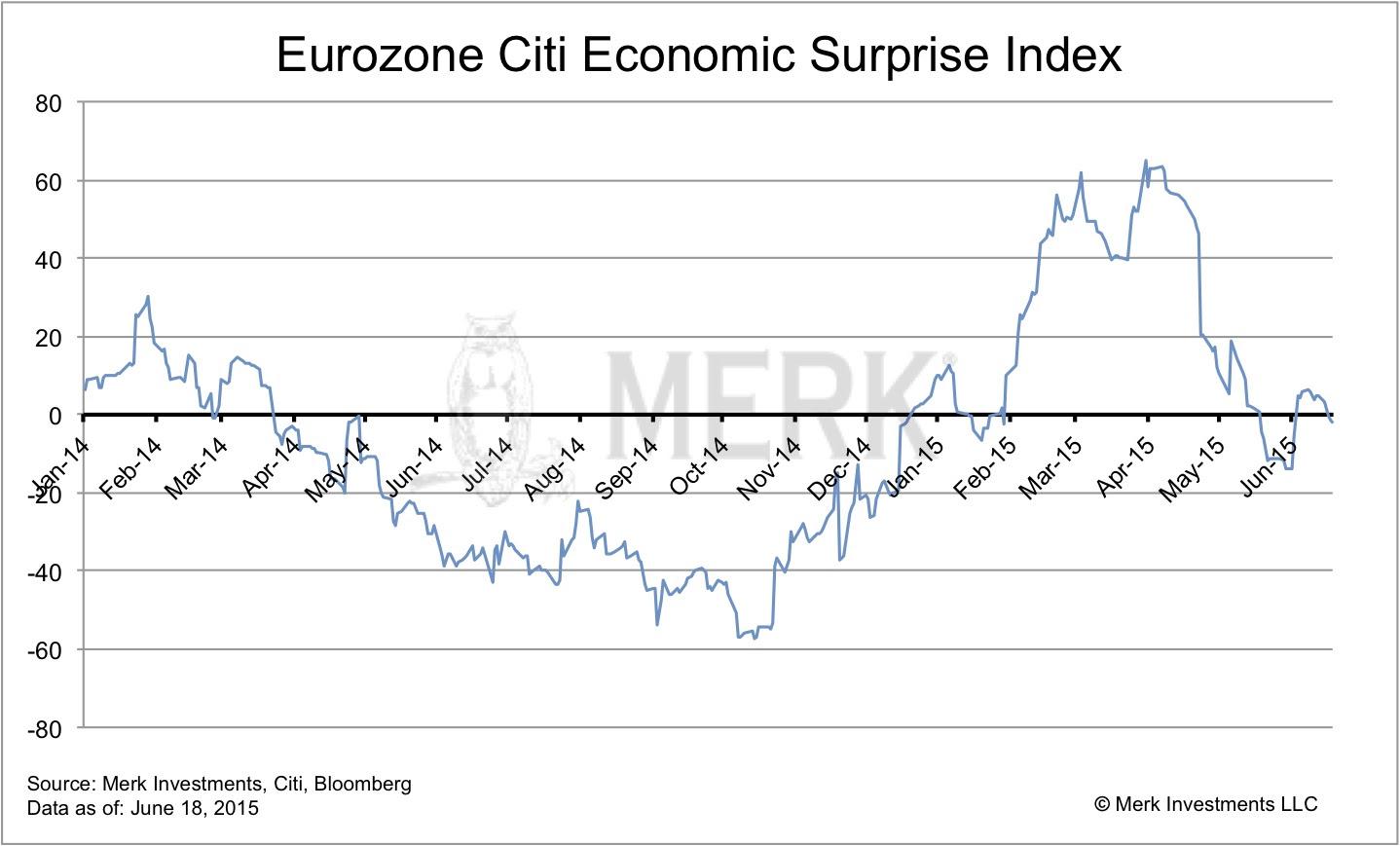

"Too much bad news" may be priced into hard currencies

As an example, please see the Citi economic surprise index for the Eurozone, an index showing how economic indicators have come in relative to expectations.

The Fed all but promises to be "behind the curve"

The Federal Open Market Committee (FOMC) has used the following sentence in their Statements since March 2014: "The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run." We interpret this as a commitment to be "behind the curve," i.e. to be late in raising rates relative to what would be warranted.Central banks, such as the Sweden's Riksbank may have to do a U-turn on their ultra-loose monetary policy

Many central banks outside of the U.S. put a heavier emphasis on headline rather than core inflation. Headline inflation includes food and energy prices. The plunge in energy prices was cited by various central banks as a reason interest rates were lowered. Starting in a few months, the year-over-year comparison on energy prices may no longer show deflationary pressures. As a result, some central banks may be inclined to reverse their highly accommodative policy, i.e. raise interest rates or reduce/eliminate quantitative easing.We define hard currencies as currencies backed by sound monetary policy. We define sound monetary policy as providing an environment fostering long-term price stability. We consider gold to be the only currency with intrinsic value and, as such, qualifying as a hard currency.

Since the Funds primarily invest in foreign currencies, changes in currency exchange rates affect the value of what the Funds own and the price of the Funds’ shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, emerging market risk, and relatively illiquid markets. The Funds are subject to interest rate risk, which is the risk that debt securities in the Funds’ portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities, such as forward contracts, which can be volatile and involve various types and degrees of risk. If the U.S. dollar fluctuates in value against currencies the Funds are exposed to, your investment may also fluctuate in value.

Recommended Content

Editors’ Picks

AUD/USD could extend the recovery to 0.6500 and above

The enhanced risk appetite and the weakening of the Greenback enabled AUD/USD to build on the promising start to the week and trade closer to the key barrier at 0.6500 the figure ahead of key inflation figures in Australia.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Bitcoin price makes run for previous cycle highs as Morgan Stanley pushes BTC ETF exposure

Bitcoin (BTC) price strength continues to grow, three days after the fourth halving. Optimism continues to abound in the market as Bitcoiners envision a reclamation of previous cycle highs.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Federal Reserve might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.