The last 2 weeks have been historic, Bitcoin reaching $14,000, Gold reaching a 7 year high above $1,400 and the sun finally appearing in London and New York respectively. However as we head into the weekend, the scorching temperature isn’t the only occupying factor many of us face. The G20 summit has commenced, and with several geo-political points on the agenda, and the markets closed over the weekend, the first week of trading in July looks set to mirror the weather forecast. Heatwave pending.

The US/China trade deal is still the pressing issue, with whispers of a potential final showdown leading to a deal. Nuclear tensions with Iran and North Korea have muted all talks of Russia recently. However with Crude approaching $60 per Barrel, concerns may be raised in a similar fashion to February, when Trump's tweet on $60 plus Oil sent the market down 3%.

So with the fundamentals still unknown, what does the technical analysis tell us? Below, using the Tradeview MT4 platform, I analyse 2 key markets which could be impacted by the fall-out of this weekend.

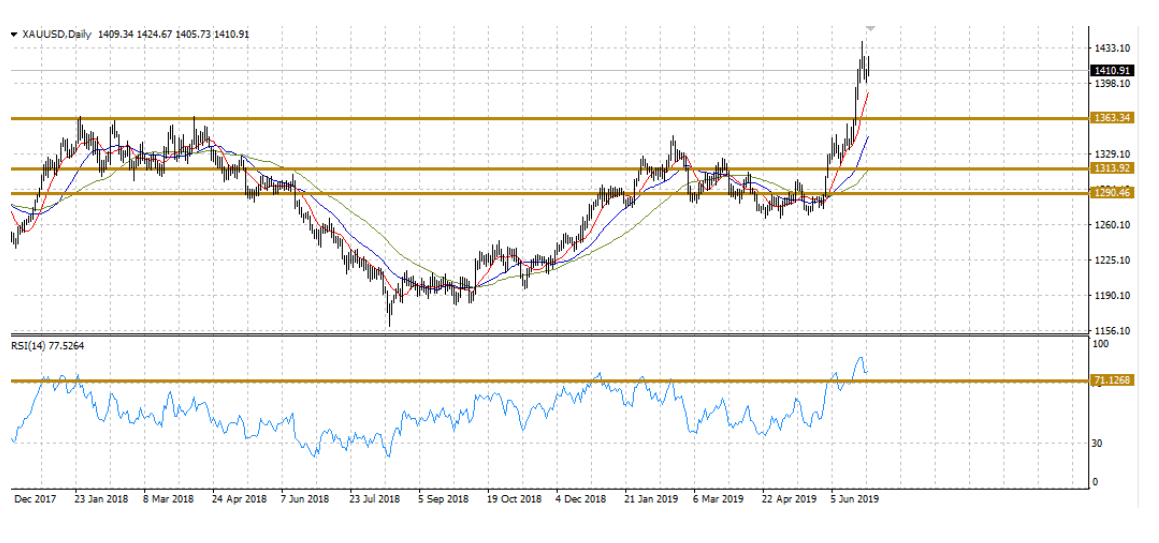

Gold

What goes up must come down? A run which many first expected to happen the second Trump won the 2016 election. However with his US first approach, the markets grew and the world didn’t end and gold traded in the $1100s as a result. The sentiment has changed, with current uncertainty on several fronts, along with the diminishing economy, Gold hit a 7-year high of $1,440. The volumes now show this as being overbought, with RSI trading above the 70 level. With 10/25 day moving averages also positioning for a potential downwards cross. Could a deal or eased trade tensions lead to a big sell-off next week?

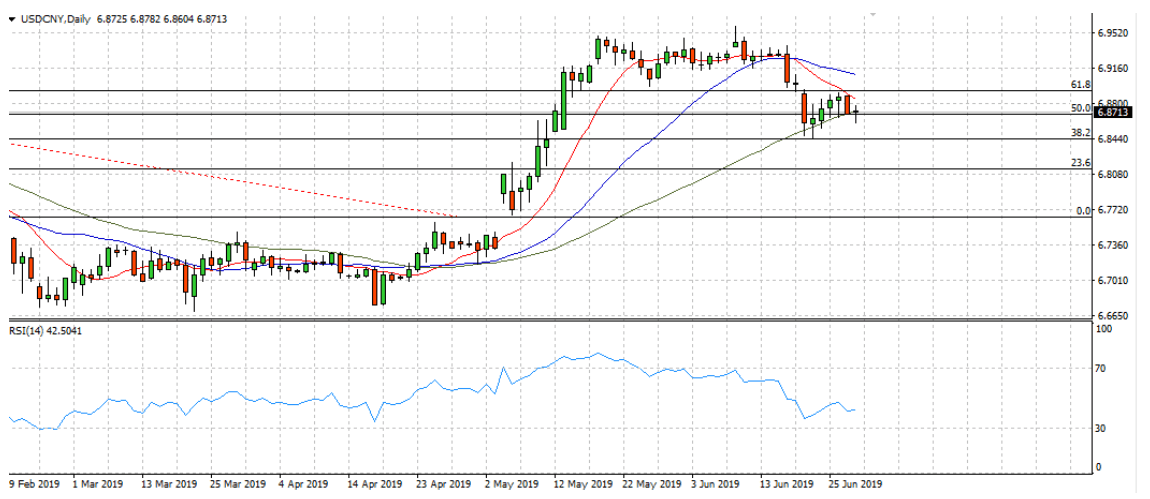

USDCNY

In addition to trade, talks of a currency war reached our ears in recent days with the US opposing a weaker CNY. This opposition coming in the form of yet another Trump tweet, where he also had some choice words for Draghi’s latest easing comments. As a result we saw the bull run in USDCNY halted at which was also a resistance of 6.950. As we now fall towards the 50% Fibonacci level, could we see sell stop orders triggered leading to a bear run?

One thing is for sure and two things are for certain of this weekend, it will be hot. We will also have further information on how global current affairs may or may not settle. As a trader will you be proactive in finding your own trading opportunities?

Trading any financial instrument on margin involves considerable risk. Therefore, before deciding to participate in margin trading, you should carefully consider your investment objectives, level of experience and risk appetite. Most importantly, do not invest money you cannot afford to lose. Consulting with your investment counselor, attorney or accountant as to the appropriateness of an investment in margin trading is recommended. This electronic mail message is intended only for the person or entity named in the addressee field. This message contains information that is privileged and confidential. If you are not the addressee thereof or the person responsible for its delivery, please notify us immediately by telephone and permanently delete all copies of this message. Any dissemination or copying of this message by anyone other than the addressee is strictly prohibited.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.