Russian Fighter Jet Shot Down by Turkey; Risk Trade is No More:

Once upon a time, if a world super power on the brink of war had a fighter jet shot down after entering the airspace of another sovereign nation for barely a few seconds, all hell would break loose in markets and risk-off would reign supreme sending stocks tumbling. Not any more.

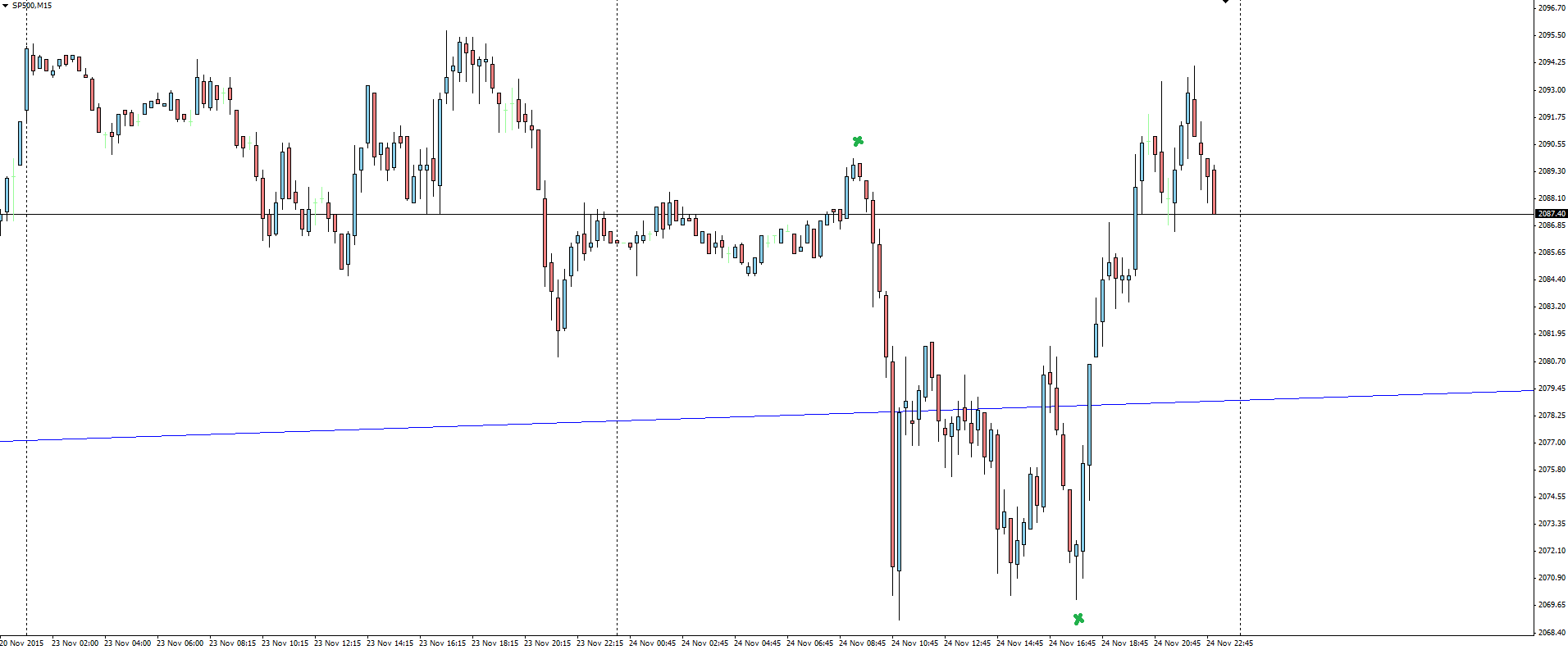

SP500 15 Minute:

The news of the Russian fighter jet being spectacularly grounded in a ball of flames saw only a mild spike down in the SP500 during early trade, but that was only a short lived move and quickly erased losses to actually close well in the green for the session. Amazing!

So just to make it absolutely clear, if you want to be a successful trader, DO NOT listen to the textbook definitions of what should or should not happen to markets during times of geopolitical risk. Times have changed and so have the perceptions that markets take on events like these.

I felt almost dirty saying it last week following the Paris attacks and again it doesn’t feel right saying it again, but as a trader it has to be said:

“Markets are slowly becoming more and more immune to these types of events.”

Aussie Rips:

RBA Governor Stevens’ speech also helped push the Aussie to new highs overnight. Speaking at a dinner in Sydney, Stevens’ gave markets the one key quote that mattered, establishing the bank’s stance is firmly neutral.

“Lower rates were not as stimulatory as they used to be.”

That is not the type of thing that someone looking to cut any time soon would say.

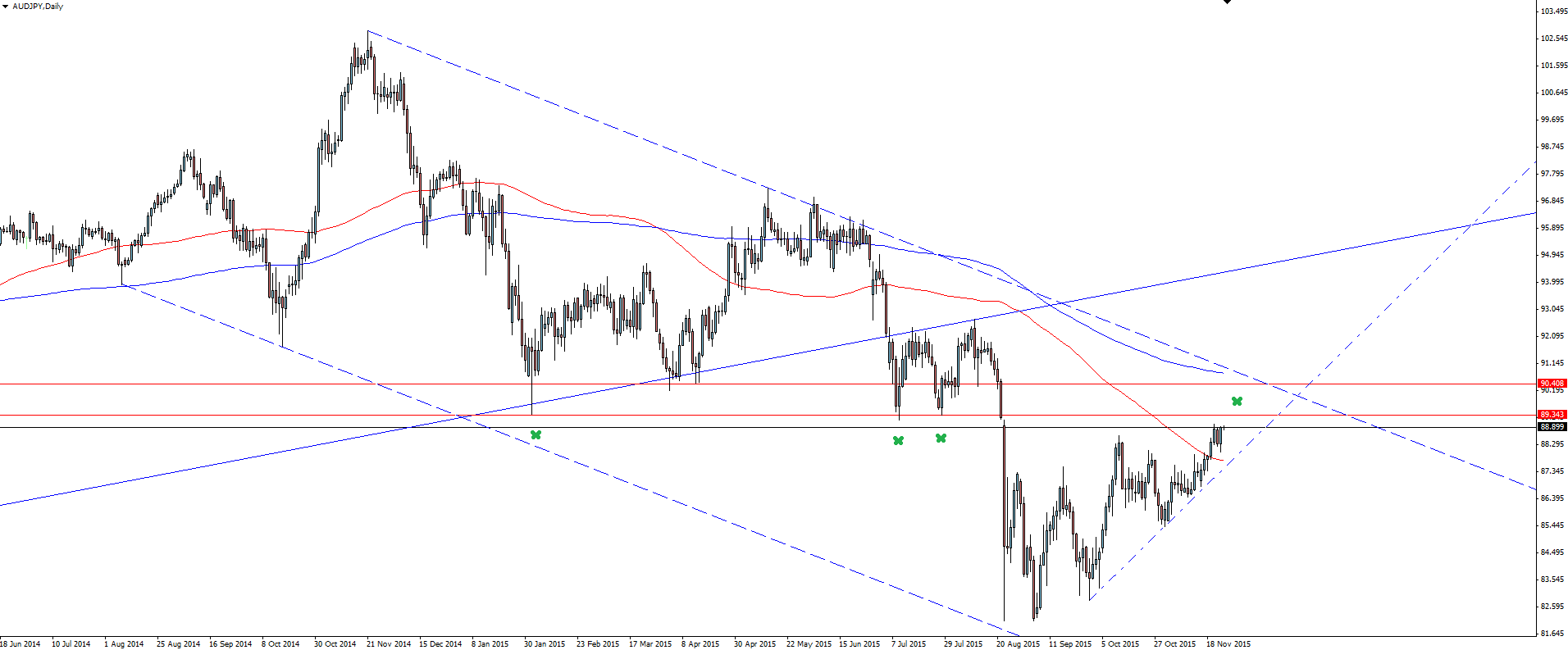

AUD/USD Daily:

The Aussie catches a bid and tucks back above the hugely important weekly trend line again.

On the Calendar Wednesday:

JPY Monetary Policy Meeting Minutes

AUD Construction Work Done q/q

AUD RBA Assist Gov Debelle Speaks

GBP Autumn Forecast Statement

USD Core Durable Goods Orders m/m

USD Unemployment Claims

Chart of the Day:

Following the news of the Russian fighter jet being shot down and it’s effect on the SP500, today’s chart of the day moves across to AUD/JPY.

AUD/JPY is often regarded as being highly correlated to the SP500, something you can check for yourself with the ‘Correlation Matrix’ in our Vantage FX Smart Trader Tools add-on for MT4. The pair tends to find buyers when markets go risk-on, while sellers enter when the environment turns to risk-off.

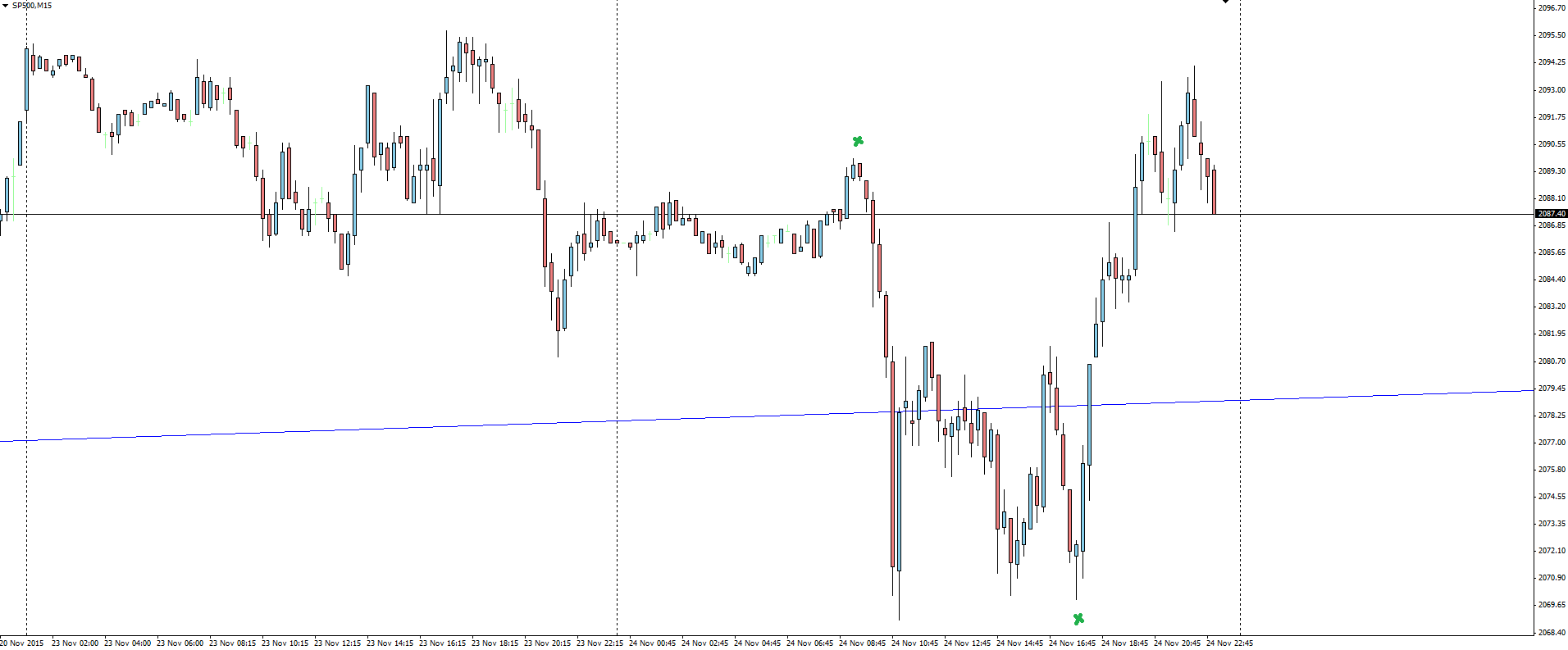

AUD/JPY 15 Minute:

Compare the 15 minute AUD/JPY chart here with the above SP500 chart we featured at the top of this blog and the correlation is clear on the plane spike, with the pair dropping but then immediately rallying hard as the market determines the event to just about be today’s normal.

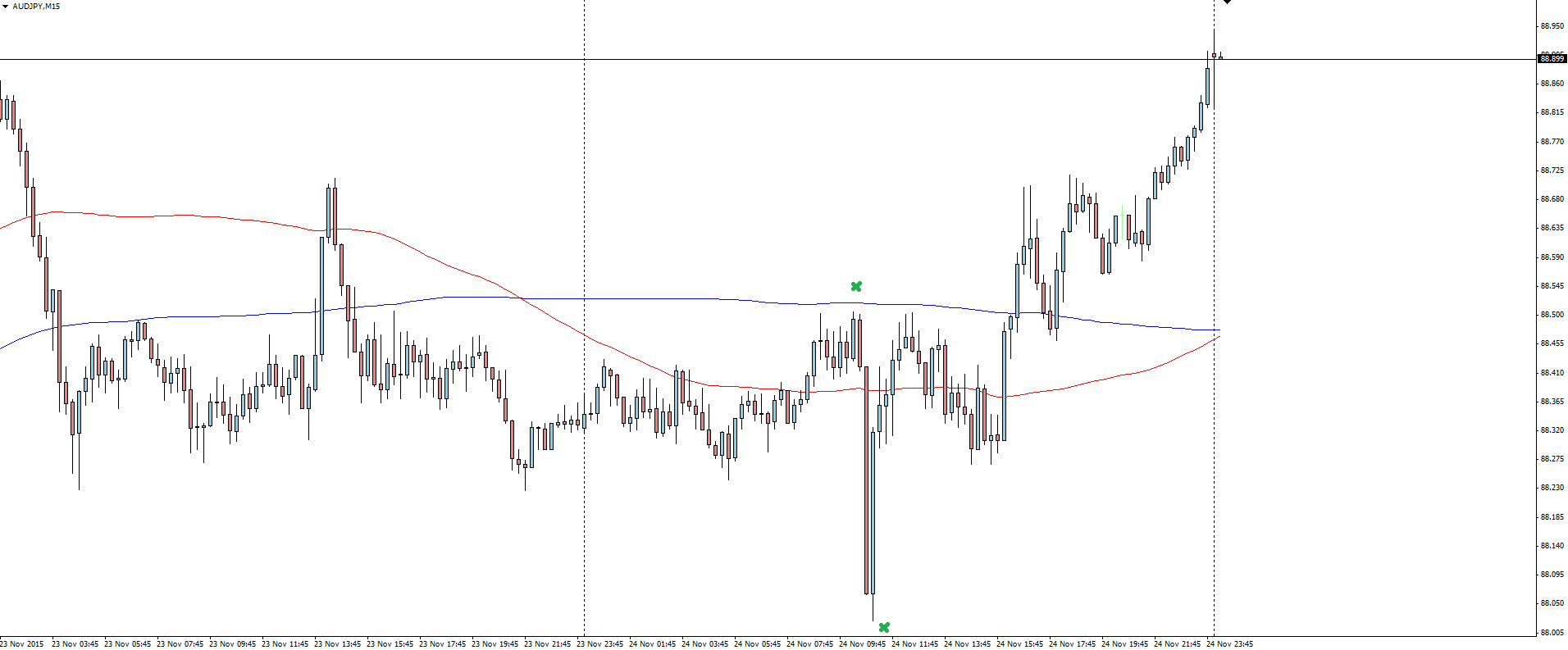

AUD/JPY Daily:

Zooming out to the daily and we can see that price smashed through the 100 SMA that we were watching last week, and looks like it is reaching for channel resistance. I have re-drawn the horizontal support/resistance line to take in the spikes and we now have a nice confluence of possible resistance from which to take trades from.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin (WLD) price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.