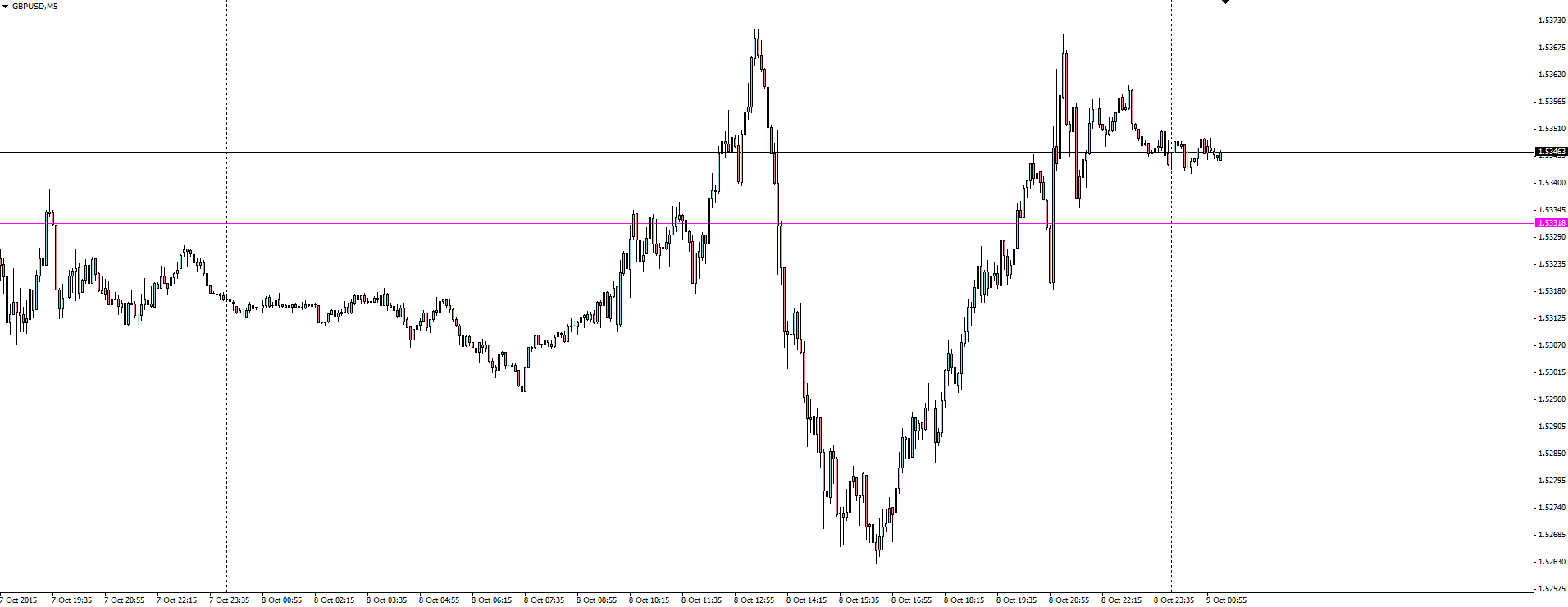

The British Pound was the big story overnight, experiencing a wild 100 pip V shaped swing as Cable first fell on the Bank of England decision and then gained it all back as the FOMC minutes came into play.

GBP/USD 5 Minute:

The Bank of England held UK interest rates at a record low level of 0.5%, with the bank’s Monetary Policy Committee voting 1-0-8 (increase-decrease-hold) in favour of keeping rates unchanged for another month.

Along with the now standard risk of turmoil in emerging markets, the BoE focused its attention on cost pressures in the UK labour market not rising at the rate required for inflation to return to the bank’s 2% target. This means that UK inflation levels would likely stay below 1% until the spring of 2016 which is longer than expected, and therefore pushed down the Pound as rate hike bets were redrawn.

Rate hikes are still on the cards for early next year but the Fed pushing things back has muddied the waters slightly, with some now predicting that the BoE move will be delayed too.

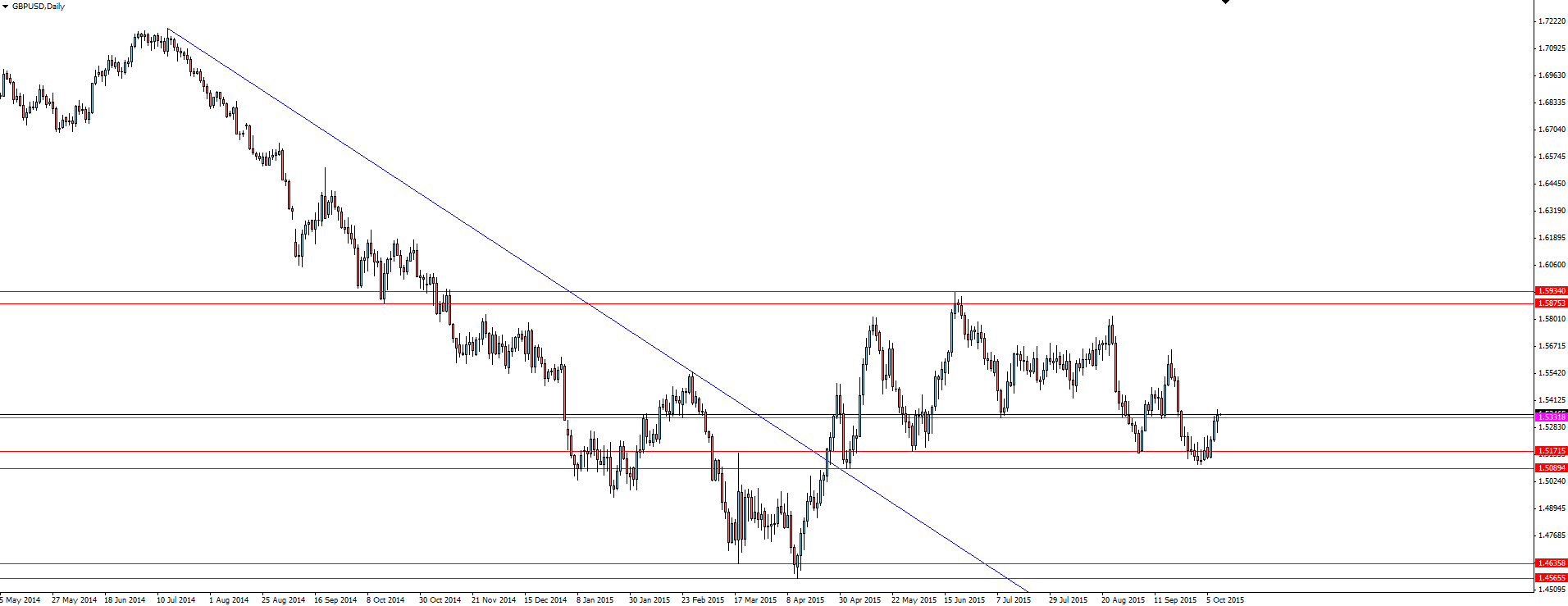

GBP/USD Daily:

FOMC Minutes: The September meeting FOMC minutes were also released overnight, showing that the committee was unsettled by signs of a global economic slowdown but still upbeat on the domestic economic outlook, stating that they thought things hadn’t “materially altered” the outlook for the economy.

“Nevertheless, in part because of the risks to the outlook for economic activity and inflation, the committee decided that it was prudent to wait for additional information.”

Just be aware that for markets, this is all old news. A lot has changed even in the short time since the FOMC meeting, most notably the September NFP Miss which showed far fewer jobs were created during the month than had been anticipated.

My favourite narrative around all this liftoff chatter is how the Fed likes to talk about keeping credibility. They most recently have stated that a premature rate rise would negatively affect their credibility but in reality they’ve put themselves in a lose/lose situation. Contradicting Fed speakers who chop and change dovish to hawkish from week to week and not following through on the stated plan at the first sign of a speed bump is what hurts credibility.

Greece MKII.

On the Calendar Friday:

AUD Home Loans m/m

CAD Employment Change

CAD Unemployment Rate

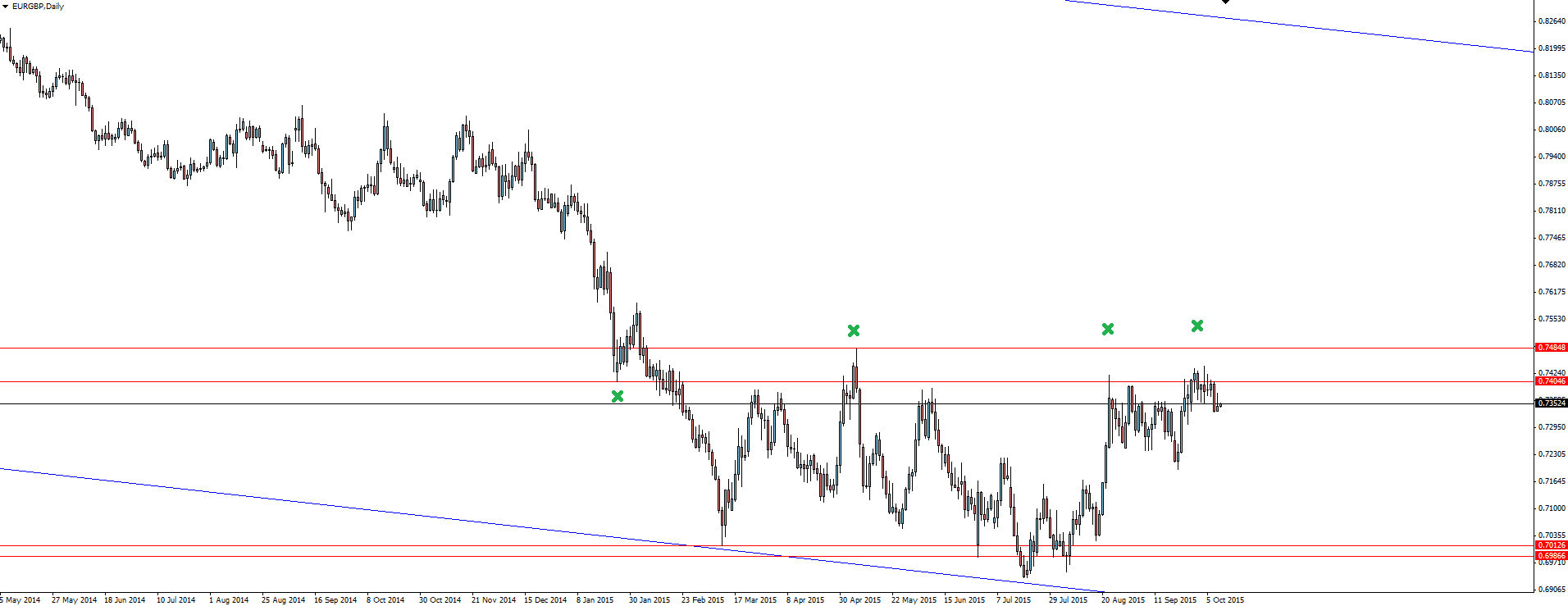

Chart of the Day:

We’ve looked at the EUR/GBP Channel in a technical analysis post a few weeks ago and we re-visit the pair in today’s chart of the day.

EUR/GBP Daily:

As you can see, the setup from weeks ago is still basically in tact. We are still at the top of the daily range and the path of least resistance still looks to the downside.

Pound strength in the fallout after the most recent BoE guidance should dictate the trade from here.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.