NFP Misses: Back on deck and refreshed after the NSW (Australian) Labour Day public holiday Monday. Summer has arrived early in Sydney, with the weekend an absolute scorcher! It was definitely good to refresh the batteries and take a break away from the charts for the couple of days. Have to keep that mind sharp for when you need it the most!

First quickly moving through Friday’s BIG NFP miss:

“USD Average Hourly Earnings m/m (0.0% v 0.2% expected)”

“USD Non-Farm Employment Change (142K v 201K expected)”

“USD Unemployment Rate (5.1% v 5.1% expected)”

An ugly set of numbers no matter which way you look at them and probably the last nail into the coffin of a 2015 rate hike. As the futures market all but prices out a hike this year, that September liftoff expectation we were speaking about not that long ago is all but a distant memory now!

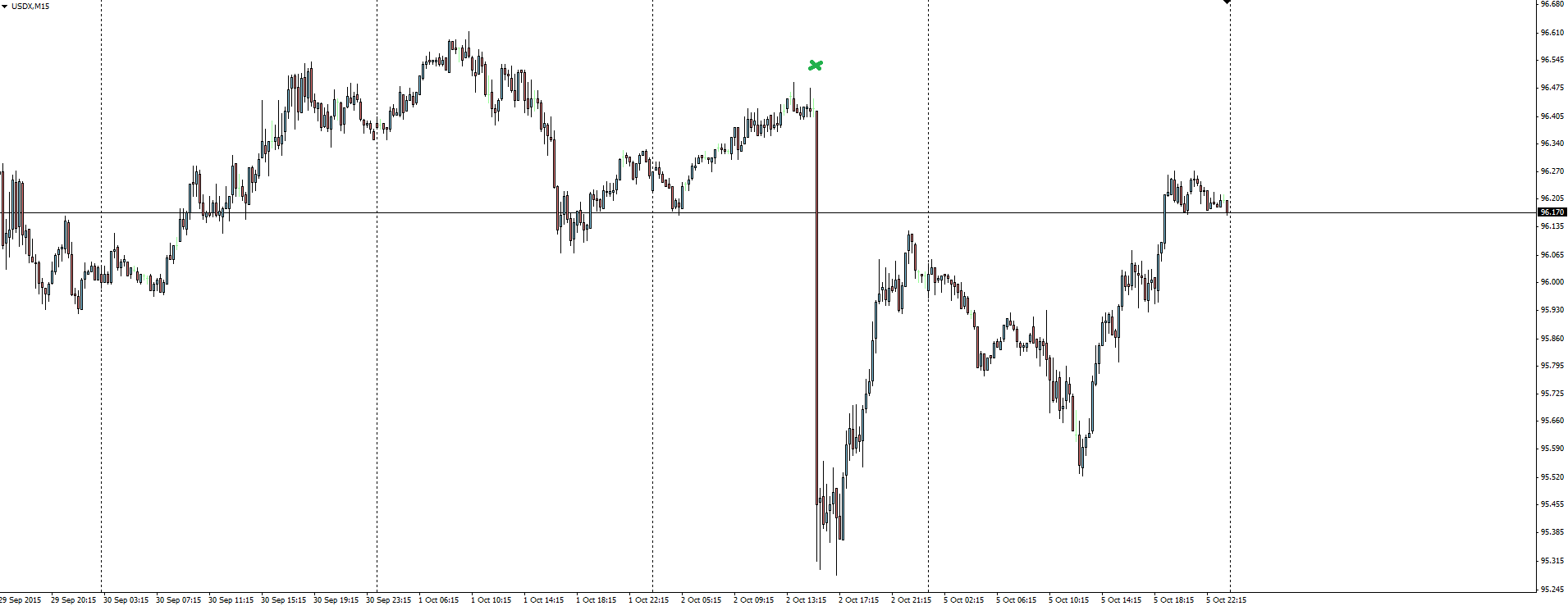

USDX 15 Minute:

The headlines numbers obviously smashed the US Dollar through the USDX basket, but by Tuesday Asian session, price has all but rebounded to where it was pre-release!

As we spoke about in Friday’s NFP Scenarios, the bigger risk was always for a miss to the upside than the down and the relatively muted, directional reaction to the downside in the USDX and across the majors is testament to just how much was already priced in.

If you took a hit on any shorts playing for the beat of expectations, you can’t feel bad because you put yourself into a position to cash in with minimal risk. That’s just trading.

RBA Tuesday:

During the Asian session, today is all about the Reserve Bank of Australia who have their monthly monetary monetary policy meeting in Sydney. The RBA is widely expected to leave interest rates unchanged at 2% both at this meeting and then into at least the early parts of 2016.

The RBA have managed to keep their powder dry through the recent months of stock market turmoil and Chinese demand woes, helped by the lower Aussie Dollar providing the loosening fiscal impacts required. With last night’s big NFP miss taking a 2015 hike off the table in the US, this could leave the door open for at least a change in guidance from the RBA.

Bloomberg is reporting that there is only a 27% chance of a 0.25% cut priced into the market as we head into Tuesday, but there are a number of economists calling for a cut sooner rather than later on local labour market concerns, now that the Fed backstop has been taken away. Here’s Josh Williamson from Citi:

“If they wait until February, it will be too late and they’d need to cut again immediately after the first one. So we’re hoping, and expect them to go in November.”

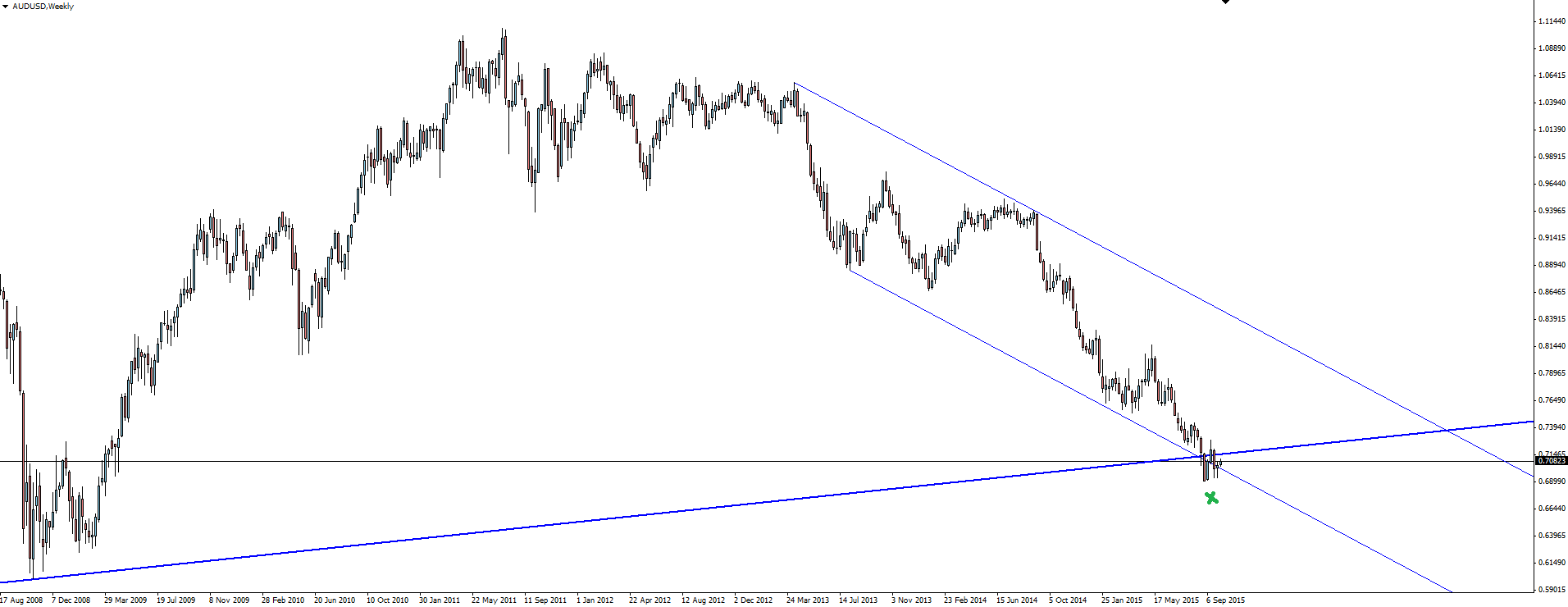

AUD/USD Weekly:

I know it’s sometimes frustrating for day traders to see weekly charts featured in these sorts of posts, but with price right inside a confluence zone of weekly support, any levels posted from a lower time frame point of view would be doing you a disservice.

Again the bigger risk is anything less than dovish coming from Stevens and the RBA. Something that I just can’t see happening after what we’ve seen heading into this week.

On the Calendar Tuesday:

CNY Bank Holiday

AUD Trade Balance

AUD Cash Rate

AUD RBA Rate Statement

CAD Trade Balance

USD Trade Balance

EUR ECB President Draghi Speaks

Chart of the Day:

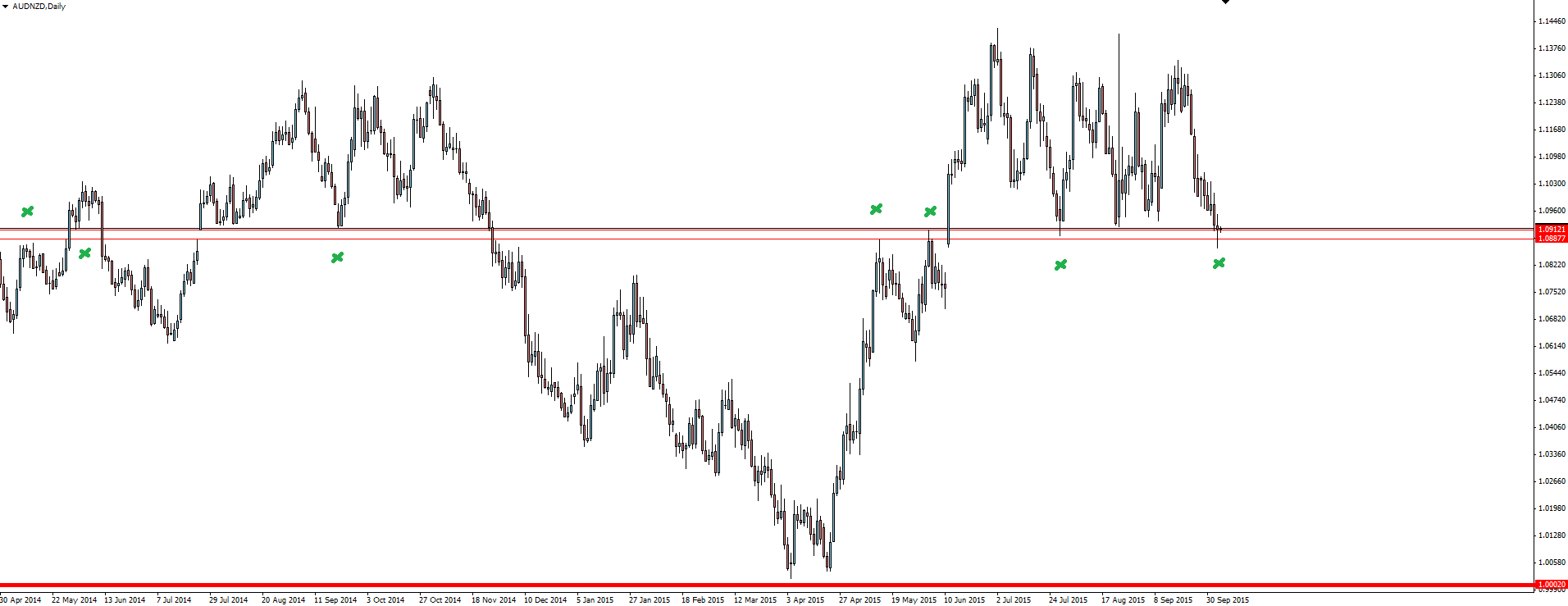

Heading into this afternoon’s RBA interest rate decision, we take a look at AUD/NZD in today’s chart of the day.

AUD/NZD Daily:

While although still in shorter term range, AUD/NZD is stepping up between major support/resistance levels nicely. A great example of how tight your stops can be placed if you get conformation of a bounce off a major support/resistance level.

Price has now come back to test one of these support/resistance levels that has been an area of interest in the past and gives a nice area to manage your risk around.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.