Reality Check:

With the Forex markets buzzing on the uncertainty that the Chinese have entered the so called currency wars, the volatility and whipsaws have given traders an extra reason to question the Fed.

With both the Fed and the BoE looking at a huge global shift in the direction of monetary policy, these moves out of China come at a time when markets are most on edge. Markets are asking whether these moves imply weakness in the Chinese economy more so than that being officially reported.

With the addition of this theme, the US Dollar rally has temporarily halted and price has pulled back down through major trend line support.

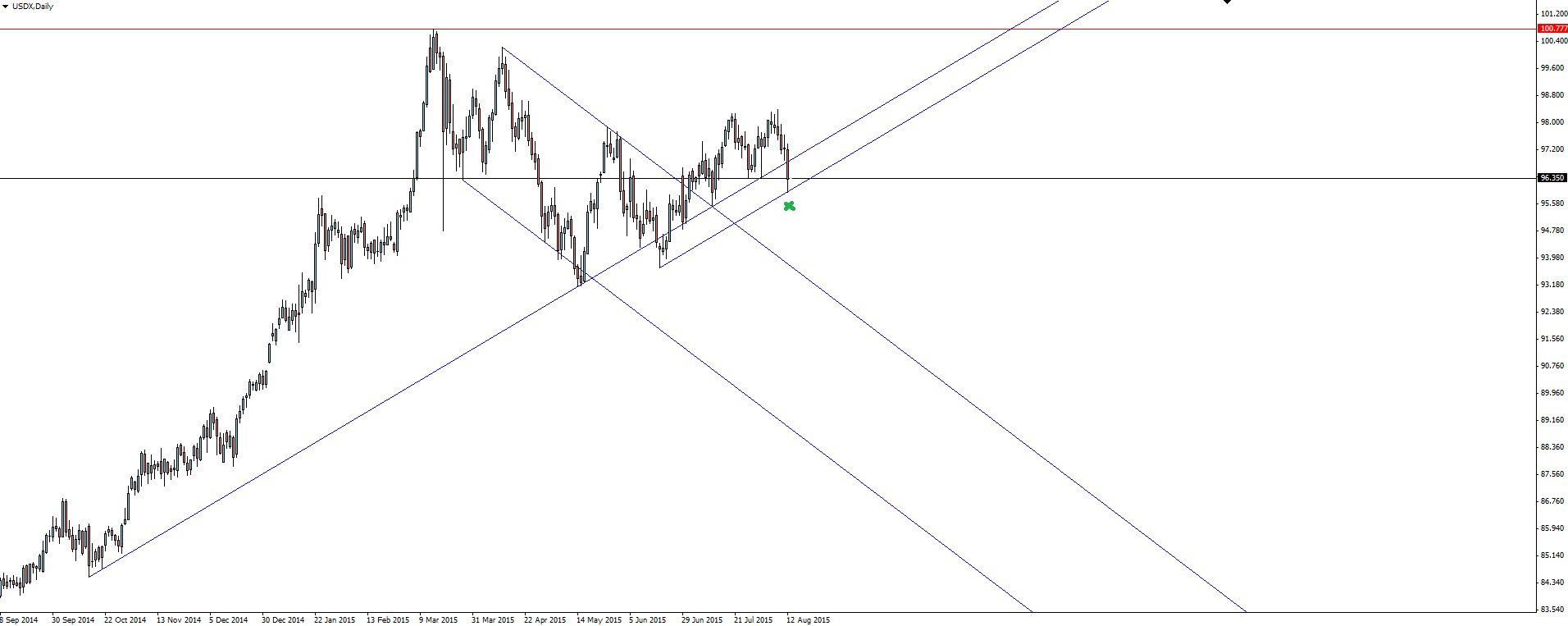

USDX Daily:

This level has been broken before and as it’s an index, it’s not a terminal break just yet and you shouldn’t treat it as so.

The US Dollar bulls are however getting nervous, but as we said yesterday in our Daily Market Update, all China has done, is give itself some breathing room. Just like all developing economies before and around it, China is experiencing some growing pains as it moves into the next economic phase but that is all. The control that the PBOC has at its disposal is unparalleled across the globe, as well as having the full set of monetary policy tools to add stimulus when needed. Something they will have no problem pulling the trigger on. Whatever it takes will be their motto.

As for the Fed, how quickly we forget about the Greek debt crisis (what a joke just quietly) as well as China’s stock market woes barely a few weeks ago. If the Fed isn’t going to alter its path on either of these points, and it made it abundantly clear that it would not, then surely this isn’t going to be any different and this theme could just be one giant USD dip to buy into.

On the Calendar Thursday:

AUD MI Inflation Expectations C

NY PBOC Yuan Briefing

USD Core Retail Sales

SD Retail Sales

USD Unemployment Claims

Chart of the Day:

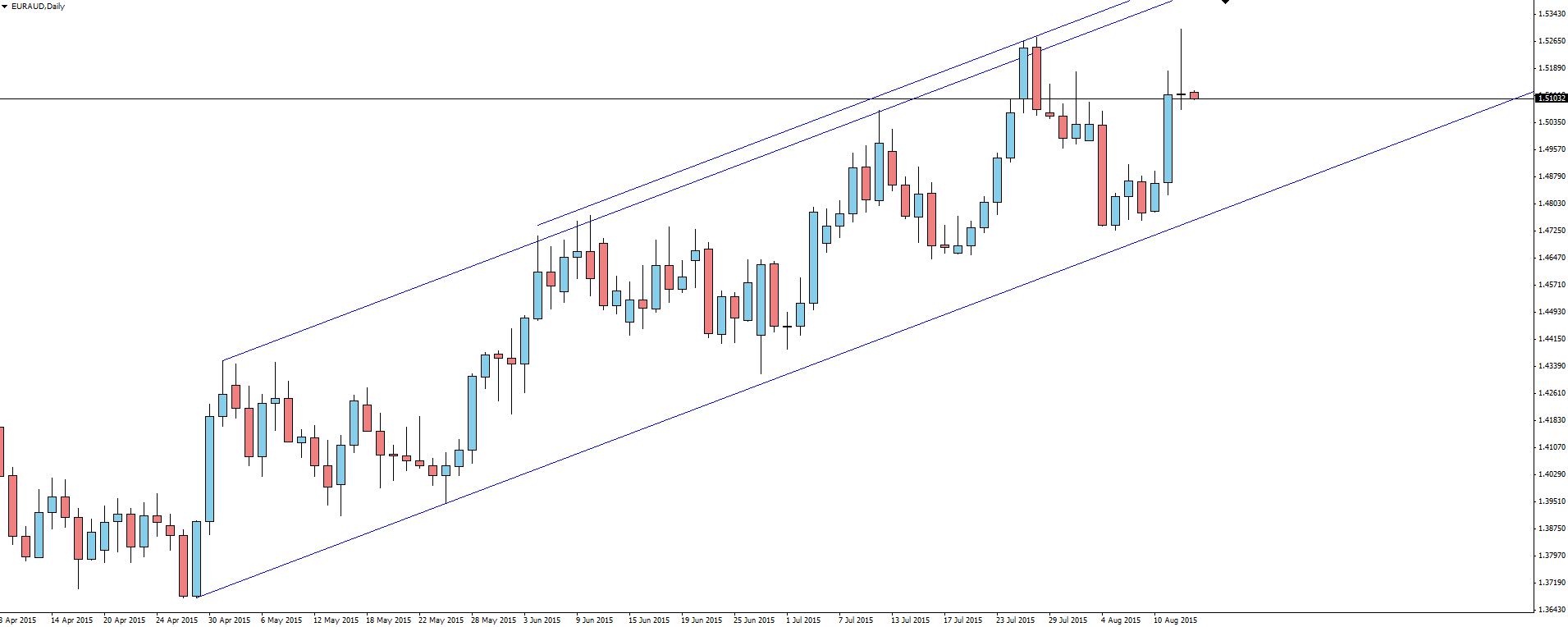

I’m loving some of the clean technical setups that the Forex crosses provide, and today’s EUR/AUD chart is a perfect example.

EUR/AUD Daily:

Over the past couple of months, EUR/AUD has been stepping up nicely inside this bullish channel. Yesterday’s daily candle is of interest as it has formed a doji after price was rejected at its previous swing high.

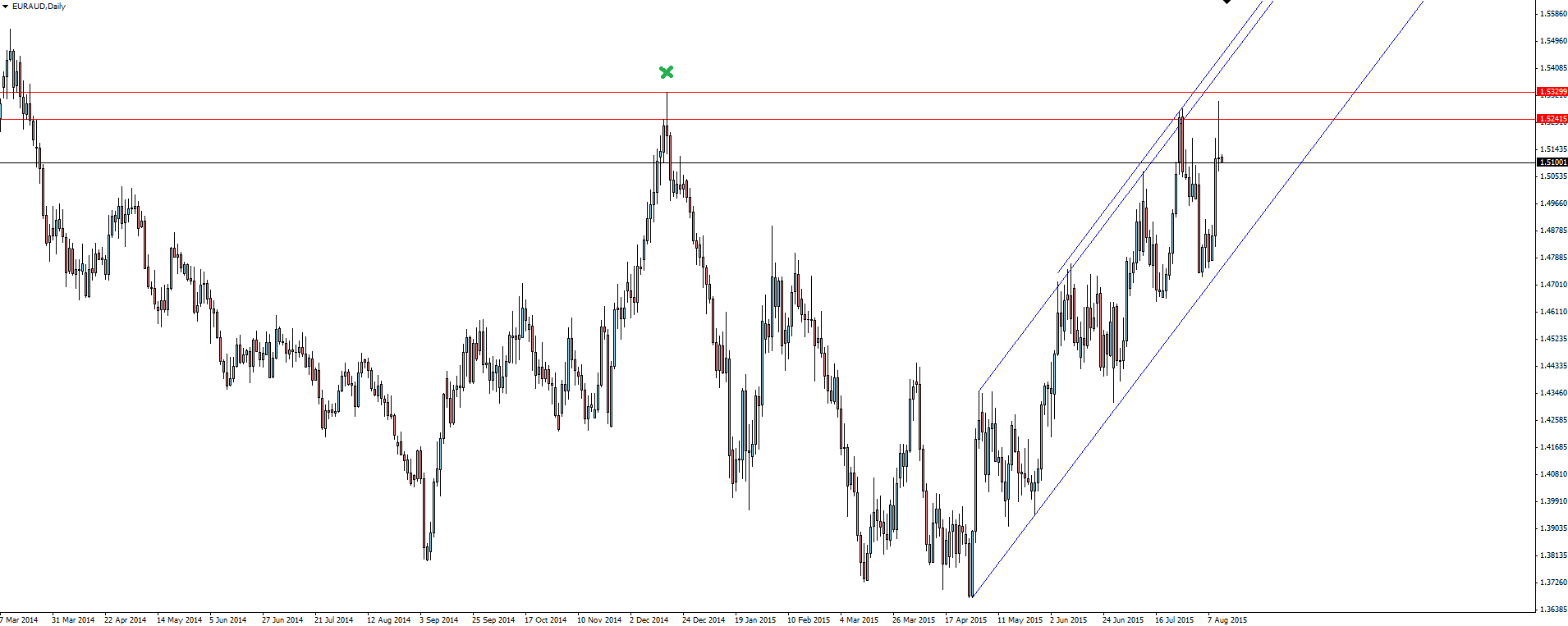

EUR/AUD Daily 2:

This swing high is also significant due to the resistance zone that has formed after its previous visit to the level where it was rejected equally as hard.

The fact that price is now 200 pips away from the zone (as well as the fundamentals spoken about above) might be a bit of a turn off to entering straight away but we’ll be keeping an eye on this one on Twitter as it unfolds

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 after German IFO data

EUR/USD stays in a consolidation phase at around 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price flat lines above $2,300 mark, looks to US macro data for fresh impetus

Gold price (XAU/USD) struggles to capitalize on the previous day's bounce from over a two-week low – levels just below the $2,300 mark – and oscillates in a narrow range heading into the European session on Wednesday.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin (WLD) price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.