RBA Preview:

RBA Tuesday! Although there isn’t much chance that Stevens will pull the trigger on another cut to fresh record lows, the accompanying statement and the wording that the bank provides will be key to how the Aussie Dollar reacts.

Cash rate futures have priced in only a 9% chance that the RBA will cut rates to fresh 1.75% lows this afternoon in Sydney, and this sentiment is backed up by the Reuters economist survey, with only 1 out of the 22 forecasting a cut. Yes, there is always 1 or 2 looking to get their name up in lights for taking a contrarian view. Wouldn’t it be interesting to know which of these economists are actually taking an AUD/USD position into the decision on the back of their surveyed opinion!

So what should we be looking out for in the accompanying statement?:

The line of ‘further depreciation in the AUD seems both likely and necessary’ has grown tired, and at these levels it could almost be seen as fair value. I say almost because I don’t know if Stevens will want to undo all his hard work by saying this and having the AUD rally hard on the back of it. The market would surely take that as a signal of a bottom.

The other major economic talking point around the Australian economy has been what is the ideal growth rate? Meaning the level keeping unemployment and inflation in an ideal band. For a long time, this ideal number for growth has been 3% but with this number not having been reached for the last 6 years, Stevens brought up the idea of potentially downgrading the RBA’s growth forecast. This is where I’ve seen a few questions asked around the fact that this could be a catalyst to actually continue to cut rates on.

Just remember that as always, the Sydney housing market remains a huge thorn in the side of the RBA when debating whether cutting rates on a slowing economy will be healthy overall. This theme has been put onto the back-burner a little bit but it’s effect on their decision making is not to be underestimated.

Let’s now take a look at the charts:

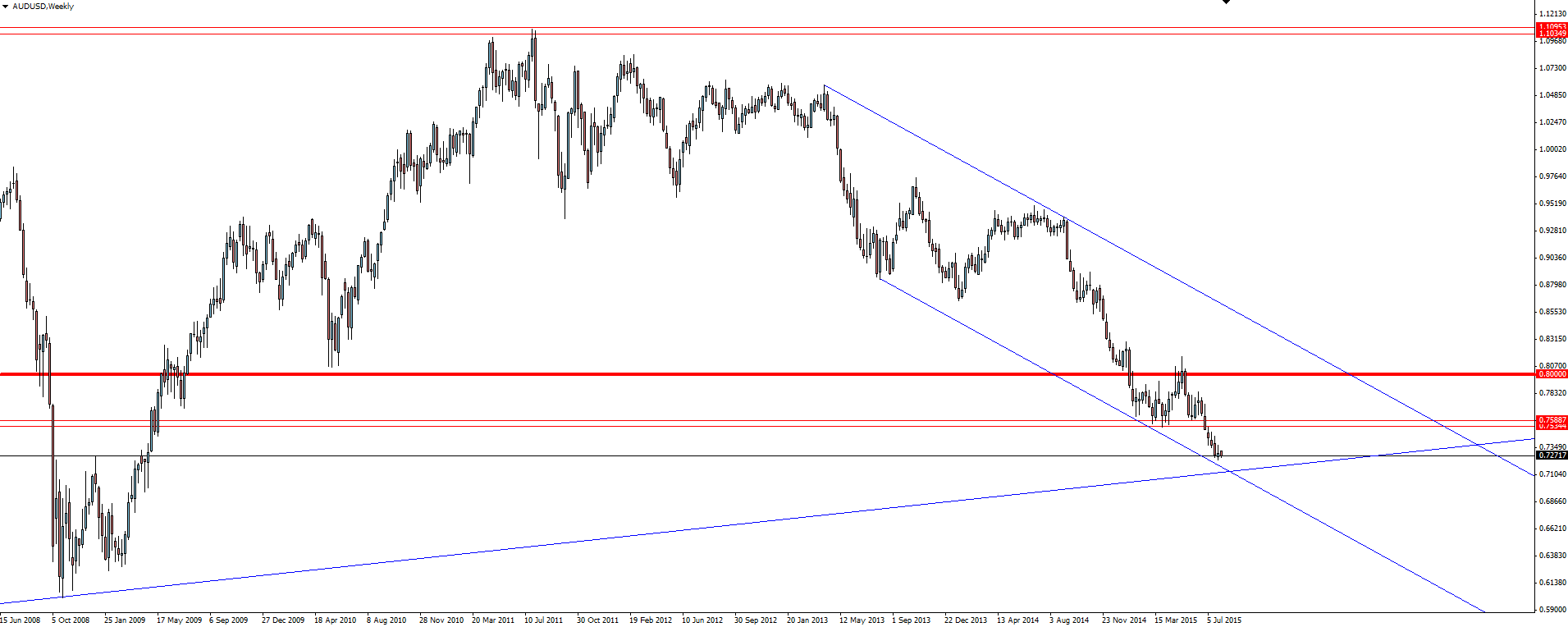

AUD/USD Weekly:

We’ve been watching the above weekly level where we have a confluence of support from the long term bullish weekly trend line and the short term bearish channel. This level really is key and another huge reason why this level around 70c is seen as ‘fair value’.

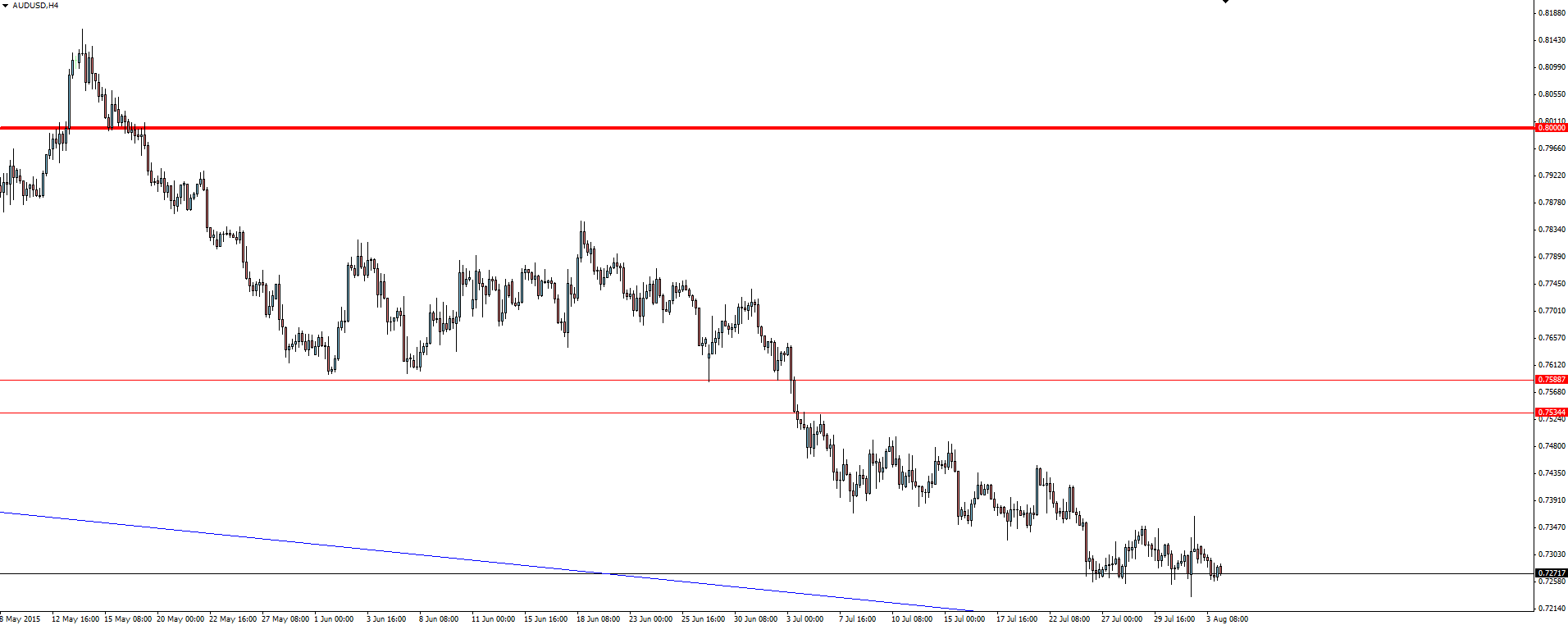

AUD/USD 4 Hourly:

The 4 hourly chart shows the way that price has been stepping down inside it’s bearish channel. The break of support and then the retest almost to the pip on 4 hourly wicks is textbook price behaviour in a strong bearish trend.

Aussie Data Dump:

Just remember that before the RBA decision at 2.30pm Sydney time, we have a flurry of data releases in the morning.

“AUD Retail Sales m/m (0.5% expected, 0.3% previously)”

“AUD Trade Balance (-3.06B expected, -2.75B previously)”

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.