Minister No More:

The big news overnight out of Europe was the resignation of Greek Finance Minister Yanis Varoufakis. You can read a short statement posted on his personal blog aptly titled Minister No More.

“Soon after the announcement of the referendum results, I was made aware of a certain preference by some Eurogroup participants, and assorted ‘partners’, for my… ‘absence’ from its meetings; an idea that the Prime Minister judged to be potentially helpful to him in reaching an agreement. For this reason I am leaving the Ministry of Finance today.”

Obviously nudged out of the job his ideals maybe never quite fit into. Varoufakis has earned the respect of his people for not backing down and resigning Greece to a tunnel of austerity with no light at the end.

“And I shall wear the creditors’ loathing with pride.”

Tell us what you really think Yanis!

(Unfortuntely for the narrative, the middle finger image is a fake. Sorry to disappoint you, but it had to be said.)

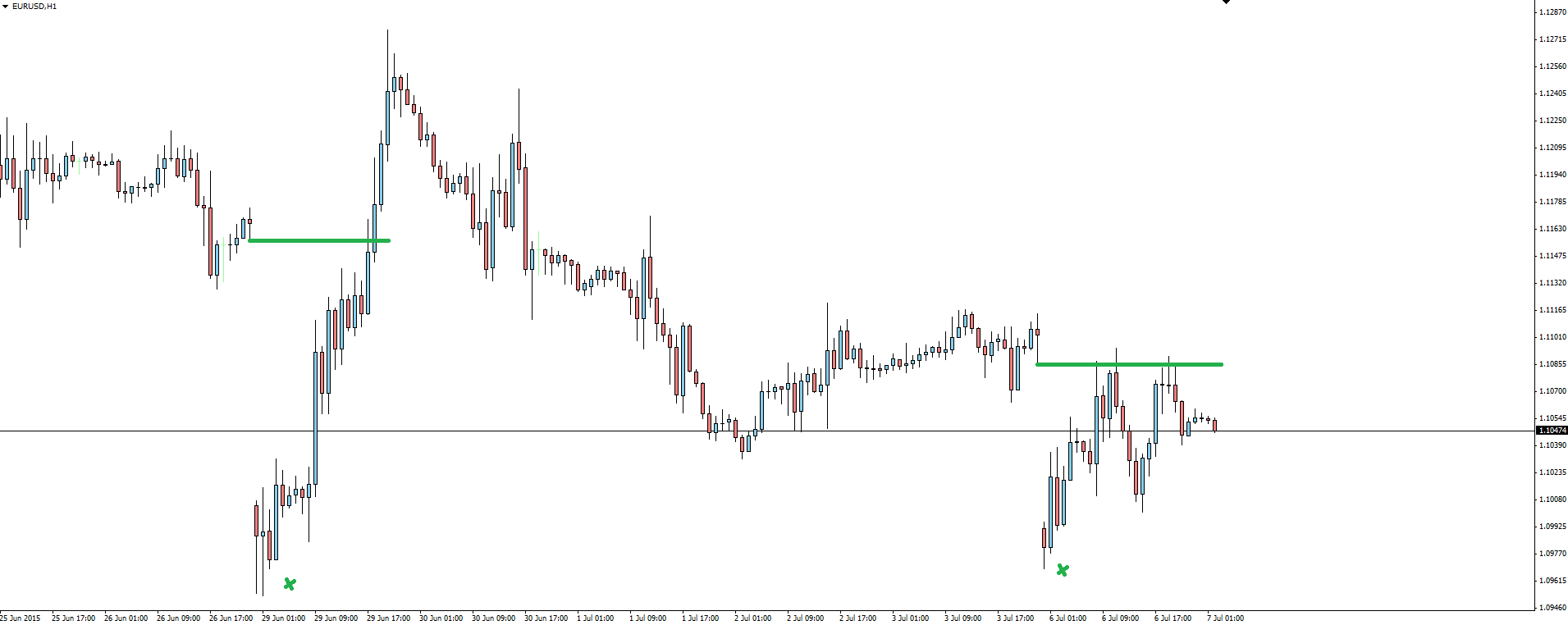

EUR/USD Hourly:

Markets interpreted the news as Euro positive and the weekend panic gap was once again closed early in the week. These gap trades have been very quick and free of drawdown if you had the guts to trade against the consensus of panic.

Whether new man Euclid Tsakalotos, who is reportedly idealogically further left than Varoufakis and very much a believer of Greece’s place in the Eurozone will mean progress in negotiations is yet to be seen. I wish him luck.

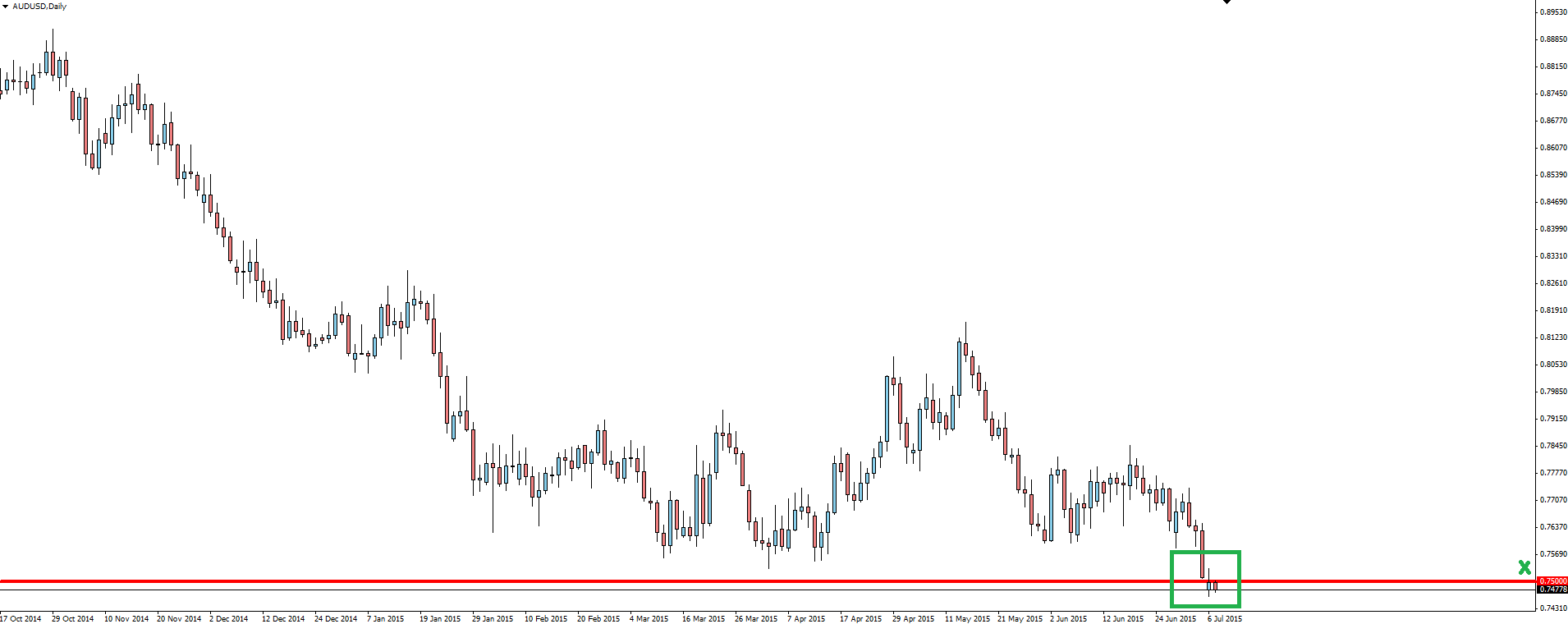

RBA Tuesday:

The Reserve Bank hold their monthly Monetary Policy meeting in Sydney today with the cash rate expected to remain on hold. With the cash rate already having been cut by 25bp in both February and May, it now sits at a record low 2.00%. Is it too soon to cut again?

More interesting to today’s trading will be whether the easing bias will be made more explicit. With economic growth continuing to stagnate in Australia and Greek uncertainty pushing back the likelihood of the Fed doing some of the work for him, Stevens may feel pressured to give the Aussie a bit more of a nudge lower.

AUD/USD Daily:

The fact that price is now testing (well broken but the gap down makes me wary) major 75 cent support heading into the decision has been talked about around Twitter as possible front running of a surprise cut, but consensus says Stevens will only look to give it a jawboning down today.

Elsewhere in Asian markets, China continues to attempt to boost it’s correcting stock market, this time with a new stock-stabilization fund, a moratorium on new issues and a liquidity pledge from the central bank.

With yet more fresh liquidity being pumped into the Chinese market, once the uncertainty settles down, this should be AUD positive. However, if investors choked up on margin debt start to see their positions all unwind at once, things could also get ugly fast.

A nice side narrative (for now) to follow which could potentially have FAR greater implications on markets than Greece.

On the Calendar Today:

I’m very interested in watching price action heading into the RBA decision this afternoon. With this heavy price action leading into the decision, the old saying of where there’s smoke, there’s fire comes up. Aussie longs, take note.

Tuesday:

AUD Cash Rate

AUD RBA Rate Statement

GBP Manufacturing Production

EUR Eurogroup Meetings

EUR Euro Summit

CAD Trade Balance

USD Trade Balance

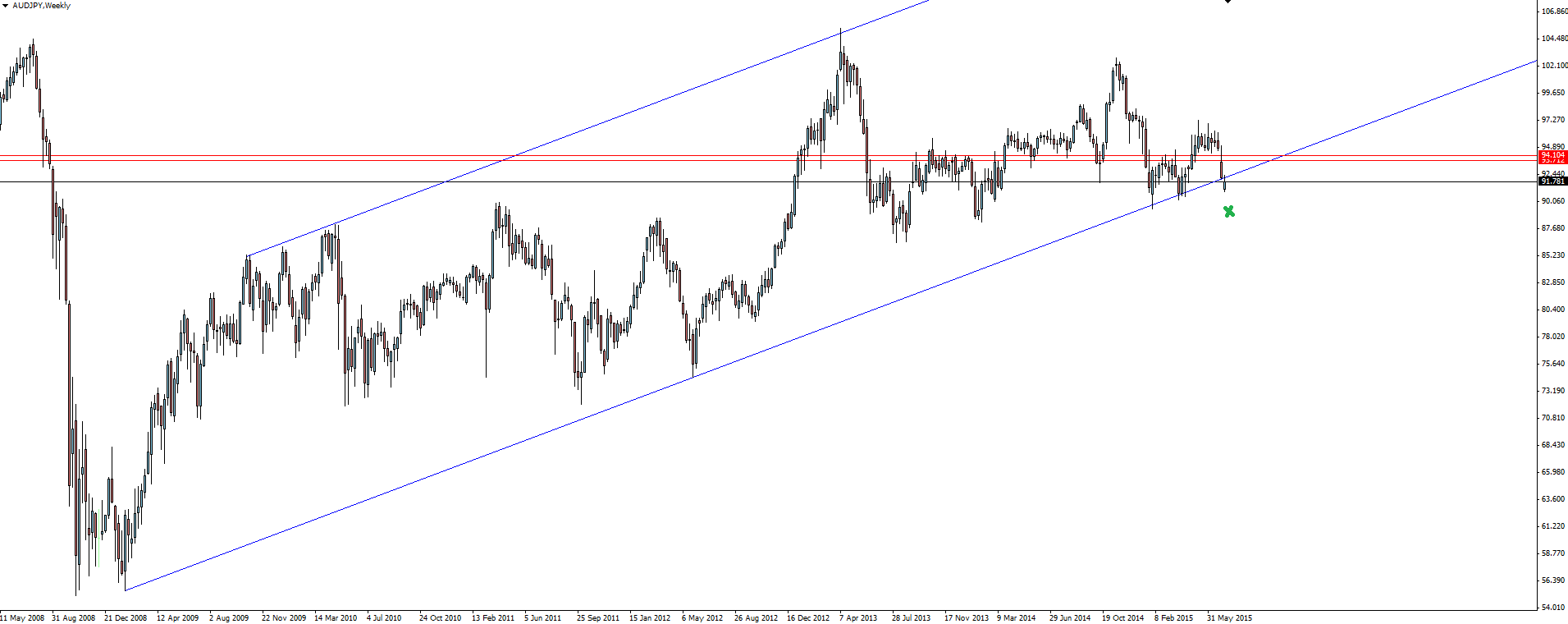

Chart of the Day:

On RBA Teusday, we take a look at one of the Aussie crosses sitting at major channel support level dating back to 2009.

AUD/JPY Weekly:

Price has broken through weekly channel support on the weekly open but the fact it was a gap through the level doesn’t confirm the break for me. I instead see this as still sitting on support. Either way, today’s RBA decision will be the catalyst for a break or bounce.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.