The Road to Nowhere:

This morning we woke to news of key stakeholders from the ECB, IMF, France and Germany meeting in Berlin to try to come to a solution on Greece. When the Europeans are heading into ‘emergency meetings’ when Asian traders are just waking up, you know things are getting dire.

Interestingly, neither Varoufakis nor Tsipras were invited to attend the meeting which sparked speculation over whether they had already submitted their final answer and that a solution from these talks was merely a formality.

Reuters:

01-Jun-2015 23:25:10:

GERMAN GOVT SPOKESMAN – MERKEL, HOLLANDE, JUNCKER, LAGARDE AND DRAGHI AGREED ON NEED FOR INTENSIVE WORK ON GREECE

01-Jun-2015 23:26:06:

GERMAN GOVT SPOKESMAN -PARTICIPANTS AT TALKS WILL REMAIN IN CLOSE CONTACT IN COMING DAYS, INCLUDING WITH GREEK GOVT

However, as you can see from the Reuters terminal updates that flashed through, this was not the case. A “step up in intensity” sounds to me like an emotional football player rattling off pre-written cliches during a post match press conference for a match they got beaten in.

What an absolute let down.

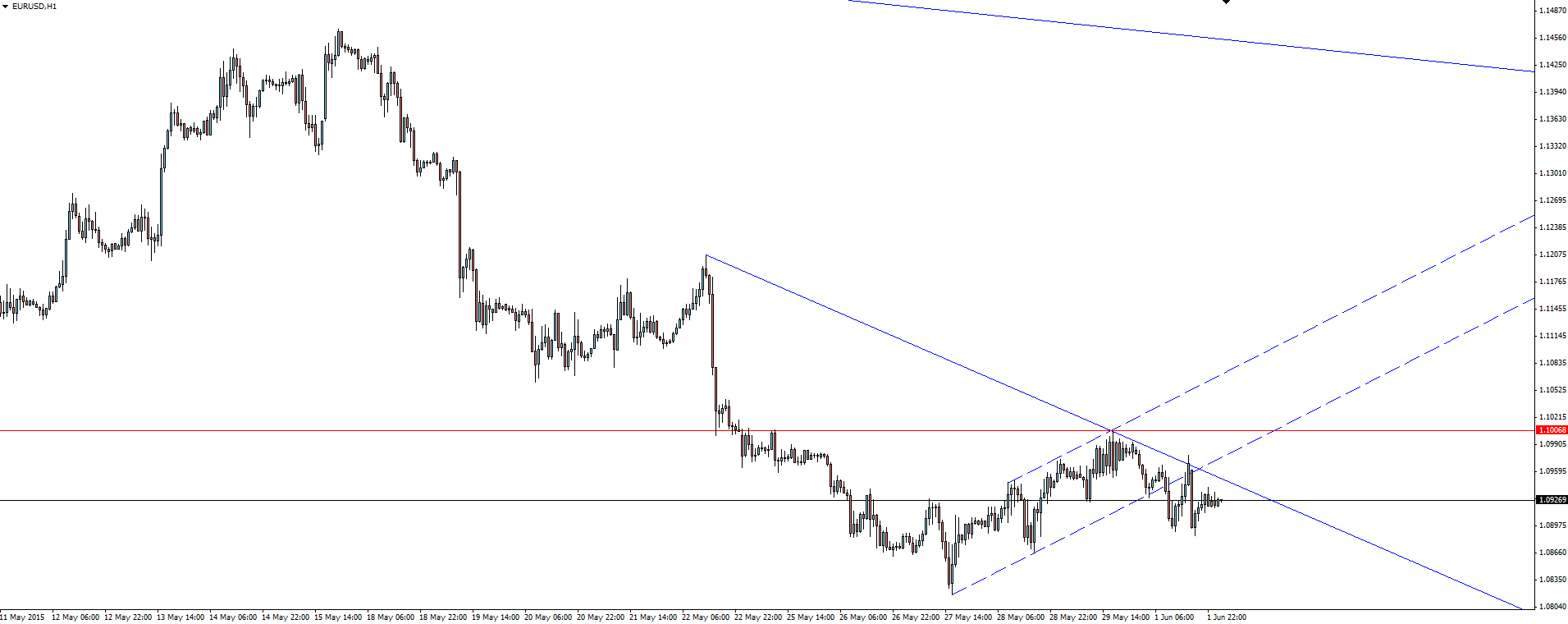

EUR/USD Hourly:

The Euro hasn’t reacted to the headlines with markets becoming de-sensitised to failure. From a technical point of view, I’m now looking for the down-trend to resume from here and new swing lows to be printed.

Thanks to the Guardian’s live blog for the action snaps. I definitely recommend reading through what happened over there if you are interested in seeing the exact path to take to get nowhere.

Elsewhere:

Sneaking under the radar a little this morning was last night’s solid May US ISM print. The 52.8 number v the expected 51.9 again helped to highlight the Fed’s stance that the the US economy is actually as strong as they have been expecting and that hikes sooner rather than later are on the cards.

USD strength after the release caused the majors to fall but as you can see from the EUR/USD chart above, after the bearish hourly candle, price has retraced over half the move. Now any Greek optimism is out of the way, for me this adds to the case to be short EUR/USD.

On the Calendar Today:

This afternoon in Australia we get the RBA’s June decision on Monetary Policy. The RBA is expected to keep rates on hold, but for traders it’s all about the wording in the statement of where the bank’s bias lies for the future.

After a poor run of data and AUD/USD at current prices, markets are expecting some sort of easing bias to be inserted into the statement. If this doesn’t materialise then expect the Aussie to rip higher from current prices.

Tuesday:

AUD Cash Rate

AUD RBA Rate Statement

GBP Construction PMI

Chart of the Day:

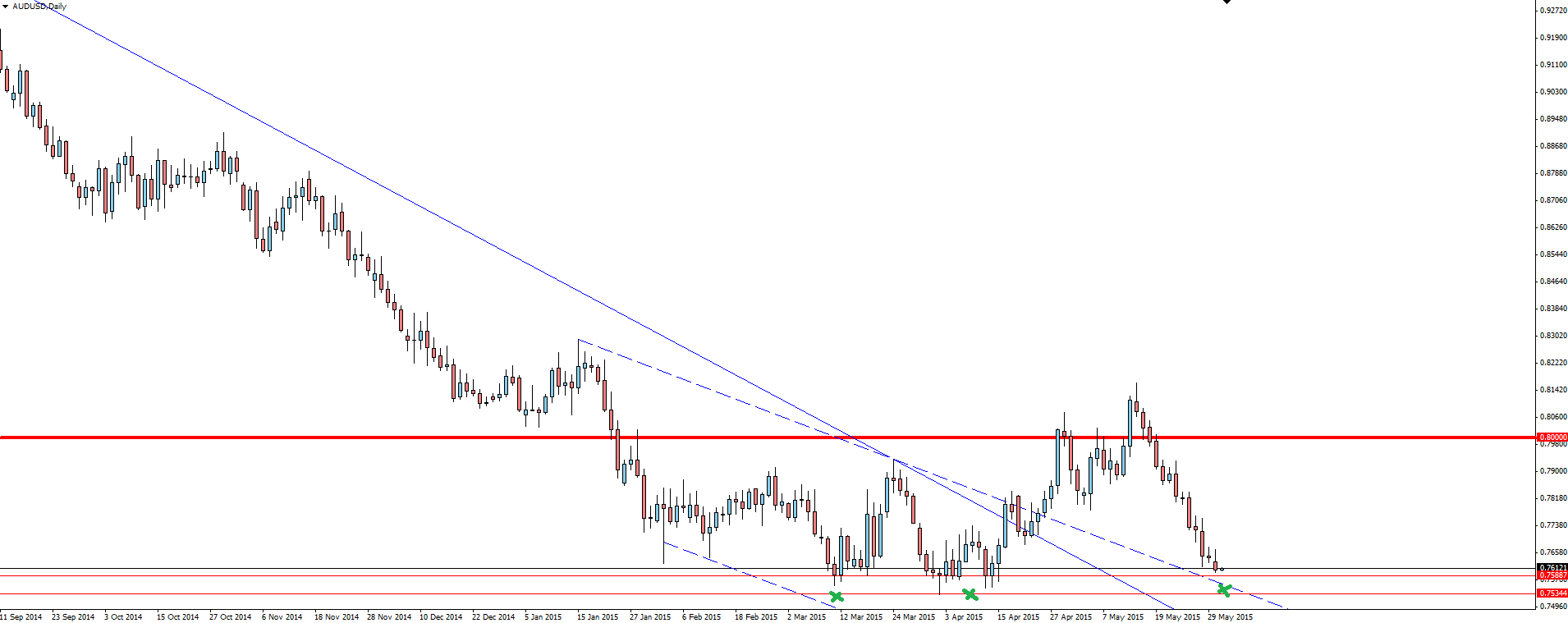

AUD/USD Daily:

With the Aussie dollar sitting just above its lows, I don’t like the risk:reward on offter by holding short into the RBA decision this afternoon. With markets expecting some sort of easing bias to be implicitly stated, anything else will see a rip higher. With buyers already waiting at current levels, I see the major risk here as a huge move to the upside.

Of course Stevens will also realise market expectations and want to cap the AUD at the lowest level he can, but he also doesn’t have to include the key sentence in his statement to get his point across. This could possibly see price rally after the release, but be talked down gradually throughout the month.

Something to think about.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.