Asian Session Morning:

Good morning traders. A fairly quiet one over night with no major market moving data releases seeing forex markets chopping about for the day and basically ending where they began.

“It’s only just beginning.”

The big news yesterday, while not being market related, was the raids on Football’s governing body FIFA. If you’re a global citizen then you should be able to at least see the potential political power for good that FIFA has and if you’re a football fan then you understand how fundamentally wrong the organisation conducts itself.

This is just the start, but 9 FIFA officials were arrested on suspicion of receiving bribes totalling $100m (£65m). President Sepp Blatter was not among the accused but he has overseen this whole shambles so surely it can only be a matter of time. Change is coming.

On the Calendar Today:

Fairly straight forward on the calendar today with only the 1 major data release coming from each of the 3 major sessions.

Thursday:

AUD Private Capital Expenditure

USD G7 Meetings

GBP Second Estimate GDP

USD Unemployment Claims

Chart of the Day:

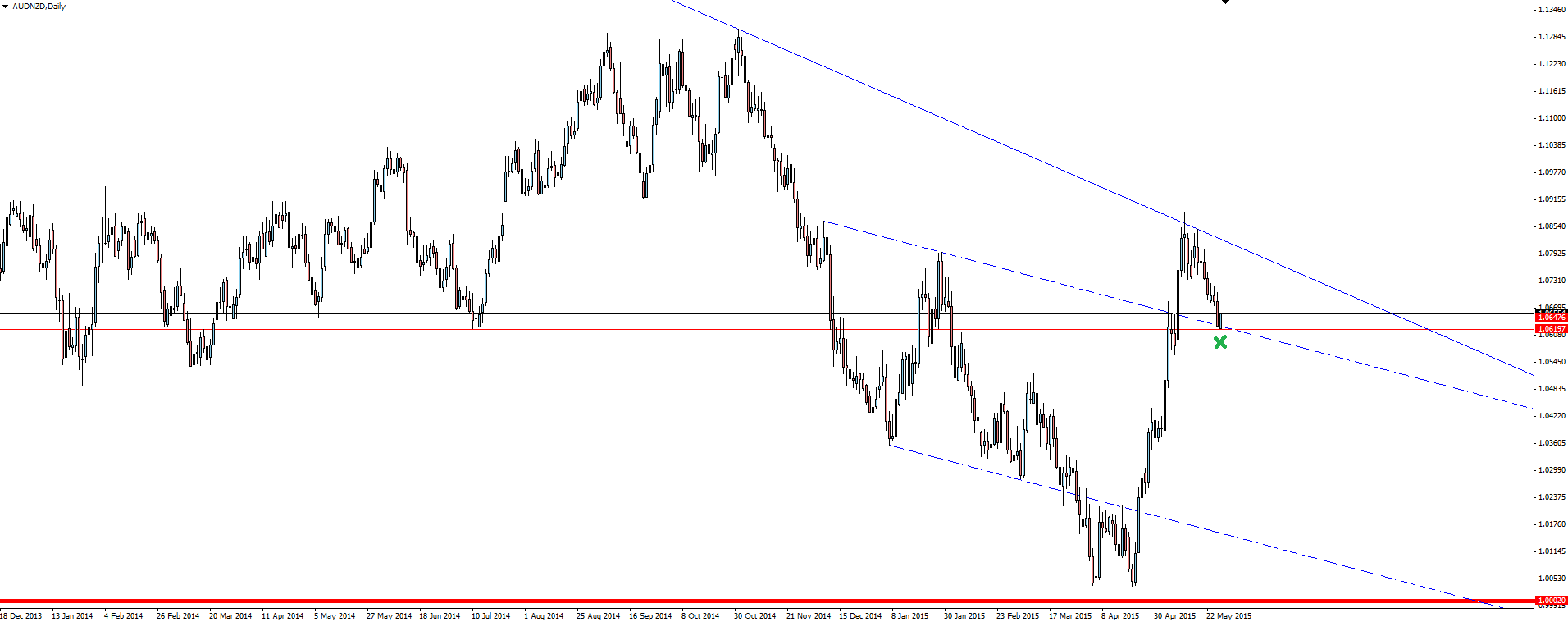

It feels like an eternity ago that we were talking about AUD/NZD below parity in the Technical Analysis section of the Vantage FX News Center. Let’s have a look at where we sit now.

AUD/NZD Weekly:

On the Weekly, as you can see price put in big bullish candles 4 weeks in a row but stalled at trend line resistance. We got a nice little rejection off this level and have now come back down to the horizontal zone that has been tested a few times over the last few years and could now be re-activated.

AUD/NZD Daily:

This horizontal zone lines up perfectly with previously broken daily channel resistance that could now also be acting as support. Anywhere that you get a confluence of levels such as this is worth taking note of.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD tests the major level of 1.0650; followed by the nine-day EMA

EUR/USD remains lackluster during the early Tuesday, hovering near 1.0650. From a technical perspective, analysis suggests a bearish sentiment for the pair as it struggles below the pullback resistance at the 1.0695 level.

GBP/USD: Flat lines around mid-1.2300s, bearish potential seems intact

GBP/USD holds steady on Tuesday amid subdued USD demand, albeit lacks bullish conviction. The divergent Fed-BoE policy expectations turn out to be a key factor acting as a headwind. The technical setup suggests that the path of least resistance for the pair is to the downside.

Gold could see a rebound before resuming the correction

Gold price sees a fresh leg down in Asia on Tuesday even as risk flows dissipate. Receding fears over Middle East escalation offset subdued US Dollar and Treasury bond yields. Gold remains heavily oversold on the 4H chart, rebound appears in the offing.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle price is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

After Monday's relief rally, attention shifts to earnings and policy fronts

With the easing of tensions in the Middle East, safe-haven demand reversed course; global stock markets experienced a modicum of relief. Indeed, in a classic relief rally fashion, Monday saw a rebound in the S&P 500, snapping a six-day losing streak.