Morning View:

Good Morning Traders.

I hope you enjoyed your Bank Holiday Monday. Whether you actually observed it or not, the markets definitely did, putting in a lackluster day of sideways trading in a tight range. Holiday trading is a bit of a coin flip in terms of whether you get what happened yesterday where price doesn’t really move, or you can get crazy whipsawing price action if something spooks the already thin market.

As always though, Greece is never far from the news, and Finance Minister Varoufakis gave us this article which for me adds a bit of a human element to the austerity issue.

“The problem is simple: Greece’s creditors insist on even greater austerity for this year and beyond – an approach that would impede recovery, obstruct growth, worsen the debt-deflationary cycle, and, in the end, erode Greeks’ willingness and ability to see through the reform agenda that the country so desperately needs. Our government cannot – and will not – accept a cure that has proven itself over five long years to be worse than the disease.”

As a trader, it is easy to detach yourself from what the word ‘austerity’ actually means for the people of Greece. The question of how can Greece expect the ever get out of this mess if it is never allowed to spur economic growth has always been for me why they will be forced to leave the Eurozone. ‘Monetary asphyxiation’ as Varoufakis so vividly describes policy being forced upon his government is not and never will be the answer.

On the Calendar Today:

Already got a trade balance beat out of New Zealand early in Asia which saw the Kiwi spike up but has given almost all of it’s gains back as I sit down to my desk now. The market is primarily USD driven at the moment and USD is king.

No market moving tier 1 data until we hit the US session tonight with Durable Goods and Consumer Confidence.

Tuesday:

NZD Trade Balance (123M v expected 105M)

USD Core Durable Goods Orders

USD CB Consumer Confidence

Chart of the Day:

NZD/USD Daily:

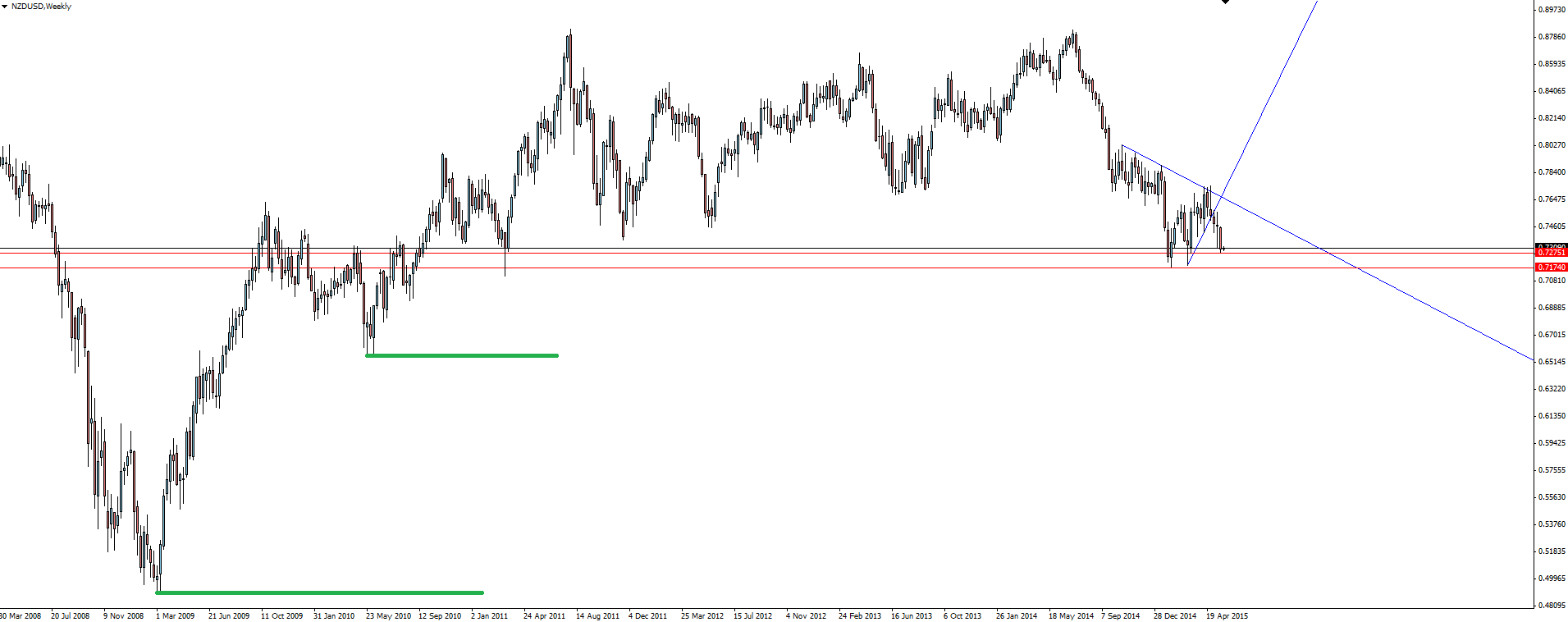

With further RBNZ rate cuts on the cards, as the Fed driven USD theme kicks back in, the Kiwi could be one of the pairs that has the most to lose. The pair gave back almost all it’s 600 pip fall after the RBNZ successfully gave it a good jawboning. The fact that it was back above those levels before this USD driven fall tells me that if/when the RBNZ make their move, then the pair will look for new lows.

I am happy selling any sort of rally and possibly looking to get in early and playing for a break of the marked support level. Take a look at the Weekly chart and you can see that there’s not much left in terms of support below that level and things could possibly get ugly quite quickly.

NZD/USD Weekly:

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.