Morning View: Greece? Who are they? Got some bigger fish to fry this morning.

FOMC Member Williams Speaks

Overnight, the Fed’s John Williams argued his point for and earlier rate hike.

“The Federal Reserve hiking interest rates ‘a bit earlier’ allows the U.S. central bank to increase rates more gradually.”

In an interview with CNBC, Williams said that the US job market has shown momentum for the rest of the year and shared his belief that inflation would continue to rise.

Of course the ‘data dependent’ line came out at the end but there’s a bit of an insight anyway.

RBNZ Financial Stability Report

The other major news release came out of the New Zealand this morning, causing NZD/USD to whipsaw.

Price fell hard then violently rose after headlines from the RBNZ Financial Stability report. The RBNZ tightened lending limits to slow the overheating housing market but then said that the NZD was above sustainable levels. They key was their failure to include the word “unjustified” when describing the value of the NZD.

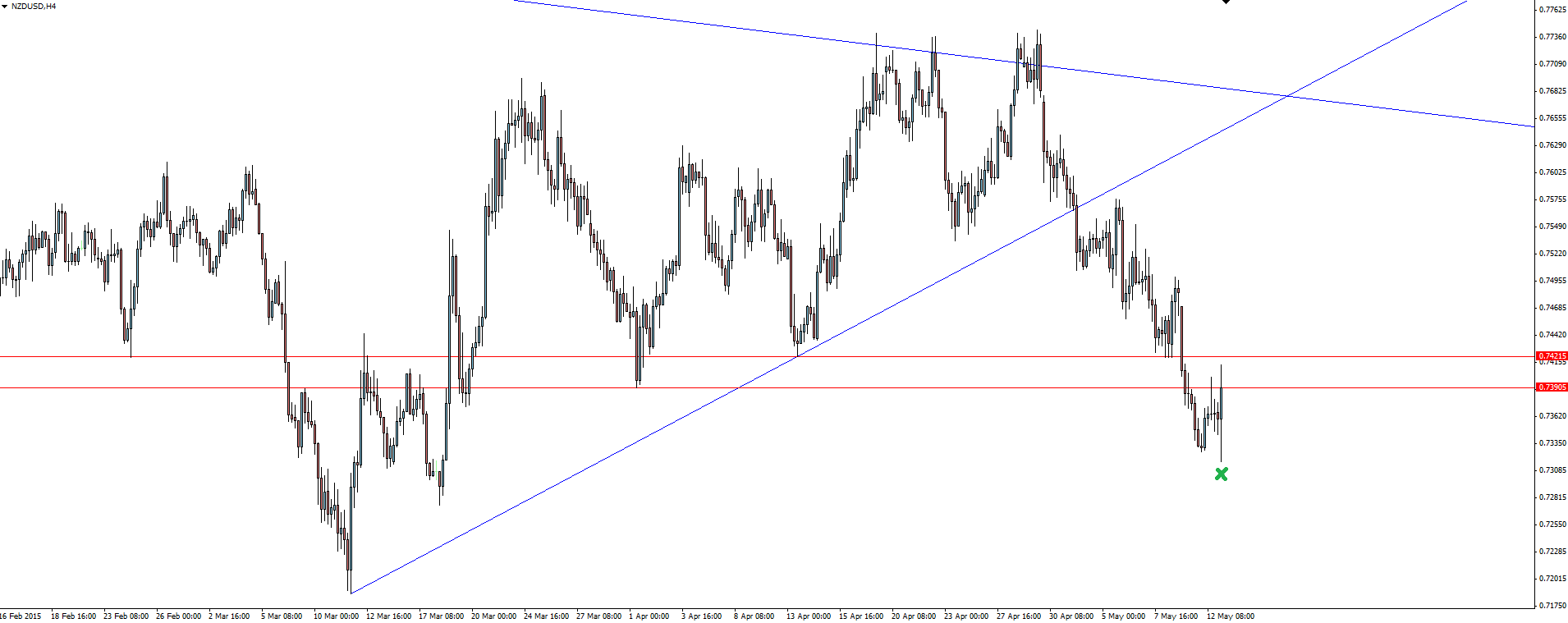

NZD/USD 4 Hourly:

Chop city but there are plenty of shorts from that trend line break we have been watching on Twitter that will look to be getting out now. The greater risk of a move is to the upside from here.

On the Calendar Today:

Packed economic calendar today and tonight with some huge tier 1 releases. The Australian wage data shouldn’t have much of an effect on the Aussie with tier one Chinese Industrial Production data only a few hours later.

Heading into London, we have a whole raft of GBP sensitive news. With the markets still digesting Cameron’s election win, it will be interesting to see what Carney and the BoE have to say.

We round out a busy night of data with USD Retail Sales.

Wednesday:

AUD Wage Price Index

CNY Industrial Production

EUR German Prelim GDP

GBP Average Earnings Index

GBP Claimant Count Change

GBP BOE Gov Carney Speaks

GBP BOE Inflation Report

USD Core Retail Sales

USD Retail Sales

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.