Varoufakis Who?:

It’s all looking like coming to a head again in Europe, with Greek Finance Minister Varoufakis taken off EU/IMF negotiations. This is in favour of a new way of going about negotiations with hopes a direct relationship between PM Tsipras and German Chancellor Merkel will get the job done.

Greek Finance Minister Varoufakis has been increasingly isolated by the EU and Greek government as an inability to (right or wrong, it doesn’t matter to them at this stage) get a deal done in a timely manner.

Whether it’s right or wrong in terms of what happens to the Greek people, EUR/USD continued to like the idea that things are actually progressing forward for Greece with the pair smashing up 100 pips from it’s lows where price was then capped by the trend line resistance I speak about in the Chart of the Day section.

Greek 10 year yields were also hammered down a full percentage point on the back of the Varoufakis move.

Optimism can do crazy things!

On the Calendar Today:

RBA Governor Stevens this morning delivered a speech at the Australian Financial Review Banking & Wealth Summit in Sydney. Stevens was expected to stay away from Monetary Policy discussion today but the Aussie is being bid on the back of some discussion during questions about what a low interest rate environment really means… Something the RBA hasn’t quite come to grips with just yet either.

Wait and see on this one.

Japanese retail sales also on the calendar during Asia. A 2nd tier release but one for the JPY traders to be aware of.

Tuesday:

AUD RBA Gov Stevens Speaks

JPY Retail Sales

GBP Prelim GDP

CAD BOC Gov Poloz Speaks

USD CB Consumer Confidence

Chart of the Day:

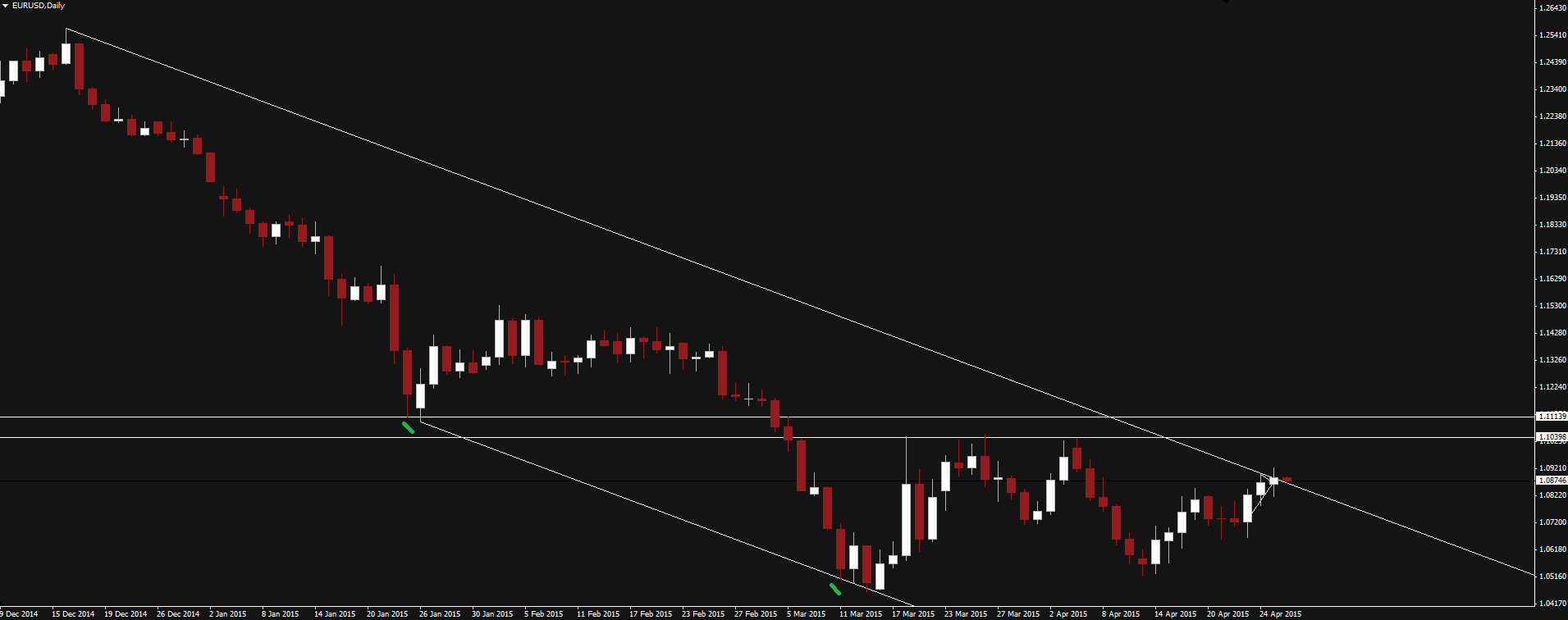

EUR/USD Daily:

This chart is just simply running the upper channel line parallel to the bottom line from the 2 marked points. I thought it was interesting that the stall in momentum on the EUR/USD rally has come at this point.

If the play is the expectation of continued fundamental Euro weakness and USD strength to kick back in, there is definitely a great risk:reward short in this zone we are in now.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold rebounds to $2,320 as US yields turn south

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.