Morning View:

Good morning from our wet and dreary Sydney office!

Stay safe!

Grexit Risk:

I keep banging on about it, but don’t get sucked into trading spikes on the back of headlines. If you read the word ‘Greece’ and you’re not looking at your Mum’s DVD collection then don’t trade it!

Last night as we head into the EU session, EUR/USD spiked down only to rally all through the US as traders realised that Greek risk is old news.

If you’re interested, the headline in question was that ECB staff are proposing to increase the ‘haircuts’ on Greek bank collateral that is offered in exchange for Emergency Liquidity Assistance from the Bank of Greece.

UK Trader Arrested for 2010 ‘Flash Crash':

The interesting story out this morning is that UK commodities trader Navinder Singh Sarao has been arrested in connection with the sharp spike down then up in the DJIA in 2010.

Sarao would ‘spoof’ (place fake orders that he had no intention of trading) the futures market by adding large orders on the sell side that he would cancel. These fake orders would increase the spread between the bid and ask price so that other traders would stay away from the best price.

You can read more by doing a quick Google search but this issue is nothing new or unusual. This happens thousands of times a day. To arrest Sarao is actually kind of laughable and just comes across as a massive scapegoating.

On the Calendar Today:

CPI data is the big release on the calendar today. The forecast is for the level to have stayed at record lows, putting pressure on the RBA to cut rates next month.

Tuesday:

AUD CPI

GBP MPC Official Bank Rate Votes

USD Existing Home Sales

USD Crude Oil Inventories

Chart of the Day:

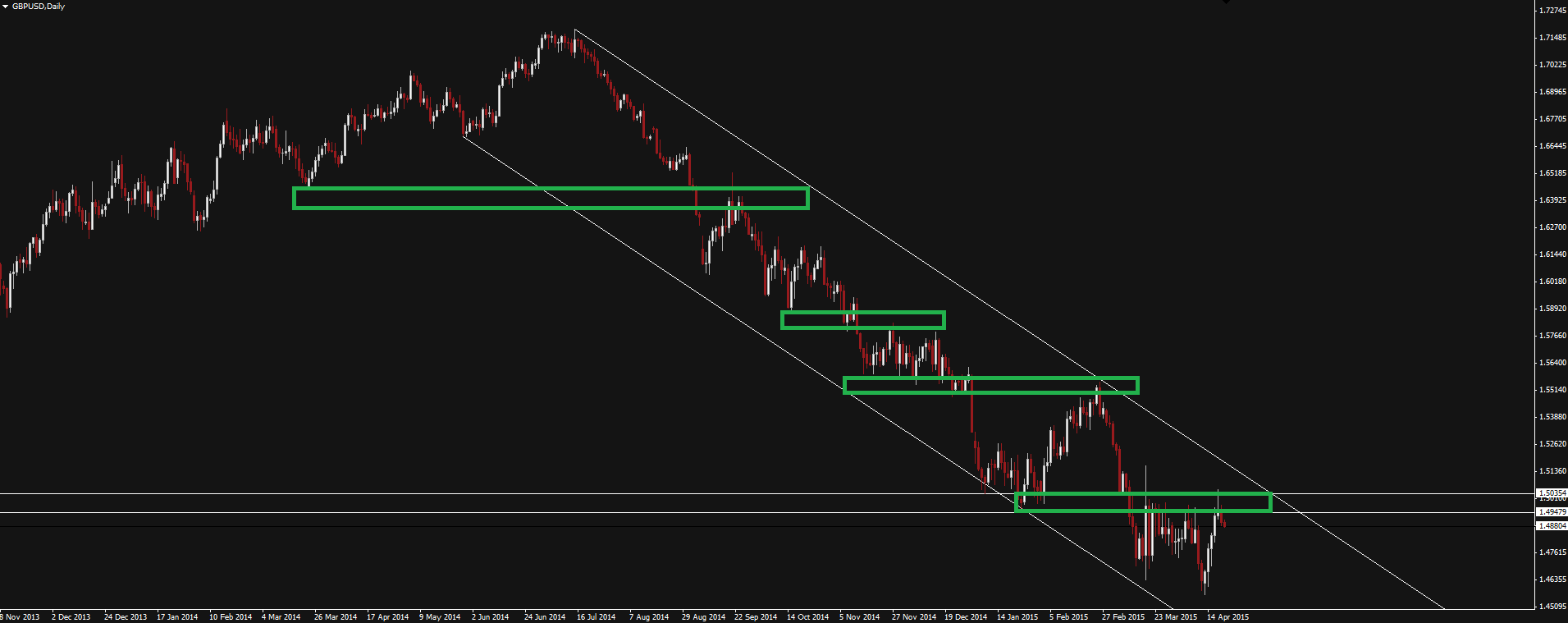

I posted these GBP/USD charts yesterday in the Technical Analysis section of the Vantage FX News Centre. The descending channel on the daily chart caught my eye, especially the way price is stepping down between supply/demand levels.

GBP/USD Daily 1:

GBP/USD Daily 1:

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.