Geopolitical concerns over ongoing tensions in North Korea and Iran, in which another round of nuclear negotiations with Western nations yielded no result, and news of an easing of Chinese inflation fears have given the energy and industrial metals a small boost.

The easing of inflationary pressure in China, which is primarily due to a sharp reduction in the cost of food, has lowered the risk for a tightening of monetary policy. Such tightening could have triggered a reduction in demand for key commodities such as oil and industrial metals. Any potential for a war with North Korea or increased tensions in the Middle East carries the risk of disrupting the supply of oil, thereby helping to keep it supported at a time of reduced demand and ample supply.

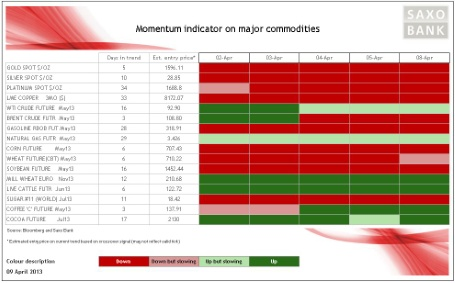

Despite these supporting factors, momentum across most of the major commodities remains negative as growth expectations have eased, grain supplies will more than cover global demand ahead of the harvest this autumn and industrial metals have seen a pick-up in supply as new production has become available. Precious metals are struggling as US equities have bounced from last week's sell-off following the disappointing job report, while ETP holdings continued to be reduced.

WTI Crude looks set to join Brent Crude in showing negative momentum in what has been a delayed reaction to the sell-off witnessed last week. Elsewhere, wheat prices, which suffered the least during the Easter cull, have also recovered the fastest due to concerns about the US winter crop. The concerns eased overnight, with crop ratings now beginning to improve following what has been a very harsh winter due to drought and little snow cover to protect them from the cold.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.