Uncertainty has enveloped the global markets this week with investor jitters intensifying as the lack of direction continues to send ominous warnings ahead of Friday’s Jackson Hole gathering. Global stocks remain pressured with Asia and Europe trading lower as anxiety and erratic oil prices sour risk appetite. Although earlier stock market gains were somewhat impressive, it is becoming increasingly clear that sentiment remains the driver rather than fundamentals and such continues to question the sustainability of the rally. A heavymarket selloff may be pending and the ongoing concerns over the unstable global landscape could be the catalyst needed for bears to pounce. Investors should keep diligent this week as the increasing focus on Yellen’s speech may present a threat of creating explosive levels of volatility if market participants are left empty handed on US rate hike timings.

Uncertainty punishes the Dollar

Dollar was left vulnerable to losses on Tuesday following Fed’s Vice Chairman Stanley Fisher’s optimistic outlook on the US economy which failed to rekindle optimism over the Fed raising US rates this year. The visible Fed divide and conflicting stances from policy makers have created a layer of uncertainty that gives permission for bears to attack prices. Although the improving domestic data in the US continues to offer a compelling reason for the Fed to take action, external developments and uncertainty could sabotage the central bank's efforts to act. Market participants may direct their attention towards Yellen’s speech on Friday which most hope canprovide some clarity on when the Fed plans to break the extended period of central bank caution. If investors fail to retrieve any clarity from Yellen on US rate hike timings, then the Dollar could be exposed to further losses.

From a technical standpoint, the Dollar Index is bearish on the daily timeframe as there have been consistently lower lows and lower highs. Prices are trading below the daily 20 SMA while the MACD has crossed to the downside. Previous support around 95.00 could transform into a dynamic resistance which could open a path towards 94.00.

Brexit fears still pressure Sterling

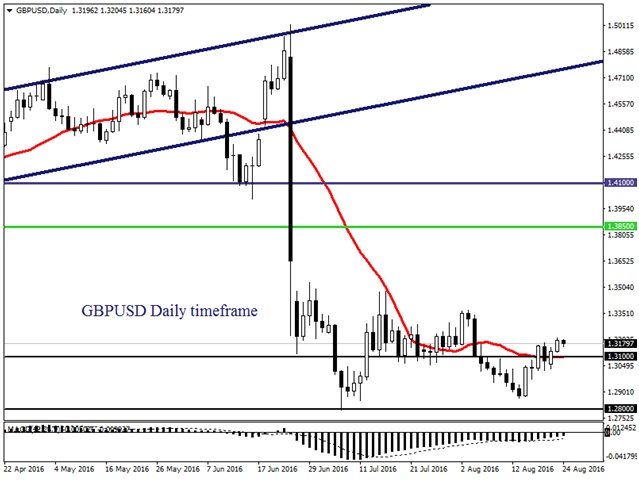

Sterling traded higher on Tuesday following reports from the CBI that showed UK export orders rising towards two year highs which slightly reduced concerns over the health of the UK economy. Regardless of the short term gains, the Brexit fears remain noticeable with the Sterling poised for further declines as uncertainty haunts investor attraction towards the currency.

Although the pound was offered a lifeline last week from the influx of positive domestic data which questioned the impacts of Brexit to the UK, it remains quite early to gauge the ramifications of Brexit and such should keep investors alert. Uncertainty is still a dominant theme that may pressure the Sterling while expectations over the Bank of England cutting UK rates to near zero could cap future upside gains.

The GBP/USD lurched higher this week and this has nothing to do with an improved sentiment towards the Sterling but Dollar weakness from fading US rate hike expectations. Although prices are turning technically bullish on the daily timeframe, 1.3100 remains a pivotal point which bears could challenge to reclaim back control.

WTI balances above $47

WTI Crude was flung onto a chaotic rollercoaster ride this week with prices trading back towards $47following the 4.5 million barrel build in API weekly crude inventories which enticed sellers to attack. Oil remains highly sensitive to production freeze talks with optimism over OPEC securing a freeze deal in September creating speculative boosts in oil prices. Although Iran has discussed the idea of supporting OPEC’s decision to prop up oil prices, this may be just another strategy to propel oil prices higher ahead of September’s informal meeting. With the fundamentals of an excessive oversupply still present and concerns that demand may be waning, Oil could be vulnerable to further losses. The threat of September’s informal meeting concluding without a deal could encourage sellers to drag oil prices back down towards $40.

Commodity spotlight – Gold

Gold remains trapped in a wide range with prices oscillating between $1345 and $1330 as uncertainty continues to heighten over when the Fed may raise US interest rates this year. This yellow metal has always been sensitive to US interest rate hopes, and with current expectations clouded; prices could remain in limbo until Friday. Risk aversion still lingers across the markets which have kept Gold somewhat buoyed but Dollars resurgence from renewed rate hike hopes may simply drag the metal lower. Investors may direct extra attention to Yellen’s speech on Friday which could pave a fresh path for Gold. From a technical standpoint, bulls need to keep above $1315 to validate the current bullish uptrend.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.