Market Brief

RBA cuts rates to depreciate AUD

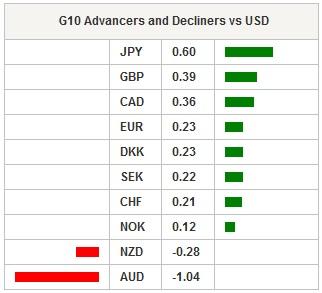

Financial markets continued to exhibit classic risk-on behavior in the Asian session, with indications that the risk appetite will remain in the European session. Part of the buy was driven by new evidence that central banks are committed to accommodating policies as the RBA cuts benchmark interest rates. Asian regional equities indices were higher with the reopened Shanghai composite rising 1.60% and ASX climbing 1.94% (supported by the RBA cut). In the FX market, the USD extended its losses following the dovish FOMC meeting and weak manufacturing ISM headline data added to worries of growth deceleration. Yesterday's read suggests that any positive US manufacturing support has received from the weak USD was offset by the slowing international backdrop. EURUSD has now safely cleared 2016 highs at 1.1465 with traders targeting 1.1714. Steady USDJPY selling pushed the pair down to 105.81, with traders seemingly unfazed by BoJ intervention threats. BOJ Governor Kuroda is again using any public appearance to warn that the JPY strength could derail Japan’s economic recovery and that the BoJ will intervene if necessary. But gone are the days when a BoJ sabre rattling would have traders rushing towards the exits! The reality of market conditions, combined with the erosion of the BoJ's credibility has a limited impact on traders' fears of any kind of a knockout blow.

In a minor twist, the Australia central bank cut its cash rates 25bps to a record low of 1.75%. Trader’s confidence in a RBA rate cut has increased following the massive downward surprise of the Q1 CPI read. AUDUSD collapsed to 0.7572 from 0.7720 on the news. The move shifts the near term focus from unemployment to fighting disinflation, utilizing the AUD as a primary tool. The RBA reiterated that “an appreciating exchange rate could complicate” any economic transient. Given the slow pace of growth and low contribution by wage growth, currency deprecation will have to do the bulk of the heavy lifting to reach the RBA inflation targets. Given this shift in focus, the RBA will need to generate further weakening of the AUD to get the inflation boost they desire (indicating another 25bp cut is expected). Our call for short AUDJPY received a solid push towards 78.00 from the event.

In China, Caixin Manufacturing PMI weakened to 49.4 in May from 49.7 in April, softer than market expectations and marking a 14th month of contraction. The data indicated that softness in labor markets and exports continue. Yet, the negative data failed to influence markets. PBoC set the USDCNY mid-Point at 6.4565.

Very light economic calendar will keep trading subdued. In Switzerland we will get Consumer confidence, expected to continue at -14, UK PMI manufacturing expected at 51.2 and EU producer prices, expected at -4.3%. For the UK, April manufacturing PMI - we are slightly more negative than the market despite an upwards revision to the Eurozone read. Slowing GDP growth and slipover from Brexit fears should send the read marginally lower.

| Global Indexes | Current Level | % Change |

| Nikkei 225 Index | 16147.38 | 0 |

| Hang Seng Index | 20842.44 | -1.05 |

| Shanghai Index | 2986.28 | 1.63 |

| FTSE futures | 6229 | 0.27 |

| DAX futures | 10133 | 0.1 |

| SMI Futures | 7930 | -0.12 |

| S&P future | 2073.05 | -0.03 |

| Global Indexes | Current Level | % Change |

| Gold | 1296.93 | 0.41 |

| Silver | 17.64 | 0.54 |

| VIX | 14.68 | -6.45 |

| Crude wti | 45.21 | 0.96 |

| USD Index | 92.27 | -0.38 |

| Today's Calendar | Estimates | Previous | Country/GMT |

| SZ Apr SECO Consumer Confidence | 0.0 | -14 | CHF/05:45 |

| SW Mar Industrial Production MoM | 0.0 | 0,10% | SEK/07:30 |

| SW Mar Industrial Production NSA YoY | 0.0 | 3,80% | SEK/07:30 |

| SW Mar Industrial Orders MoM | - | -3,10% | SEK/07:30 |

| SW Mar Industrial Orders NSA YoY | - | 2,00% | SEK/07:30 |

| SW Mar Service Production MoM SA | 0,60% | -0,50% | SEK/07:30 |

| SW Mar Service Production YoY WDA | - | -0,20% | SEK/07:30 |

| NO Norges Bank Deputy Governors Nicolaisen, Matsen Speak | - | - | NOK/08:20 |

| UK Apr Markit UK PMI Manufacturing SA | 51,2 | 51 | GBP/08:30 |

| EC Mar PPI MoM | 0,00% | -0,70% | EUR/09:00 |

| EC Mar PPI YoY | -4,30% | -4,20% | EUR/09:00 |

| EC European Commission Economic Forecasts | - | - | EUR/09:00 |

| US Apr ISM New York | - | 50,4 | USD/13:45 |

| DE Apr Foreign Reserves | 415,4 | 412,4 | DKK/14:00 |

| US May IBD/TIPP Economic Optimism | 46,5 | 46,3 | USD/14:00 |

Currency Tech

EURUSD

R 2: 1.1714

R 1: 1.1465

CURRENT: 1.1396

S 1: 1.1217

S 2: 1.1144

GBPUSD

R 2: 1.4959

R 1: 1.4668

CURRENT: 1.4643

S 1: 1.4300

S 2: 1.4132

USDJPY

R 2: 112.68

R 1: 111.91

CURRENT: 106.94

S 1: 105.23

S 2: 100.78

USDCHF

R 2: 1.0093

R 1: 0.9913

CURRENT: 0.9621

S 1: 0.9476

S 2: 0.9259

- S: Strong, M: Minor, T: Trendline, K: Keylevel, P: Pivot

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0700, awaits key US data

EUR/USD clings to gains near the 1.0700 level in early Europe on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter gross domestic product (GDP) data on Thursday.