Market Brief

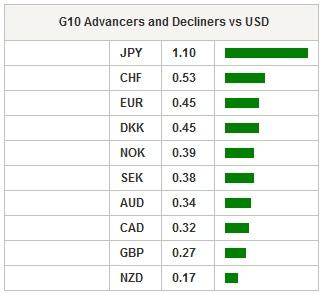

US dollar continued to lose ground against across the board after data showed the US economy expanded at the slowest since the second quarter of 2009. The gross domestic product increased at a 0.5% annualised rate - versus 0.7% expected - after rising 1.4% in the fourth quarter of 2015 as personal consumption failed to boost growth in spite of a low gasoline price. The dollar index, which measures the value of the US dollar against a basket of currency, fell another 0.34% during the Asian session and is currently trying to validate a break of the key support at around 93.80 (low from mid-October 2014). The dollar index has lost more than 7% since December last year as investors started to price in a slower path of interest rate increase - we do expect more than one rate hike in 2016 and it is already overly optimistic in our view. EUR/USD gained momentum and reached 1.1397 in Tokyo. Given the continuous flow of disappointing economic data from the US, we expect the pair would soon test once again the 1.1495 before heading towards the next one, which lies at 1.1714 (high from August last year).

The South Korean won was one of the worst performing currency among the Asian complex after March’s industrial production came in on the soft side, contracting 2.2%m/m, while the market anticipated a contraction of -0.5%. On a year-over-year basis the industrial output shrank -1.5%, missing estimates of +0.2%, while previous month’s reading was downwardly revised to 2.2% as exports continue to shrink as the Chinese economy slowdown. USD/KRW rose 1,139 from 1,1136.

In New Zealand, business confidence printed higher in April, rising from 3.2 in the previous month to 6.2. However, NZD/USD traded range bound during the Asian session between 0.6956 and 0.6989. In Australia, AUD/USD edged up 0.38% despite weak PPI numbers. The price producer index contracted 0.2%q/q in the March quarter, down from +0.3% in the previous one.

On the equity market, equities were trading in negative territory across Asian markets with the Shanghai and Shenzhen Composites down -0.25% and -0.02% respectively. In Japan, markets were close for Shōwa Day. In South Korea, the KOSPI fell 0.34%, while in Singapore the STI slid 0.65%. In Europe, equity futures are suffering a small sell-off, following the negative lead from Wall-Street.

Today traders will be watching trade balance from Turkey; KOF leading indicator from Switzerland; GDP from Spain; unemployment rate from Norway; mortgage approvals from UK; CPI and GDP from the Eurozone; CPI from Italy; key rate from Russia; trade balance from South Africa; personal income and spending, PCE deflator and Michigan Index.

| Global Indexes | Current Level | % Change |

| Hang Seng Index | 21111.4 | -1.29 |

| Shanghai Index | 2938.323 | -0.25 |

| FTSE futures | 6221.5 | -0.78 |

| DAX futures | 10270.5 | -0.7 |

| SMI Futures | 7966 | -1.08 |

| CAC futures | 4451.5 | -1.1 |

| S&P future | 2073.8 | 0.07 |

| Global Indexes | Current Level | % Change |

| Gold | 1277.43 | 0.88 |

| Silver | 17.82 | 1.5 |

| VIX | 15.22 | 10.53 |

| Crude wti | 46.2 | 0.37 |

| USD Index | 93.3 | -0.49 |

| Today's Calendar | Estimates | Previous | Country/GMT |

| DE Mar Unemployment Rate SA | - | 3,50% | DKK/07:00 |

| DE Mar Unemployment Rate Gross Rate | - | 4,30% | DKK/07:00 |

| TU Mar Trade Balance | -5.00b | -3.17b | TRY/07:00 |

| SZ Apr KOF Leading Indicator | 102,5 | 102,5 | CHF/07:00 |

| SP 1Q P GDP QoQ | 0,70% | 0,80% | EUR/07:00 |

| SP 1Q P GDP YoY | 3,30% | 3,50% | EUR/07:00 |

| SW Feb Wages Non-Manual Workers YoY | - | - | SEK/07:30 |

| SW January and February Wages will be released on the same day. | - | - | SEK/07:30 |

| UK BOE's Gracie Speaks at SRB Conference in Brussels | - | - | GBP/07:30 |

| SZ SNB's Thomas Jordan Speaks at Annual General Meeting in Bern | - | - | CHF/08:00 |

| RU Apr 22 Money Supply Narrow Def | - | 8.51t | RUB/08:00 |

| NO Apr Unemployment Rate | 3,30% | 3,30% | NOK/08:00 |

| SP Feb Current Account Balance | - | -0.7b | EUR/08:00 |

| IT Mar P Unemployment Rate | 11,60% | 11,70% | EUR/08:00 |

| NO Mar Credit Indicator Growth YoY | 5,00% | 5,20% | NOK/08:00 |

| NO May Norges Bank Daily FX Purchases | - | -900m | NOK/08:00 |

| NO Norges Bank Regional Phone Survey | - | - | NOK/08:00 |

| UK Mar Net Lending Sec. on Dwellings | 3.7b | 3.6b | GBP/08:30 |

| UK Mar Mortgage Approvals | 74.2k | 73.9k | GBP/08:30 |

| UK Mar Money Supply M4 MoM | - | 0,90% | GBP/08:30 |

| UK Mar M4 Money Supply YoY | - | 2,00% | GBP/08:30 |

| UK Mar M4 Ex IOFCs 3M Annualised | 6,00% | 5,00% | GBP/08:30 |

| EC Mar Unemployment Rate | 10,30% | 10,30% | EUR/09:00 |

| EC Apr CPI Estimate YoY | -0,10% | - | EUR/09:00 |

| EC Apr A CPI Core YoY | 0,90% | 1,00% | EUR/09:00 |

| EC 1Q A GDP SA QoQ | 0,40% | 0,30% | EUR/09:00 |

| EC 1Q A GDP SA YoY | 1,40% | 1,60% | EUR/09:00 |

| EC ECB Governing Council's Weidmann Speaks in Munich | - | - | EUR/09:00 |

| IT Apr P CPI NIC incl. tobacco MoM | 0,20% | 0,20% | EUR/09:00 |

| IT Apr P CPI NIC incl. tobacco YoY | -0,20% | -0,20% | EUR/09:00 |

| IT Apr P CPI EU Harmonized MoM | 0,50% | 2,00% | EUR/09:00 |

| IT Apr P CPI EU Harmonized YoY | -0,10% | -0,20% | EUR/09:00 |

| IT Mar PPI MoM | - | -0,50% | EUR/10:00 |

| IT Mar PPI YoY | - | -4,10% | EUR/10:00 |

| RU Apr 29 Key Rate | 11,00% | 11,00% | RUB/10:30 |

| US Fed's Robert Kaplan Speaks in London at Monetary Forum | - | - | USD/10:30 |

| SA Mar Trade Balance Rand | -1.9b | -1.1b | ZAR/12:00 |

| SA Mar South Africa Budget | 4.79b | 16.39b | ZAR/12:00 |

| BZ Mar National Unemployment Rate | 10,70% | 10,20% | BRL/12:00 |

| UK BOE Deputy Governor Cunliffe Speaks at SRB Conference | - | - | GBP/12:00 |

| BZ Mar PPI Manufacturing MoM | - | -0,57% | BRL/12:00 |

| BZ Mar PPI Manufacturing YoY | - | 9,70% | BRL/12:00 |

| US 1Q Employment Cost Index | 0,60% | 0,60% | USD/12:30 |

| US Mar Personal Income | 0,30% | 0,20% | USD/12:30 |

| CA Mar Industrial Product Price MoM | 0,50% | -1,10% | CAD/12:30 |

| US Mar Personal Spending | 0,20% | 0,10% | USD/12:30 |

| CA Mar Raw Materials Price Index MoM | 3,70% | -2,60% | CAD/12:30 |

| US Mar Real Personal Spending | 0,10% | 0,20% | USD/12:30 |

| CA Feb GDP MoM | -0,20% | 0,60% | CAD/12:30 |

| US Mar PCE Deflator MoM | 0,10% | -0,10% | USD/12:30 |

| CA Feb GDP YoY | 1,50% | 1,50% | CAD/12:30 |

| US Mar PCE Deflator YoY | 0,80% | 1,00% | USD/12:30 |

| US Mar PCE Core MoM | 0,10% | 0,10% | USD/12:30 |

| US Mar PCE Core YoY | 1,60% | 1,70% | USD/12:30 |

| US Apr ISM Milwaukee | - | 57,78 | USD/13:00 |

| BZ Mar Primary Budget Balance | -9.5b | -23.0b | BRL/13:30 |

| BZ Mar Nominal Budget Balance | -11.7b | -52.8b | BRL/13:30 |

| BZ Mar Net Debt % GDP | 38,10% | 36,80% | BRL/13:30 |

| US Apr Chicago Purchasing Manager | 52,6 | 53,6 | USD/13:45 |

| US Revisions: Retail Sales | - | - | USD/14:00 |

| US Apr F U. of Mich. Sentiment | 90 | 89,7 | USD/14:00 |

| US Apr F U. of Mich. Current Conditions | - | 105,4 | USD/14:00 |

| US Apr F U. of Mich. Expectations | - | 79,6 | USD/14:00 |

| US Apr F U. of Mich. 1 Yr Inflation | - | 2,70% | USD/14:00 |

| US Apr F U. of Mich. 5-10 Yr Inflation | - | 2,50% | USD/14:00 |

| CH Mar Leading Index | - | 99 | CNY/22:00 |

| IN Mar Eight Infrastructure Industries | - | 5,70% | INR/22:00 |

| AU Australia's Budget Deficit Estimated A$35b | - | - | AUD/22:00 |

Currency Tech

EURUSD

R 2: 1.1714

R 1: 1.1465

CURRENT: 1.1396

S 1: 1.1217

S 2: 1.1144

GBPUSD

R 2: 1.4959

R 1: 1.4668

CURRENT: 1.4643

S 1: 1.4300

S 2: 1.4132

USDJPY

R 2: 112.68

R 1: 111.91

CURRENT: 106.94

S 1: 105.23

S 2: 100.78

USDCHF

R 2: 1.0093

R 1: 0.9913

CURRENT: 0.9621

S 1: 0.9476

S 2: 0.9259

- S: Strong, M: Minor, T: Trendline, K: Keylevel, P: Pivot

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.