Market Brief

Uncertainties are flying over financial markets, volatility was important this Monday. In the U.S, the S&P 500 recorded a loss as it closes at -1.42% at 1853.44 points. The fear of a U.S. recession is now more than a possibility and markets are pricing it. It then pressures Treasury yields. Indeed 10-year yield are very close to last year’s low of 1.6357%. Other major American indices, DJIA and Nasdaq 100 fell respectively by -1.1% at 16027 points and -1.59% at 3960.671 points.

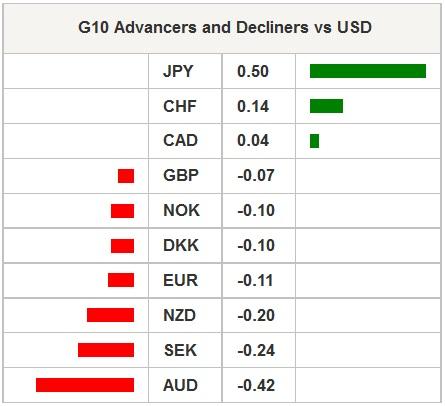

The sentiment is risk-off at the moment, with Gold reaching $1,200 for the first time since June. Golds bullish momentum continues, yet commodity linked currencies like AUD and NZD failed to gain the advantage as outside precious metals, other commodities broadly fell. In particular, WTI Crude is now back towards below 30 dollars a barrel over lingering oversupply concerns. Markets are now fearing that the lingering low oil prices period should last a long time.

Benoit Coeure from the ECB has talked yesterday and confirmed that the European institution will decide whether further monetary policy will be applied at its March meeting. Falling inflation expectations would trigger a reaction from the ECB. For the time being, ahead of the Eurogroup meeting that will be held this Thursday, Greek bonds are extending their losses over disagreement in pension reform. The 10-year is now yielding at 10.18% up from 61 basis points

In the Asian session, the Nikkei dropped over 5% as safe haven flows sent the JPY higher despite insisting rumours saying that the Bank of Japan should ease further. The Japanese currency has climbed because of concerns over the European banking sector. The demand for the yen, which serves as haven, has sent the Japan’s 10-year government bond yield below zero for the first time. The USDJPY has broken the key psychological support at 115.0 for the first time since November 2014.

In Europe, equity futures are down this morning with the Footsie and the Dax trading in negative territory, respectively down -0.26% and -0.91%.

Today, traders will be watching U.S. Wholesale Inventories, U.K. Trade Balance, German Industrial Production, and Mexican CPI.Uncertainties are flying over financial markets, volatility was important this Monday. In the U.S, the S&P 500 recorded a loss as it closes at -1.42% at 1853.44 points. The fear of a U.S. recession is now more than a possibility and markets are pricing it. It then pressures Treasury yields. Indeed 10-year yield are very close to last year’s low of 1.6357%. Other major American indices, DJIA and Nasdaq 100 fell respectively by -1.1% at 16027 points and -1.59% at 3960.671 points.

The sentiment is risk-off at the moment, with Gold reaching $1,200 for the first time since June. Golds bullish momentum continues, yet commodity linked currencies like AUD and NZD failed to gain the advantage as outside precious metals, other commodities broadly fell. In particular, WTI Crude is now back towards below 30 dollars a barrel over lingering oversupply concerns. Markets are now fearing that the lingering low oil prices period should last a long time.

Benoit Coeure from the ECB has talked yesterday and confirmed that the European institution will decide whether further monetary policy will be applied at its March meeting. Falling inflation expectations would trigger a reaction from the ECB. For the time being, ahead of the Eurogroup meeting that will be held this Thursday, Greek bonds are extending their losses over disagreement in pension reform. The 10-year is now yielding at 10.18% up from 61 basis points

In the Asian session, the Nikkei dropped over 5% as safe haven flows sent the JPY higher despite insisting rumours saying that the Bank of Japan should ease further. The Japanese currency has climbed because of concerns over the European banking sector. The demand for the yen, which serves as haven, has sent the Japan’s 10-year government bond yield below zero for the first time. The USDJPY has broken the key psychological support at 115.0 for the first time since November 2014.

In Europe, equity futures are down this morning with the Footsie and the Dax trading in negative territory, respectively down -0.26% and -0.91%.

Today, traders will be watching U.S. Wholesale Inventories, U.K. Trade Balance, German Industrial Production, and Mexican CPI.

| Global Indexes | Current Level | % Change |

| Nikkei 225 Index | 16085.44 | -5.4 |

| Hang Seng Index | 19288.17 | 0.54 |

| Shanghai Index | 2763.49 | -0.63 |

| FTSE futures | 5646 | 0.15 |

| DAX futures | 8929 | -0.48 |

| SMI Index | 7674 | 0 |

| S&P future | 1843.3 | -0.46 |

| Global Indexes | Current Level | % Change |

| Gold | 1186.26 | -0.25 |

| Silver | 15.31 | -0.03 |

| VIX | 26 | 11.2 |

| Crude wti | 30.26 | 1.91 |

| USD Index | 96.72 | 0.15 |

| Today's Calendar | Estimates | Previous | Country/GMT |

| SW SEB New Economic Forecasts | - | - | SEK/09:00 |

| UK Dec Visible Trade Balance GBP/Mn | -£10400 | -£10642 | GBP/09:30 |

| UK Dec Trade Balance Non EU GBP/Mn | -£2500 | -£2450 | GBP/09:30 |

| UK Dec Trade Balance | -£3000 | -£3170 | GBP/09:30 |

| UK BOE's Cunliffe Speaks at Conference in London | - | - | GBP/09:30 |

| IT Bank of Italy Publishes Monthly Report `Money and Banks' | - | - | EUR/10:00 |

| US Jan NFIB Small Business Optimism | 94,5 | 95,2 | USD/11:00 |

| SP Bank of Spain Governor Linde Speaks in London | - | - | EUR/11:00 |

| US Dec JOLTS Job Openings | 5413 | 5431 | USD/15:00 |

| US Dec Wholesale Inventories MoM | -0,20% | -0,30% | USD/15:00 |

| US Dec Wholesale Trade Sales MoM | -0,40% | -1,00% | USD/15:00 |

| NZ Jan Card Spending Retail MoM | 0,30% | -0,20% | NZD/21:45 |

| NZ Jan Card Spending Total MoM | - | 0,10% | NZD/21:45 |

| IN Jan Local Car Sales | - | 172671 | INR/23:00 |

Currency Tech

EURUSD

R 2: 1.1495

R 1: 1.1387

CURRENT: 1.1181

S 1: 1.0711

S 2: 1.0524

GBPUSD

R 2: 1.5242

R 1: 1.4969

CURRENT: 1.4408

S 1: 1.4081

S 2: 1.3657

USDJPY

R 2: 125.86

R 1: 123.76

CURRENT: 115.19

S 1: 105.23

S 2: 100.78

USDCHF

R 2: 1.0676

R 1: 1.0328

CURRENT: 0.9858

S 1: 0.9786

S 2: 0.9476

- S: Strong, M: Minor, T: Trendline, K: Keylevel, P: Pivot

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

GBP/USD remains on the defensive below 1.2450 ahead of UK Retail Sales data

GBP/USD remains on the defensive near 1.2430 during the early Asian session on Friday. The downtick of the major pair is backed by the stronger US Dollar as the strong US economic data and hawkish remarks from the Fed officials have triggered the speculation that the US central bank will delay interest rate cuts to September.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.