Market Brief

European stocks were trapped under fire yesterday due to mounting geopolitical tensions as Turkey took down a Russian warplane near the Syrian border. The DAX lost as much as 2% before erasing partially early day losses. The German index end up the day down 1.43%. The broader Euro Stoxx 600 followed roughly the same pattern, losing as much as 2.04% and ending the day down 1.20%. In the US, economic data came in broadly mixed yesterday as the third quarter GDP was revised higher to 2.1%q/q (annualised) from 1.5% as expected. However, personal consumption came on the soft side, printing at 3% versus 3.2% median forecast and first estimate. Finally, consumer confidence fell to 90.4 in November after a reading of 99.1 in October as American people’s confidence in the job market erodes. While on the equity side, the Turkey-Russia incident didn’t much Wall Street as all three main equity indices end up the day in positive territory with the S&P500, the Dow Jones and the Nasdaq up 0.12%, 0.11% and 0.01% respectively.

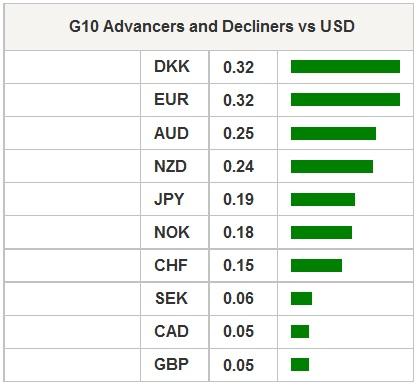

In German, the IFO business climate index surprisingly jumped to 109 in November, the highest level since July 2014, from 108.2 in the previous month. The German economy seemed to have managed pretty well the end of the summer and the outlook looks great especially considering the fact that the weaker euro is going to give an extra boost to the economy. The single currency recovered in the Asian session and rose 0.32% versus the dollar, bringing EUR/USD back above the 1.0650 threshold. However, we still believe that there is further room for euro depreciation.

In Asia, regional equity indices were broadly lower with the exception of mainland Chinese markets which were able to report gains. The Shanghai and Shenzhen Composite were up 0.88% and 1.89% respectively. In Japan, the Nikkei fell 0.39% while the broader Topix index dropped 0.70%. Elsewhere, Hong Kong’s Hang Seng was down 0.50%, South Korea’s Kospi fell 0.34% while in Singapore stocks retreated 1.02%.

In Australia, skilled vacancies rose 0.6%m/m in October, down from a revised increase of 1.1% in September. AUD/USD’s positive trend is gaining momentum as Governor Stevens declared that the RBA was pretty comfortable with the state of its current monetary policy. A cut in the cash rate is therefore not for tomorrow. After successfully validating a break of its 50dma, AUD/USD is now heading toward its 200dma standing at 0.7482 for the moment. The closest resistance can be found at 0.7382 (high from October 12th) while on the downside a support lies at 0.7017 (low from November 8th and 20th).

Today traders will be watching PPI from Sweden; unemployment rate from Norway; industrial orders and retail sales from Italy; MBA mortgage application, personal income and spending, durable goods orders, Markit composite and services PMI, new home sales and Michigan sentiment index from the US; trade balance from New Zealand; interest rate decision from Brazil (BCB expected to stay on hold).

| Global Indexes | Current Level | % Change |

| Nikkei 225 Index | 19847.58 | -0.39 |

| Hang Seng Index | 22474.49 | -0.5 |

| Shanghai Index | 3647.93 | 0.88 |

| FTSE futures | 6293 | 0.27 |

| DAX futures | 10950 | 0.28 |

| SMI Futures | 8825 | 0.42 |

| S&P future | 2084.1 | -0.03 |

| Global Indexes | Current Level | % Change |

| Gold | 1078.63 | 0.29 |

| Silver | 14.22 | 0.17 |

| VIX | 15.93 | 1.98 |

| Crude wti | 42.87 | 0 |

| USD Index | 99.39 | -0.13 |

| Today's Calendar | Estimates | Previous | Country/GMT |

| SP Oct PPI MoM | - | -0,90% | EUR/08:00 |

| SP Oct PPI YoY | - | -3,60% | EUR/08:00 |

| SW Nov Consumer Confidence | 98 | 98,8 | SEK/08:00 |

| SW Nov Manufacturing Confidence s.a. | 111,9 | 112 | SEK/08:00 |

| SW Nov Economic Tendency Survey | 108,5 | 108,3 | SEK/08:00 |

| SW Oct PPI MoM | - | -0,30% | SEK/08:30 |

| SW Oct PPI YoY | - | -1,40% | SEK/08:30 |

| NO Sep Unemployment Rate AKU | 4,60% | 4,60% | NOK/09:00 |

| IT Sep Industrial Orders MoM | - | -5,50% | EUR/09:00 |

| IT Sep Industrial Orders NSA YoY | - | 2,10% | EUR/09:00 |

| IT Sep Industrial Sales MoM | - | -1,60% | EUR/09:00 |

| IT Sep Industrial Sales WDA YoY | - | -2,40% | EUR/09:00 |

| UK Oct BBA Loans for House Purchase | 45500 | 44489 | GBP/09:0 |

| EC ECB's Honohan Speaks in Dublin | - | - | EUR/09:30 |

| SA 4Q BER Business Confidence | 42 | 38 | ZAR/10:00 |

| BZ Nov FGV Construction Costs MoM | 0,37% | 0,27% | BRL/10:00 |

| BZ Nov FGV Consumer Confidence | - | 75,7 | BRL/10:00 |

| EC ECB releases Financial Stability Review | - | - | EUR/10:00 |

| IT Sep Retail Sales MoM | 0,50% | 0,30% | EUR/10:00 |

| IT Sep Retail Sales YoY | 1,40% | 1,30% | EUR/10:00 |

| AU RBA's Debelle Speech in London | - | - | AUD/10:20 |

| GE Bundesbank releases Financial Stability Report | - | - | EUR/11:00 |

| BZ Oct PPI Manufacturing MoM | - | 2,75% | BRL/11:00 |

| BZ Oct PPI Manufacturing YoY | - | 10,41% | BRL/11:00 |

| US nov..20 MBA Mortgage Applications | - | 6,20% | USD/12:00 |

| US Oct Personal Income | 0,40% | 0,10% | USD/13:30 |

| US Oct Personal Spending | 0,30% | 0,10% | USD/13:30 |

| US Oct Real Personal Spending | 0,20% | 0,20% | USD/13:30 |

| US Oct PCE Deflator MoM | 0,20% | -0,10% | USD/13:30 |

| US Oct PCE Deflator YoY | 0,30% | 0,20% | USD/13:30 |

| US Oct PCE Core MoM | 0,10% | 0,10% | USD/13:30 |

| US Oct PCE Core YoY | 1,40% | 1,30% | USD/13:30 |

| US Oct P Durable Goods Orders | 1,70% | -1,20% | USD/13:30 |

| US Oct P Durables Ex Transportation | 0,30% | -0,40% | USD/13:30 |

| US Oct P Cap Goods Orders Nondef Ex Air | 0,20% | -0,30% | USD/13:30 |

| US Oct P Cap Goods Ship Nondef Ex Air | -0,30% | 0,50% | USD/13:30 |

| US nov..21 Initial Jobless Claims | 270k | 271k | USD/13:30 |

| US nov..14 Continuing Claims | 2161k | 2175k | USD/13:30 |

| US Sep FHFA House Price Index MoM | 0,40% | 0,30% | USD/14:00 |

| US 3Q House Price Purchase Index QoQ | - | 1,20% | USD/14:00 |

| BZ Currency Flows Weekly | - | - | BRL/14:30 |

| US Nov P Markit US Composite PMI | - | 55 | USD/14:45 |

| US Nov P Markit US Services PMI | 55,1 | 54,8 | USD/14:45 |

| US nov..22 Bloomberg Consumer Comfort | - | 41,2 | USD/14:45 |

| US Oct New Home Sales | 500k | 468k | USD/15:00 |

| US Oct New Home Sales MoM | 6,80% | -11,50% | USD/15:00 |

| US Nov F U. of Mich. Sentiment | 93,1 | 93,1 | USD/15:00 |

| US Nov F U. of Mich. Current Conditions | - | 104,8 | USD/15:00 |

| US Nov F U. of Mich. Expectations | - | 85,6 | USD/15:00 |

| US Nov F U. of Mich. 1 Yr Inflation | - | 2,50% | USD/15:00 |

| US Nov F U. of Mich. 5-10 Yr Inflation | - | 2,50% | USD/15:00 |

| SK Nov Consumer Confidence | - | 105 | KRW/21:00 |

| NZ Oct Trade Balance | -1000m | -1222m | NZD/21:45 |

| NZ Oct Exports | 4.00b | 3.69b | NZD/21:45 |

| NZ Oct Imports | 4.97b | 4.91b | NZD/21:45 |

| NZ Oct Trade Balance 12 Mth YTD | -3318m | -3235m | NZD/21:45 |

| BZ nov..25 Selic Rate | 14,25% | 14,25% | BRL/20:00 |

| IN Oct Eight Infrastructure Industries | - | 3,20% | INR/23:00 |

Currency Tech

EURUSD

R 2: 1.1387

R 1: 1.1095

CURRENT: 1.0674

S 1: 1.0458

S 2: 1.0000

GBPUSD

R 2: 1.5659

R 1: 1.5529

CURRENT: 1.5095

S 1: 1.5027

S 2: 1.4566

USDJPY

R 2: 135.15

R 1: 125.86

CURRENT: 122.30

S 1: 120.07

S 2: 118.07

USDCHF

R 2: 1.0676

R 1: 1.0240

CURRENT: 1.0151

S 1: 0.9739

S 2: 0.9476

- S: Strong, M: Minor, T: Trendline, K: Keylevel, P: Pivot

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD fluctuates in daily range above 1.0600

EUR/USD struggles to gather directional momentum and continues to fluctuate above 1.0600 on Tuesday. The modest improvement seen in risk mood limits the US Dollar's gains as investors await Fed Chairman Jerome Powell's speech.

GBP/USD stabilizes near 1.2450 ahead of Powell speech

GBP/USD holds steady at around 1.2450 after recovering from the multi-month low it touched near 1.2400 in the European morning. The USD struggles to gather strength after disappointing housing data. Market focus shifts to Fed Chairman Powell's appearance.

Gold retreats to $2,370 as US yields push higher

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

US outperformance continues

The economic divergence between the US and the rest of the world has become increasingly pronounced. The latest US inflation prints highlight that underlying inflation pressures seemingly remain stickier than in most other parts of the world.