Market Brief

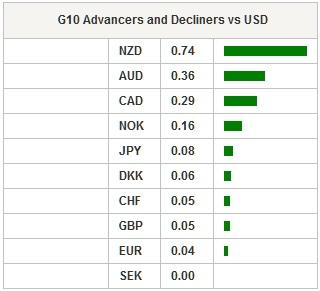

The selling pressure on the greenback continues and shows no sign of weakness as bad news from the US keeps piling up. Retail sales only grew 0.1%m/m versus 0.2% median forecast, while the previous figure was downwardly revised from 0.2% to 0.00% as Americans decided to put savings from lower oil prices aside. When excluding auto sales, retail sales contracted -0.3%m/m in September, below market expectations of -0.1% and a downwardly revised figure of -0.1% in August. On the inflation front, the disappointing PPI figures are raising concerns about when inflation will start picking up. Headline PPI missed expectations as it printed at -0.5%m/m, while economists were expecting a contraction of -0.2%. More worryingly, core PPI indicated that prices only increased 0.8%y/y in September, while economists were looking for an increase of 1.2%. As a result, the US dollar lost ground against all G10. The dollar index fell 0.90% yesterday and is currently stabilising around 93.88.

The entire US yields curve shifted lower yesterday with the 10-year slipping as much as 10bps to 1.9720%, while the monetary policy sensitive 2-year slid 7bps to 0.5490%. However, yields recovered slightly in the Asian session as the market realised the overreaction.

The rally in EUR/USD accelerated in Wall Street yesterday. The pair reached 1.1495 in Asia, its highest level since August 26th. The euro will likely turns the 1.1475 (Fib 61.8% on August-September rally) resistance into a support. On the upside, the closest resistance stands at 1.1714 (high from August 24th), while on the downside, a support can be found at 1.1345 (low from October 13th).

In Australia, the latest employment report surprised to the downside despite a stable unemployment rate (participation rate fell to 64.9% from 65%). The Australian economy lost 5.1k jobs in September, while the market expected that the economy had actually created 9.6k jobs. However, this was only a minor setback for AUD/USD; the pair continues to rally and is now heading toward the next resistance standing at 0.7382 (high from October 12th). With the RBA staying on the sideline, the $0.74 is now within reach.

As expected, the Bank of Korea left the repo rate unchanged at 1.5%. The less dovish statement allowed the won to print some solid gains against the US dollar. USD/KRW fell to 113.30, the lowest level since July 14th.

On the equity front, Asian regional equity markets are all trading in positive territory despite Wall Street’s negative lead. The Japanese Nikkei rose 1.15% while the broader Topix index soared 1.35%. In mainland China, the Shanghai Composite climbed 1.95% and the tech-heavy Shenzhen Composite soared 2.59%. Hong Kong’s Hang Seng rose 2.05%. South Korea’s Kospi jumped 1.18%.

Today traders will focus on the US with September CPI report and a few speeches from Fed members. Bullard, Dudley and Mester will talk today. New Zealand’s CPI report is expected in the evening.

| Global Indexes | Current Level | % Change |

| Nikkei 225 Index | 18096.9 | 1.15 |

| Hang Seng Index | 22900.94 | 2.05 |

| Shanghai Index | 3326.127 | 1.95 |

| FTSE futures | 6279 | 0.46 |

| DAX futures | 9991.5 | 0.64 |

| SMI Futures | 8594 | 0.59 |

| S&P future | 1998 | 0.71 |

| Global Indexes | Current Level | % Change |

| Gold | 1184.22 | 0.01 |

| Silver | 16.15 | 0.09 |

| VIX | 18.03 | 2.04 |

| Crude wti | 46.45 | -0.41 |

| USD Index | 93.85 | -0.08 |

| Today's Calendar | Estimates | Previous | Country/GMT |

| DE Sep PPI MoM | - | 0.70% | DKK/07:00 |

| DE Sep PPI YoY | - | -3.70% | DKK/07:00 |

| TU Jul Unemployment Rate | 9.80% | 9.60% | TRY/07:00 |

| EC ECB's Nowotny Speaks at Central Bank Conference | - | - | EUR/07:00 |

| SW Sep Unemployment Rate | 6.60% | 6.40% | SEK/07:30 |

| SW Sep Unemployment Rate Trend | - | 7.20% | SEK/07:30 |

| SW Sep Unemployment Rate SA | 7.10% | 7.00% | SEK/07:30 |

| NO Sep Trade Balance NOK | - | 20.8b | NOK/08:00 |

| UK BOE Publishes Consultation Paper on Ring-Fencing | - | - | GBP/08:30 |

| EC ECB's Hansson Speaks at Conference in Warsaw | - | - | EUR/09:30 |

| US oct..10 Initial Jobless Claims | 270k | 263k | USD/12:30 |

| CA Sep Teranet/National Bank HPI MoM | - | 1.00% | CAD/12:30 |

| CA Sep Teranet/National Bank HPI YoY | - | 5.40% | CAD/12:30 |

| US oct..03 Continuing Claims | 2200k | 2204k | USD/12:30 |

| CA Sep Teranet/National Bank HP Index | - | 176.12 | CAD/12:30 |

| US Oct Empire Manufacturing | -8 | -14.67 | USD/12:30 |

| US Sep CPI MoM | -0.20% | -0.10% | USD/12:30 |

| US Sep CPI Ex Food and Energy MoM | 0.10% | 0.10% | USD/12:30 |

| US Sep CPI YoY | -0.10% | 0.20% | USD/12:30 |

| US Sep CPI Ex Food and Energy YoY | 1.80% | 1.80% | USD/12:30 |

| US Sep CPI Index NSA | 237.799 | 238.316 | USD/12:30 |

| US Sep CPI Core Index SA | 243.041 | 242.693 | USD/12:30 |

| US Sep Real Avg Weekly Earnings YoY | - | 2.30% | USD/12:30 |

| CA Sep Existing Home Sales MoM | - | 0.30% | CAD/13:00 |

| US oct..11 Bloomberg Consumer Comfort | - | 44.8 | USD/13:45 |

| US Oct Philadelphia Fed Business Outlook | -2 | -6 | USD/14:00 |

| US Fed's Bullard Makes Opening Remarks at Policy Conference | - | - | USD/14:30 |

| US Fed's Dudley Speaks at Brookings Institution | - | - | USD/14:30 |

| EC ECB's Nowotny Speaks at Conference in Warsaw | - | - | EUR/17:00 |

| US Sep Monthly Budget Statement | $95.0b | $105.8b | USD/19:30 |

| US Cleveland Fed's Mester Delivers Remarks at Event in New York | - | - | USD/20:30 |

| NZ 3Q CPI QoQ | 0.20% | 0.40% | NZD/21:45 |

| NZ 3Q CPI YoY | 0.30% | 0.30% | NZD/21:45 |

| CH Sep New Yuan Loans CNY | 900.0b | 809.6b | CNY/22:00 |

| CH Sep Money Supply M2 YoY | 13.10% | 13.30% | CNY/22:00 |

| CH Sep Aggregate Financing CNY | 1200.0b | 1080.0b | CNY/22:00 |

| CH Sep Money Supply M1 YoY | 9.80% | 9.30% | CNY/22:00 |

| CH Sep Money Supply M0 YoY | 3.00% | 1.80% | CNY/22:00 |

| BZ Sep Formal Job Creation Total | -53500 | -86543 | BRL/22:00 |

| BZ Sep Tax Collections | 94250m | 93738m | BRL/22:00 |

| IN Sep Exports YoY | - | -20.70% | INR/22:00 |

| IN Sep Imports YoY | - | -9.90% | INR/22:00 |

| BZ Aug Economic Activity MoM | -0.60% | -0.02% | BRL/22:00 |

| BZ Aug Economic Activity YoY | -4.21% | -4.25% | BRL/22:00 |

| IN Sep Trade Balance | -$11500.0m | -$12478.0m | INR/22:00 |

Currency Tech

EURUSD

R 2: 1.1714

R 1: 1.1561

CURRENT: 1.1479

S 1: 1.1106

S 2: 1.1017

GBPUSD

R 2: 1.5819

R 1: 1.5659

CURRENT: 1.5485

S 1: 1.5202

S 2: 1.5089

USDJPY

R 2: 125.86

R 1: 121.75

CURRENT: 118.71

S 1: 118.61

S 2: 116.18

USDCHF

R 2: 0.9844

R 1: 0.9741

CURRENT: 0.9490

S 1: 0.9384

S 2: 0.9259

- S: Strong, M: Minor, T: Trendline, K: Keylevel, P: Pivot

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.