Market Brief

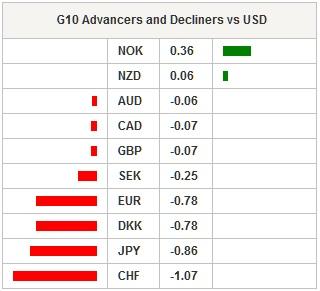

The last batch of data from the US came in mostly on the soft side yesterday. Ahead of Friday’s Non-farm payrolls, ADP indicated that the private sector added 190k in August, slightly below consensus estimates of 200k but up from July’s revised 177k increase. Factory orders grew 0.4%m/m (s.a.), below median forecast of 0.9% and down from June revised 2.2% expansion. Yesterday as well, the Fed’s Beige Book report indicated that “Most districts reported modest to moderate growth in labour demand,” and that “this tightening of labour markets was said to be pushing wages up slightly”. Overall, the report found that “economic activity continued expanding across most regions and sectors” in July and August. The US dollar strengthen against its main counterparts, especially against low yielding currencies such as the Swiss franc, the Danish krone, the Japanese yen and the euro. The dollar index had risen 0.60% yesterday and is currently grinding lower ahead of the London session.

In China, stock markets are closed due to World War II anniversary. In Japan, the Nikkei edges up 0.48% while the broader Topix index gains 0.61%. USD/JPY response to better-than-expected Nikkei PMI was muted. August’s services PMI printed at 53.7 verse 51.2 consensus while Composite PMI came in at 52.9 versus 51.5 median forecast. The dollar is trading at Y120.40 at the moment with a positive bias.

In Australia, the trade deficit narrowed to AUD 2460mn in July, above consensus estimates of AUD 3160mn but up from July’s revised deficit of AUD 3050mn. In August, retail sales declined 0.1% compared to July as consumers cut spending in household goods and cafés and restaurants expenses. Australian shares paid the bill and dropped 1.44% in Sydney. AUD/USD dropped another 0.70% on the headlines and is gaining negative momentum. The Aussie lost around 3.70% against the US dollar since the beginning of the month and we see no reason for the Aussie to reverse the trend as bad news keep piling up.

Unsurprisingly, Brazil’s Central Bank left the Selic rate unchanged at 14.25% as the Copom kept the same statement of the July meeting. Meanwhile, industrial production contracted - for 16th straight month - by 8.9%y/y in July, well below median forecast of -6.3%y/y and previous read revised to -2.8%. The Brazilian real keeps sinking and lost another 1.60% yesterday against the US dollar and is heading toward the next key resistance standing at 3.8225 (high from December 2002 !).

In Europe, equity futures are trading in positive territory this morning with the Footsie up 0.55%, the DAX 0.65%, the CAC 0.79% and the SMI 0.44%.

Today traders will be watching Markit PMI from Italy, France, Germany, United Kingdom and Euro zone; the ECB staff macroeconomic projections and ECB main refinancing rate; initial jobless claims, trade balance, Markit composite and service PMI, ISM non-manf. Composite from the US.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD could extend the recovery to 0.6500 and above

The enhanced risk appetite and the weakening of the Greenback enabled AUD/USD to build on the promising start to the week and trade closer to the key barrier at 0.6500 the figure ahead of key inflation figures in Australia.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Bitcoin price makes run for previous cycle highs as Morgan Stanley pushes BTC ETF exposure

Bitcoin (BTC) price strength continues to grow, three days after the fourth halving. Optimism continues to abound in the market as Bitcoiners envision a reclamation of previous cycle highs.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Federal Reserve might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.