Market Brief

China’s Caixin flash manufacturing PMI surprised markets to the downside with a reading of 47.1 versus 48.2 consensus and 47.8 in July. Despite China’s monetary easing, the manufacturing sector is contracting since March and it seems that we have not reach the bottom yet. Therefore, be ready for further policy support. Chinese shares tumble with the Shanghai Composite down almost 3% while the tech-heavy Shenzhen dropped 3.56%. However, the sell-off is not contained to Chinese mainland shares: Hong Kong’s Hang Seng dropped 2.20%, the Nikkei fell 2.72%, the Topix retreated 3.13%, Australian shares dropped 1.40% while in South Korea the Kospi index fell 2.01%.

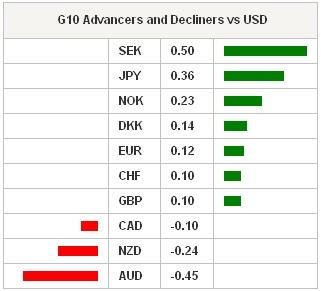

In the FX market, the dollar is feeling the pressure as traders are losing faith in a September rate hike from the Federal Reserves and adjust their positioning for a delayed lift-off. Since the beginning of the week the greenback lost 2.4% against the Swiss franc, 1.87% against the DKK, 1.85% versus the euro and 1.20% against the yen. Only the Canadian and Australian dollar are losing ground against the US dollar, down 0.20% and 0.94% respectively.

In Europe, Alexis Tsipras, Greece Prime Minister, resigned yesterday and called snap election for September 20. According to Tsipras, he wants to put everything he has done (mostly regarding the bailout deal) to the judgment of Greek people. Greece is therefore back into short-term political uncertainty. This morning, the single currency is trading higher against most G10. EUR/USD is taking off and has jumped 2.30% since Wednesday. The single currency validated a break of the 1.12 threshold and is heading toward 1.13 with the next key resistance lying at 1.14.

Safen haven assets such as the Swiss franc and gold are back under the spotlight, showing strong performances over the week. The Swiss franc is appreciating against all G10 currencies since the beginning of the week while gold is up 3.50% over the same period due to mounting uncertainties about global growth.

On the equity front, all signs point toward a negative opening in Europe. Futures on the German DAX are down -2.40% while ones on the CAC 40 are down -2.09%. UK shares are down 0.53%, SMI falls -1.73% while the Euro Stoxx 50 is down -2.24%. GBP/USD is having a hard time taking off and is stuck below the 1.57 threshold. On the other hand, EUR/GBP is set to break its second resistance in 2 days. On the upside, the closest resistance stands at 0.7215 (Fib 61.8% on June-July debasement) while on the downside the pair is trying to turn the previous resistance, lying at 0.7162 (Fib 50%), into a support.

Today traders will be watching German and Euro zone Markit PMIs; retail sales and CPI from Canada and consumer confidence from Euro zone.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.