Market Brief

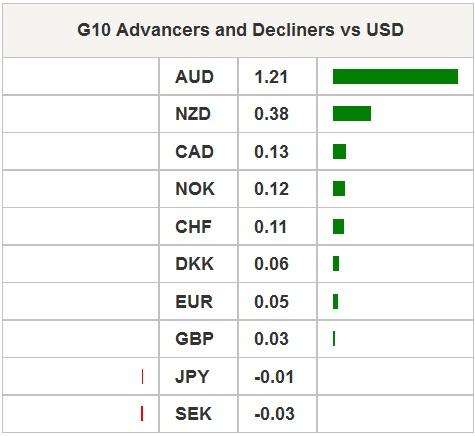

FX markets were stable in Asia trading, with the exception of AUD. As was universally expected the RBA held OCR at 2.0% and continue to see the current accommodative policy as appropriate. Yet, the accompanying statement took a hawkish turn when members stated that AUD was adjusting to declines in commodity prices, sheading the language for more depreciation. In reference to the currency, the statement said it was “adjusting to the significant declines in key commodity prices.” Local AUD yields jumped 3bps on the statement. Heavily sold AUDUSD quickly ran to 91.39 from 90.10 as short were squeezed. On the data, front Australian retail sales hastened 0.7% m/m in June, above estimates of 0.4% m/m and revised higher 0.4% m/m read in May. Finally, Australia’s trade deficit came in at A$2933mn in June slightly below expectations of deficit of A$3000mn. We will be watching developments in China carefully but favor carry-based trades in AUDJPY and AUDCHF. The positive AU economic data, specifically strong housing data, combined with today’s slightly neutral statement (shift from dovish) indicates that it’s unlikely that the RBA will cut rates further. However, the SNB and BoJ are not tightening anytime soon, while FX vol remains low.

Asian equity markets were mixed with the China seeing some well needed gains. Yet the gains were made on the back that new rules to restrict daily trading via short selling regulations. The Shanghai composite rose 3.015%, the Hang Seng increase 0.30% while the Nikkei fell -0.13%. EURUSD drifted between 1.0932 and 1.0967 picking up demand closer to European open. USDJPY continues to consolidate, stuck in a 20 pip range around the 124 handle. Currencies in EM were subdued as the USDCNY fixed 8 pips higher at 6.1177. Gold was unchanged around the $1087 level, as US rates were firm. European stocks are primed for a lower open.

In Japan, monetary base rose 32.8% y/y in July following a surge of 34.2% in June. Elsewhere, labor cash earnings fell 2.4%y/y in June below expected read of growth of 0.9% against revised increase of 0.7% in May. Despite recent comments indicating that no additional BoJ action is coming we suspect that in order to fuel the “Abe miracle” policy will remain at least ultra-accommodating. This should equate to a weaker JPY within the G10.

On the fridge, Puerto Rico has suspended depositing into the fund that is directed to pay bonds. This would be the first time Puerto Rico has defaulted on its debt obligations. Years for borrowing to convers budget short falls has pushed the island nations financial health over the edge. Governor Alejandro Garcia Padilla is seeking to restructure Puerto Rico’s $72bn of debt, halting monthly transfers of capital into the fund that repays $13bn of general obligations debt. We don’t see a high probability for risk contagion.

In the European session, traders are scheduled to see EU PPI, UK Housing Prices and construction PMI, Norway PMI and Russian CPI. The market anticipate that UK house prices to increase from -0.2% m/m to 0.4% m/m which should support GBP ahead of a busy Thursday.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.