Market Brief

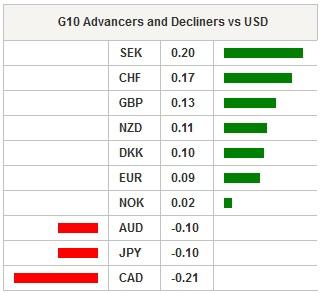

Asia stocks declined across the board as Chinese economic data showed more weakness. China Caixin manufacturing PMI final (different from the official read which fell to a five-month low at 50.0) contracted to a 2-year low at 47.8 in July compared with flash estimates of 48.2 and down from 49.4 in June. The Shanghai composite fell -2.33% and Shenzhen declined 2.30%. The Hang Seng fell -1.01% and the Nikkei -0.17%. In the FX markets volatility was subdued after Fridays wild swings. EURUSD was range bound between 1.0966 to 1.0991 while traded slightly higher from 123.90 to 124.10. AUDUSD edged lower despite solid economic data. AUDUSD fell from 0.7321 to 0.7290. US rates were slightly higher as the 10yr yields rose 2.5bp to 2.205% on the open but quickly slipped to 2.194%. The PBoC kept the USDCNY fix steady at 6.116. With a busy GBP week ahead, the sterling was range bound. Commodties remain under pressure with oil falling in early trading. According to a Bloomberg report, ahead of the China's top leadership’s annual gathering, policy makers are preparing new fiscal spending initiatives to safeguard against economic weakening wouldn’t put there 2015 target out of reach (as in 2014). In the European session, Greece is anticipated to open its stock markets for the first time in over one month. Heavy selling is excepted and headwinds in stock across Europe.

According to Bloomberg, BoJ Governor Haruhiko Kuroda stated that there was no current need for additional monetary easing. The inflation trend was improving, yet the BoJ stood ready to adjust policy if needed. He went on to say that in his view the private sector remained more pessimistic then the central bank on inflation outlook. Finally, it was the official BoJ view that its inflation target of 2% would be achieved around the first half of 2056. In economic data, Nikkei manufacturing PMI expanded to 51.2 in July revised lower from 51.4 of preliminary estimates.

Australia, July AIG performance of manufacturing index expanded to 50.4 recovering from a contraction of 44.2 in June. While, HIA new home sales rose 0.5% m/m in June against a prior fall of 2.3% in May. Australia, house prices continue to surge despite efforts of regulators to control growing real-estate prices (dampening RBA easing expectations). Elsewhere, South Korea’s BoP current account surplus quickened to a record high of $12186.5mn against revised lower figures of $8618.1mn in May.

In the European session, traders will expect EU, UK and Swedish manufacturing PMI. Switzerland will release sight deposit data which will be of interest due to the fact that EURCHF has traded well above intervention levels. This read will help us understand if the SNB is looking to push the EURCH higher or only intervene to in defensive of the CHF. In the US personal income and spending, PCE and ISM manufacturing are anticipated to be release.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.