Market Brief

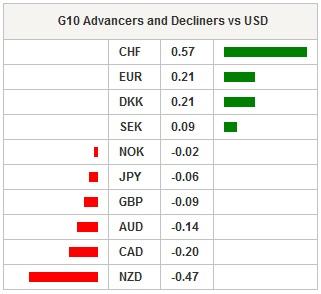

FX markets were quiet, shifting into summer trading patterns. USD was marginally weaker against G10 and EM currencies as US rates were unchanged at 2.264%. EURUSD traded from 1.0929 to 1.0949 in controlled behavior. USDJPY traded in a u-shaped pattern down from 124.25 to 123.91 then back to 124.16. Indicative of a sleepy August Friday trading session. Asia regional equity indices were higher across the board. The Nikkei was up 0.12%, the Hang Seng rose 0.52% and the Shanghai composite increased 0.60%. Commodities remain under pressure with gold falling from $1089 to $1083. Since interest rates have begun to rise globally, gold cost of carry has increased making the precious metal an unfavorable asset to hold. VIX index fell to 12.13 as volatility in stocks dried up. In FX, volatility also continued to decrease indicating that carry based trades should become popular again. In our view CHF and JPY would be the strongest candidate for funding they interest rate driven trades. According to newswire, Alexis Tsipras won his battle against the far left dissenters for the governing of Syriza party. The terms of the current €86bn bailout being negotiated remains highly divisive and we are likely to get a end of year snap election. Elsewhere, the IMF board has told Athens that the unsustainable high level of debt and weak history of reform implementation could keep the IMF from participating in the third bailout. Lingering concerns over Greek bailout negotiations and technical break of 1.0930 should keep EURUSD risk to the downside. Finally, the Swiss National Bank has reported a loss of CHF 50.1 billion for the first half of 2015 (chf 10bn above prior report). Residual costs of abandoning the EURCHF minimum exchange rate.

Japan’s June CPI increased 0.4% y/y above market expectation of 0.3% y/y, but slower than the 0.5% rise in May. Core inflation was unmoved at 0.1% y/y against 0.0% expected and CPI excluding food & energy surged to 0.6% y/y, both above expectation of 0.4%. Overall household spending disappointed falling -2.0% y/y in June, below then consensus growth of 1.9% following a 4.8% increase in May. Weak consumption spending will weigh on 2Q GDP growth and has become a worrying signals that Abenomics effect are slowing.

New Zealand July business confidence fell to -15.3 following a dip -2.3 in June and activity outlook continued falling to 19.0 in July from 23.6. These reads indicated a further weakening of growth momentum. South Korea’s June industrial production growth hastened 1.2% y/y above expectations of a -2.0% fall and revised slump of 3.0% in May.

In a light European session, traders will see EA June unemployment rate which is expected to fall 11.0% from 11.1%. EA July flash HICP inflation is anticipated to be unchanged at 0.2% y/y and core inflation at 0.8% y/y. In Russia, we expect that central banks to cut 50bp in line with consensus. The central bank is in a real bind with inflation rising yet growth collapsing. We remain buyers of USDRUB, as the fragile growth outlook and lower official rates, will have markets selling RUB (CBR interventions have paused due to increase RUB decline and high volatility).

In the US session, Canada GDP is expected to be flat at 0.0% m/m from -0.1% in May. The BoC recent rate cut would suggest that market will overlook this weak read. We remain significantly bearish on the CAD due to slowing growth, weak commodity prices and dovish central bank. In the near term USDCAD bullish trend remains intact and likely challenge 1.3103 July 15 high, break would extend strength to 1.3275.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.