Market Brief

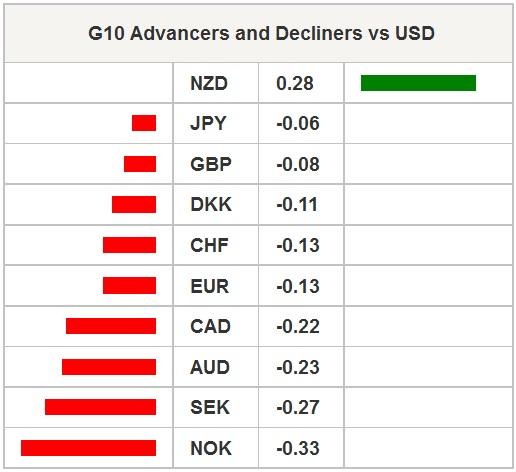

Asia stock markets were subdued today with a majority of indices in the green. The Hang Seng rose 0.26% and the Shanghai Composite increased 0.15% while the Nikkei fell -0.16%. Investors are hoping that Beijings efforts to hold up stock prices will protect the downside (a "Beijing put"). Volatility across stocks were lower following a stronger US session (good US data). Rates across Asia were flat while the US 10-year yields rose 2 bps to 2.253%. As expected volatility in FX died out ahead of the FOMC decision later today. EURUSD took a one-way path from 1.1084 to 1.1037 while USDJPY was range bound between 123.35 to 123.65. AUDUSD gave back much of yesterday hard won gains falling to 0.7315 from 0.7359. EM Asia FX were generally unchanged against the USD.

RBNZ Governor Graeme Wheeler again highlighted his easing bias as New Zealand’s economic growth was seen as below its potential. However, he stressed that easing should be constant as strong construction growth could get wild if rates were too low. Wheeler stated “local commentators have predicted large declines in interest rates over coming months that could only be consistent with the economy moving into recession.” In comments directly aimed at the NZD he stresses the need for further weakening. He stated in crystal clear terms “current levels of export prices, a more substantial exchange rate depreciation will be required to stabilize the net external liabilities position.” NZD reacted strongly to Wheelers comments as NZDUSD spiked from 0.6659 to 0.6739 as long term interest rates became the brief focus. However, worries over weak commodity prices and outlook of Asia EM has pushed NZDUSD to 0.6690.

Elsewhere in Asia, Japan’s retail sales fell -0.8% m/m in June, below expected -0.9%, a significant deceleration from 1.7% increase witnessed in May. Retail trade expanded 0.9%y/y, against expected rise of 1.1%, and prior 3.0% May read. From China, Westpac-MNI consumer sentiments increased 1.9% m/m to 114.5 in July slight improvement from prior reading of 112.3 in June.

Today we have an event and data heavy schedule (so FX traders should expect increase in vol as liquidity conditions remain thin). In the European session, German GfK consumer confidence, French consumer confidence and seasonally adjusted Spanish retail sales expected to rise from 3.4% y/y to 3.6% y/y in June. Swedish consumer confidence is expected to rise from 97.9 to 98.9 and manufacturing confidence to increase marginally from 101.3 to 101.5. Norwegian unemployment rate is anticipated to rise from 4.2% to 4.3% in May.

In the US session, Brazils central bank is expected to hike interest rates 50bp to 14.75, yet a smaller hike of 25bp is a strong possibility. It is generally expected that the accompanying state will signal the end of the current tightening cycle. From the US, first we will get Pending Home Sales then the main event, the FOMC rate decision. No change in policy is expected that this meeting. Overall, we anticipate that the changing of wording in the FOMC statement will signal that September is the likely timing for the first rate hike. Should the wording remain unchanged, it’s unlikely that a rate hike will occur in September. This Fed meeting will not include economic forecasts or press conference.

For free Trade Signals

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.