Market Brief

US data released yesterday were mixed as usual and did not allow the USD to gain positive momentum. Personal spending rose 0.9% in May after a disappointing 0.1% in April while personal income came in stable at 0.5%, matching expectations. Spending increased by most in 5 years (1.3% in August 2009) which is quite normal after a low print in April while income held steady for the last 2 months. Initial jobless claims came in better-than-expected at 271k while analysts were looking for 273k. On the dark side, Markit June preliminary Composite and Service PMI contracted from previous month. Service PMI was expected at 56.5 and printed at 54.8 (56.2 prior read) while Composite PMI came in at 54.6 versus 56.2 prior read. This is the lower read since January this year. In our opinion, we cannot only blame the lingering uncertainties over the Greek situation for the lack of dollar bullish momentum as recent US data do not point toward a strong recovery in the US economy in the ongoing second quarter. We therefore reiterate our call for a return of substantial growth in Q3, Q2 being already lost. EUR/USD has been treading water for the last 3 days and stayed below the 1.2020 resistance threshold implied by the 61.8% Fibonacci level (on May debasement). A support stands at 1.1143 (Fib. 50%).

In China, equity sell-off continues and the market is now wondering whether this is due to the breakdown in talks between Greece and its creditors or the burst of the stock market bubble. The Shanghai Composite lost another 7.36% today, down 19% from its record high on June 12. The Shenzhen Composite retreated -7.98% over the session, down 21% since June 12. Most equity analysts do not recommend to buy into weakness as it may not be the end of the correction. Hong Kong’s Hang Seng is also feeling the heat but to a lesser extent with drop of -1.84%. In Japan, the Nikkei was down only -0.31% while USD/JPY is losing momentum and is testing again the support standing at 123.20 (Fib 38.2% on May-June Rally).

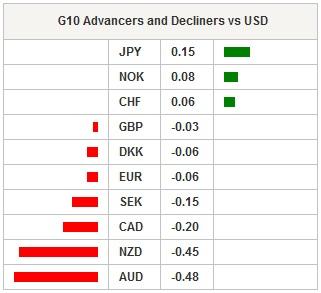

Australian equities paired losses with the S&P/ASX down -1.54%. AUD/USD is one of the biggest losers against the US dollar tonight (-0.48%) and is heading toward the support lying at 0.77. However, the Aussie is moving sideways since the beginning of the week, partly due to a light economic calendar. Fortunately, the Aussie will be back in business next week with a more consistent one.

In New Zealand, trade surplus surged to NZ$350mn in May while analysts expected a trade deficit of NZ$100mn. The rise is due to weaker imports which fell to NZ$4.01bn versus NZ$4.30bn median forecast. Exports came in slightly above expectations at NZ$4.36bn versus NZ$4.30bn consensus. In its Statement of Intent for 2015-2018, the Reserve Bank of New Zealand reiterated its view that the Kiwi is still overvalued. As a result, NZD/USD dropped at 0.6865 before stabilising around 0.6880. We maintain our bearish view on the New Zealand dollar and we expect further depreciation of the Kiwi against the US dollar, with the $0.6557 level as next target.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.