Market Brief

Chinese equities tumble after margin lending tighten at brokerages. The Shanghai Composite retreated -3.78% while Hong Kong’s Hang Seng lost -2.10%. In Shanghai, the main gauge is up more than 50% since the beginning of the year; at the same time, the Chinese economy grew only 7%y/y in Q1, the lowest read since Q1 2009. There is clearly a stock market bubble, in our opinion, fuelled by the perspective of further monetary easing from the PBoC, in it attempt to cushion the slowdown, and implemented using margin accounts. However, the biggest challenge is to find out where is the top and to enjoy the ride as long as possible before leaving the vessel ahead of the correction.

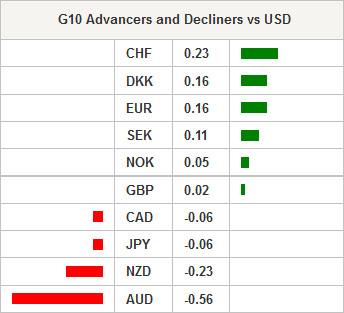

In Australia, S&P/ASX retreated 0.21% as private capital expenditure dropped -4.4%q/q in Q1 versus -2.2% consensus, accelerating from a previous fall of -1.7% (revised up from -2.2%). As a result, the sell-off in AUD/USD accelerated and dragged the Aussie as low as 0.7671. The pair was unable to break the strong support standing around 0.7704/0.7675 (low from July 2009 and August 2007, respectively). We remain AUD bears and we expect further depreciation of the Aussie against the greenback, 0.7553 level is the next target.

In Japan, retail sales jumped 5%y/y in April compared to a contraction of -9.7% prior read. However, market analysts were looking for a higher read of 5.5% and it was enough to help the dollar reaching a 12-year high against the Japanese’s yen to 124.25. However, the dollar is having a hard time converting the 124.14 resistance (high from June 22, 2007) into a support.

Yesterday in Europe, equity markets cheered “rumours” that progress has been made to reach an agreement between Greece and its creditors, lowering the odds of a Greek default on the next IMF payment. Italian shares jumped 2.29%, Euro Stoxx 50 was up 1.76%, Footsie up 1.21% and SMI 1.33%. This morning, European equity futures are slightly lower as market participants await the latest news about the situation. EUR/USD stopped free falling and used the 1.0882 support (Fib 61.8% on April-May rally) to rebound above 1.09. On the upside, the single currency will find resistance at 1.10 and will need good news about the Greek situation to stop, or at least to slow, the current EUR/USD fall.

In UK, second release of Q2 GDP is due today and is expected to be revised upward to 0.4%q/q from 0.3% 1st read. GBP/USD is treading water ahead of the release, slightly above the 1.5338 support (Fib 38.2% April 13–May 14 rally). Next resistance stands around 1.55 (psychological threshold and April 29 high) while, on the downside, the pair should find support at 1.52. EUR/GBP stopped sliding lower as it reacted positively to encouraging news about the Greek situation. The euro is now trading above €1.52 for £1.

Today traders will be watching consumer and business confidence from Italy and Eurozone; UK Q1 GDP (2nd read); Brazil’s FGV inflation IGPM; initial jobless claims, Bloomberg consumer comfort and pending home sales.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD stays weak near 1.0650 ahead of Eurozone PMI data

EUR/USD remains on the back foot near 1.0650 in European trading on Tuesday. Resurgent US Dollar demand amid a cautious risk tone weighs on the pair. Investors stay wary ahead of the preliminary Eurozone and US business PMI data.

GBP/USD eases below 1.2350, UK PMIs eyed

GBP/USD is dropping below 1.2350 in the European session, as the US Dollar sees fresh buying interest on tepid risk sentiment. The further downside in the pair could remain capped, as traders await the UK PMI reports for fresh trading impetus.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

Focus on April PMIs today

In the euro area, focus today will be on the euro area PMIs for April. The previous months' PMIs have shown a return of the two-speed economy with the service sector in expansionary territory and manufacturing sector stuck in contraction.