Market Brief

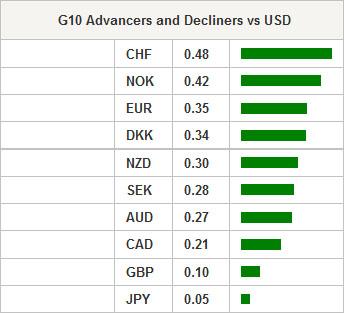

The latest data from the US were broadly mixed with April Durables Goods Orders matching expectations at -0.5%m/m (4% prior). Markit Flash Services PMI came in below expectation at 65.4 versus 56.5 expected (57.4 prior) indicating that the US service sector lost momentum in May. However, since a read above the 50 threshold indicates an expansion, May’s figure is therefore not that bad. Finally, Consumer Confidence surprised markets on the upside as the index surged at 95.4 in May versus 95 expected and 94.3 prior. All in all, data release didn’t trigger major moves in FX markets as USD consolidates against G10 overnight before sliding slightly in late Asian session.

In Asia, equity returns are broadly negative. Korea’s Kospi is the biggest loser, down -1.68%. In Japan, the Nikkei is roughly positive, up 0.17% while the Shanghai Composite is rising, again, up 0.72%. Australian shares are down -0.83% despite Westpac leading index surged 0.1%m/m in April, rebounding from -0.35m/m in March. USD/JPY is consolidating around 123 after adding more than 3% in less than 3 weeks. This morning, BoJ minutes indicate that Japanese officials are comfortable with a weak Yen, helping to boost inflation. The dollar should find support at 121.48 (Fib 38.2% on late April – May rally) while a strong resistance implied by June 2007 high stands at 121.14. Further South, AUD/USD free fall continues as the Aussie broke the 0.7786 support (Fib 61.8% on April 13 – May 14 rally). Moreover, the break of the 50dma (0.7808) validate a negative trend, we therefore expect the pair lower. On the downside, the next support can be found at 0.75 (psychological threshold).

In Canada, we expect the BoC to leave its target rate unchanged at 0.75% at its policy meeting today, in line with consensus. USD/CAD broke the 50dma to the upside and is now finding resistance at the bottom of its January-April 1.2425-1.2845 range.

In Europe, equity futures are blinking green on the screen after yesterday sharp sell-off. Euro Stoxx 50 is up 0.42%, UK’s Footsie is up 0.19%, German DAX up 0.40% while Swiss equities gained 0.44%. GBP/USD has proved unable to break the 1.5338 support (Fib 38.2% April 13 – May 14 rally). The cable rebounded on the level and is heading toward the closest resistance standing around 1.55 (psychological threshold and April 29 high). EUR/GBP remains in its declining channel even if the pace of depreciation has slowed down. The euro reached 0.7041 against the sterling yesterday after losing 5.5% in less than 3 weeks.

USD/CHF stands at a turning point, testing the strong resistance at 0.9525 implied by the conjunction of its 50dma and 200dma. The dollar will need fresh boost to validate a break to the upside, if not the pair will find support at 0.9052 (Fib 61.8% on January 16 – March 12 rally).

Today’s economic calendar is light, however traders will be watching MBA Mortgage applications from the US and Bank of Canada rate decision at 14pm GMT. G-7 finance ministers and central banks chiefs meet in Dresden, Germany. The meeting will last three days until Friday.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.