Market Brief

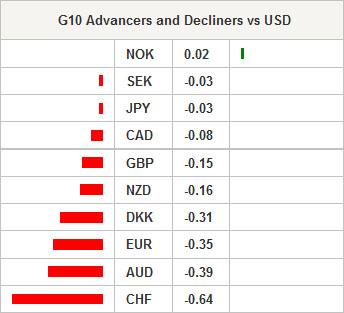

The last 2 weeks were not easy for dollar bulls with the dollar index down 3.6% at 94.39 on April 30th, the lowest since February 26th. Finally, the greenback got some respite last Friday and even enjoyed a quiet Asian session. Japan markets are closed this morning as the Golden Week takes off, today is Greenery Day; Tokyo will also be closed tomorrow due to Children Day and Wednesday as well. Talking about holidays, UK traders are also off today due to Early May bank holiday. Expect thinner trading volume, especially today.

China’s HSBC Manufacturing PMI was revised lower to 48.9 from 49.4 (49.2 prior read). Hong Kong’s Hang Seng edges up 0.12% while the Shanghai Composite is up 0.50% to 4,463 points. In India, equity markets erased losses from last week and are back at 27,335, up 1.20% during the session. After last week’s sharp moves, USD/JPY is edging down toward 120, slightly below the 50% Fibonacci retracement level (120.18) on March sell-off.

AUD/USD is trading sideways this morning after reaching a 3-month high at 0.8076 last week. The Aussie is currently sitting on the 0.78 resistance (Fib 50% on April rise and psychological level). On the downside, the pair should find some support around 0.7741 (Fib 61.8%) and then around the 0.7550/70 area (multi lows). A resistance lies at 0.7920 (high from April 30th) and further at 0.8076 (high of April 29th). Australia’s building approval in March rose 2.8%m/m in March while analysts were looking for a contraction of -1.5%m/m. Markets expect the RBA to lower its cash rate by 25bps to 2%, while prior was revised higher from -3.2% to -1.6%. However, we think that the Royal Bank doesn’t want to add fuel to the fire as the housing market is clearly showing no sign of a cool down.

EUR/USD is down to 1.1184 this morning, consolidating slightly lower from last week high of 1.1290. The next support stands at 1.1043, previous highs from March. While on the upside, the euro will need some fresh boost to break the 1.1380 resistance (high from February 26th). We think that the current dollar weakness is temporary and traders will soon start to price in again the upcoming rate hike from the Fed. However, before increasing rates the Fed needs to see further improvements in the job market and inflation level. It’s all about data.

USD/CHF remained quiet in Asia and is trading slightly higher this morning, getting closer to the key 0.94 level. On the upside, a resistance stands around 0.9451/81 (multi highs and lows). EUR/CHF found buying interests last week and was able to take off, testing 1.0523 at the highest, amid SNB’s decision to tighten exemption rules from negative rates. The euro is consolidating around 1.0460.

Today traders will watch April Manufacturing PMI out of Eurozone (and separately from France, Spain, Italy and Germany), April SVME PMI from Switzerland, March Factory orders from the US while FOMC member William will speak tonight.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.