Market Brief

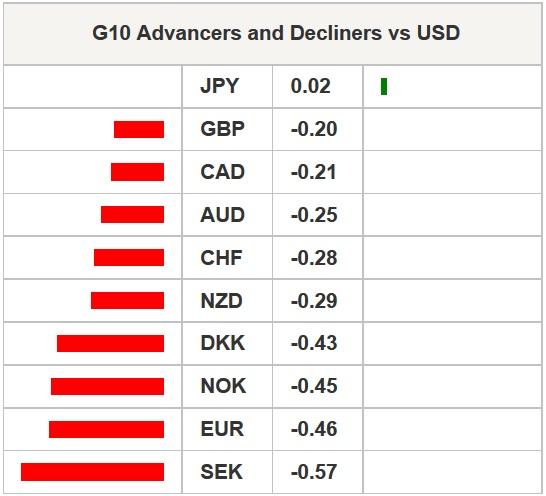

The last trading day of the quarter has been subdued. In the Asian session, FX markets were dominated by more USD strength as traders further priced in policy divergence. However, due to the short holiday week, trading volumes are already thinning and direction lacking conviction. Regional equity markets were broadly higher with only the Nikkei (down -0.51%), breaking up the green across the screen. US stock futures are pointing to a higher open. Once again it was commodity currencies that led the G10 downwards slide. AUDUSD dropped from 0.7665 to 0.7620 despite the strong new homes sales data which posted a 1.1% increase. NZDUSD after a brief rally to 0.7511, fell to 0.7473. Again the better than expected data in business confidence (35.8 up from 43.4) did little to generate NZD demand. NZDUSD is now trading below the 65d MA putting the immediate risk of a retest of cycle lows at 0.7200. USDJPY bounced around 120.0 and 120.35 for most of the session with no directional bias. USDJPY base is complete the next bullish target should be 121.20 (3/20/15 high). Oil futures fell as Iran and world powers seem to have moved closer to a deal that could lessen sanctions and open up more Iranian crude to the worlds markets.

In the European, session traders will be watching UK final Q4 GDP growth expected to be unrevised at 0.5% q/q. GBPUSD has been consolidating loses around the 1.4790 areas but our bias is towards further downside. Despite UK accelerating economy, inflation is worryingly low which will keep the BoE from any policy action in the foreseeable future. In the short term growing political risk generating from the upcoming, highly uncertain, election will weigh on the sterling. With GBPUSD comfortable below the short term downtrend at 1.4880 indicates a test of 1.0458 low.

From the Eurozone, expect flash HICP inflation to rise from -0.1% y/y to 0.0% y/y in March. Markets expect euro area unemployment to stay at 11.2% while German unemployment rate to be flat in March at 6.5%. With the markets focus on US data (payrolls) and developments around the Greek reforms negotiations, this data will go unnoticed unless we see a significant surprise. Yesterday, Prime Minister Alexis Tsipras hit the wires again to appeal for a "honest compromise" with creditors but warned that “unconditional” deals would not be accepted. With the Greek debt situation still far from being resolved, our short term bias is to the downside for EURUSD. A close below the 21d MA would indicate a bearish move towards 1.0458.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.