Market Brief

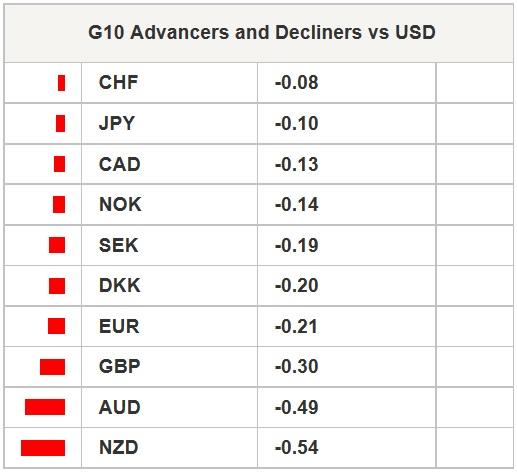

The FX markets started the week in a subdued fashion with the USD slightly stronger verse G10 and EM currencies. In Asian equity markets, Chinese stocks were the big gainers with the Shanghai composite up 2.47% aided by PBoC governor pro-growth comments. The Hang Seng and Nikkei rose 1.73% and 0.65% respectively. S&P 500 futures are pointing to a stronger open. Commodity currencies (AUD, NZD, NOK and CAD) were under pressure following falls in Oil. extended loses as fear of supply disruption from military operations in Yemen were exaggerated (but situation remains fluid). Lingering worries over the lack of a tangible bailout solution for Greece will renew USD buying. In Japan, industrial production collapsed -3.4% m/m verse -1.9% expected. The decline was broad-based but critically focused in key export industries. The sharp decline may have been caused by slower demand from China during the New Year. USDJPY remains contained in at 118.95 to 119.50 trading range.

USDCNY fell on the open to 6.21 and the fix was only slighter higher. PBoC governor Zhou Xiaochuan provided markets with reassurance that managing a soft-landing would be the highest priority. China's central banks chief suggested that the countries growth rate had fallen too much and that policy makers had plenty of tools to respond. Governor Zhou mentioned using both interest rates and quantitative measures. He also highlighted declining inflation stating “we need to be vigilant to see if the disinflation trend will continue.” A pro-stimulus comment if there every was one. In regards to foreign exchange which policy makers have become extremely involved with recently (see Weekly Report), Zhou said China will change regulations radically this year. We remains constructive on the CNY based on China massive firepower still unused. China will continue to move in a proactive manner which will revive growth by Q3 2015.

In the European, session the focus will be on developments around the Greek reform proposal to the Eurogroup. With Greece running out of money negotiations are key for Greece to avoid an liquidity event (next Monday a €450m loan payment is due to IMF). Officials on both side stated that weekend talks were positive yet slow. Creditors have demanded that Greece must implement reforms before any of the €7.0bn from the bailout fund is disbursed. The most recent reform proposal looks to put property tax concession at the middle of the new agreement (estimated to raise €2.5bn of €3.0bn needed). However, Greece’s new reform has failed to include changes to labor laws and pension systems which are essential according to creditors to the final bailout program. We remain bearish on the EUR. Rejection at 1.1098 resistance areas suggests a test of 1.0570. Spanish HICP inflation provided a slight turn around at -0.7 from prior read at -1.2%y/y. Swiss KoF surprisingly increased to 90.8 verse 89.1 expected (prior revised to 90.3) decline.

In the US session personal spending & income, PCE deflator and pending home sales will hold traders attention.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.