Market Brief

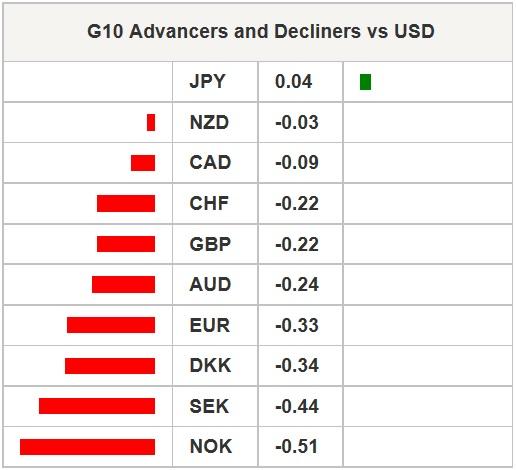

The USD paired losses in Asia and outperformed the majority of G10 and Eastern European currencies. The emerging Asia extended gains verse the greenback yet the sell-off should start curbing with the Fed officials’ comments in focus. SF Fed’s Williams said yesterday that mid-year rate rise should be appropriate (in line with the first rate hike in June and gradual normalization). US economy can handle strong USD, he added. While Dallas Fed’s Fischer (known to be a hawkish member) repeated that extremely low rates increase the financial instability. All in all, there is a hawkish shift in expectations for the first FF rate hike, to happen in June rather than in September, according to implied probabilities extracted from the rate markets. This means that gains in high yielders could soon come under pressure.

To be released today (at 12:30 GMT), the US consumer prices should remain soft due to weak oil prices in February. However, the soft inflation alone does not seem to worry. In his speech yesterday, Fischer mentioned the inflation is expected to gradually move toward Fed’s 2% target. In the meanwhile, the lower oil prices are good for fueling the economic activity and the lower inflation gives flexibility to Fed-doves to maintain their cautious stance to sustain growth. Risk-on warranted!

Rapidly into the EM: the USD/TRY eased to 2.5405, a rebound back to 1.5725 will get the price back to January-March uptrend channel. The USD/ZAR eased to the Fibonacci 50% on Feb-Mar rally, levels below the 50% Fib are seen as fragile walking into SARB meeting (Thu). The USD/BRL fell to 3.1307 as the S&P affirmed country’s investment grade rating. This is important for the short/mid-run capital allocations in portfolios. With the 1-week realized volatility above 32% however, the challenge should stay strong at 3.00/10 area.

An important issue this week is the Greek / EU negotiations. Even if Tsipras and Merkel did not come to a conclusion yesterday, the EUR/USD is better bid, at least on efforts that are being put into discussions. The ECB President Draghi spoke to European Parliament Committee in Brussels yesterday. EUR/USD advanced to 1.0971 as Draghi said the ECB will reinstate the Greek waiver if the review is successful. We still keep in mind that Greece should service 2 billion euro debt on Friday (besides paying salaries to government workers and pensions) and can do it only by rolling over its treasury bills as the ECB stopped funding the Greek banks in February. This gives the Greek banks the choice between participating to fund raising to save Greece, or to let it default. The second scenario could harm the recent EUR gains, if avoided a EUR/USD break above 1.1043 (last week high) will shift the next resistances to 1.1280 (Fib 76.4% on Feb-Mar sell-off), then 1.1534 (Feb 3rd high). In the mid-run however, the divergence between the ECB and the Fed keeps the bias on the downside, with the parity being still the key target.

Across the Channel, the GBP/USD faces offers at 1.50+ before the inflation read (at 09:30 GMT). Soft inflation should send the GBP/USD lower on concerns that Carney will be tempted to keep the rates at low levels for a longer period of time as strong pound reinforces the disinflationary pressures. In addition, the pre-election talks anchor the market on the sell side. Offers pre-1.50 should be cleared for a fresh bullish reversal signal.

We are heading into a data-full day. The focus of the will be the inflation figures in the UK (Tue), the US (Tue). In both countries, the consumer prices should have softened further on weak oil prices in February. As the lower oil prices are good for fueling the economic activity, the lower inflation gives flexibility to central banks to maintain their dovish policy stance to sustain growth. The dovish Fed being already priced in, the impact of soft inflation should lead to a negatively skewed GBP/USD through the day.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Bitcoin price could be primed for correction as bearish activity grows near $66K area

Bitcoin (BTC) price managed to maintain a northbound trajectory after the April 20 halving, despite bold assertions by analysts that the event would be a “sell the news” situation. However, after four days of strength, the tables could be turning as a dark cloud now hovers above BTC price.

Bank of Japan's predicament: The BOJ is trapped

In this special edition of TradeGATEHub Live Trading, we're joined by guest speaker Tavi @TaviCosta, who shares his insights on the Bank of Japan's current predicament, stating, 'The BOJ is Trapped.'