Market Brief

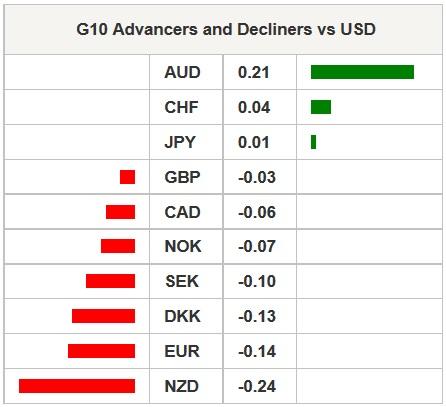

Today’s key event is the US jobs data. Amid good ADP read on Wednesday, the consensus for the NFP is a strong 235K (vs. 257K last month) with lower unemployment rate (5.6% vs. 5.7% last) and higher wages in February. The US 10-year bonds stabilize at about the 100-dma (2.1162%), sign of increased expectations for the Fed rate hike to happen sooner rather than later (June is the earliest we see).

USD/JPY advanced to 120.40 in New York yesterday (a stone’s throw lower than Feb 11/12th double top (120.47/48). The bias remains positive with good USD appetite. US jobs data will determine whether it is time to pull out the resistance and challenge Dec’14 high (121.85). Large vanilla calls above 119.80/120.00 should limit the downside before the week’s closing bell.

USD/CHF extended gains to 0.9750, EUR/CHF holds ground above the 21-dma (1.07445) still choppy on the upside with globally negative EUR sentiment.

In line with the consensus, the BoE and the ECB maintained status quo in March. While the BoE decision gathered little attention, the ECB President Draghi’s speech triggered price action in the EUR-complex. EUR/USD first rallied to 1.1114 on favorable inflation expectations and economic outlook, then tumbled down to fresh 1-year low of 1.1006 as 1. ECB said the QE may extend beyond Sep’16 if needed, 2. ECB will buy negative yielding bonds up to deposit rate and 3. Greek banks are in good shape yet progress on bailout is needed to avoid a situation where the country would not fulfill the conditions to become eligible and therefore would be left out of the QE program. The sentiment in EUR remains negative while the failure to break below 1.10 psychological support will likely encourage corrective bids before the US NFP read in New York today. A strong read should trigger fresh sell-off in EUR/USD and challenge the 1.10 support for the second consecutive day.

In Brazil, USD/BRL traded above 3.00 (hit 3.0216) for the first time since 2004 on broad USD appetite. February inflation is due today and is expected to accelerate to 7.56% from 7.14% last. Higher inflation keep the BCB-hawks alert, however the selling pressures in real should remain pre-NFPs. Moving forward, although the political tensions are long-term issue, temporary cool-off will create window for tactical long carry positions (with relatively interesting rate spread amid additional 50 bp hike on Wednesday meeting).

Besides US jobs (February NFPs, unemployment & participation rate, earnings), traders watch the SNB’s FY earnings and February FX Reserves, German and Spanish January Industrial Production m/m & y/y, French January Budget and Trade Balance, Spanish January House Transactions y/y, Swiss February CPI m/m & y/y, Swedish February Budget Balance and Average House Prices, Norwegian January Industrial Production and Manufacturing m/m & y/y, Italian January PPI m/m & y/y, Euro-Zone’s 4Q Gross Fixed Capital q/q, Government Expenditures q/q, Household Consumption q/q and 4Q (Prelim) GDP q/q & y/y, Canadian January Building Permits m£/m and International Merchandise Trade, Canadian 4Q Labor Productivity q/q, US January Trade Balance and Consumer Credit.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.