Market Brief

The week starts with bad news out of Japan. Japanese economy unexpectedly entered recession amid 3Q preliminary GDP reading showed 1.7% q/q annualized contraction (vs. 2.2% exp. & previous -7.1% revised down to -7.3%). The impact of April’s sales tax hike has been heavier than anticipated on the Abenomics. The PM Abe is shortly expected to delay hike in sales tax and announce snap elections in December. USD/JPY and JPY crosses took a dive in Tokyo, Nikkei stocks started the week -2.96% lower. USD/JPY hit the fresh high of 117.05 before tumbling to 115.46 post-GDP. Once the negative GDP digested, the anticipation for more growth supportive measure should continue giving support to JPY-crosses. Option bids are seen at 115+. More support is given at 113.86/112.45 (Nov 3th low / Nov 10th low). On a similar pattern, EUR/JPY advanced to fresh year of 146.53 before correction.

Released on Friday, the US retail sales data surprised on the upside in October release. The headline retail sales grew 0.3% on month (vs 0.2% exp. & -0.3% last), retail sales ex-autos and gas surged 0.6% m/m (vs. 0.4% exp. & -0.1% last). EUR/USD shortly tested 1.2400 bids and rebounded to close the week at 1.2525, sending MACD in the green zone. The short-term technicals now hint at deeper upside correction. Resistance is seen at 1.2688/97 (50-dma / daily Ichimoku base), then 1.2744 (Fibonacci 23.6% on May-November drop). EUR/GBP tests 0.80 resistance. With strengthening bullish momentum, the focus shifts to 200-dma (0.80573).

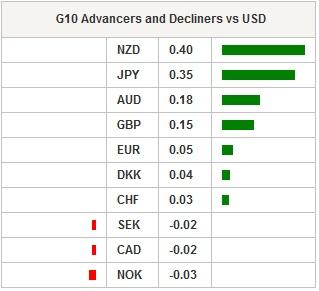

The antipodeans were well bid at the start of the week. Australia-China Free Trade Agreement gave support to AUD overnight. AUD/USD extended gains to 0.8796, NZD/USD remained well bid above the 50-dma (0.7923). The broad based JPY strength post-Japan GDP somewhat curbed the appetite. Combined to global sentiment still USD-positive, the upside attempts will likely remain limited. NZD/USD offers are eyed at 0.8000/0.8034, AUD/USD resistance is seen at 0.8870/90 (Fib 38.2% on Sep-Nov drop / daily Ichimoku base).

EUR/CHF trades at the tight range of 1.20115/1.20185. As selling pressures continue 10 pips above the critical 1.20-floor, traders stand ready for an SNB intervention. Large option barriers are placed at 1.2030 for today expiry.

The weakness in oil markets continue. The WTI crude opens the week 1.15% lower after hitting $73.25 on Friday; the Brent traded at $76.76 and closed the week slightly higher on speculation that OPEC may be tempted to cut production if prices remain below $80. USD/RUB rallied to 47.8754 on Friday as Russian President Putin said to consider and to admit all scenarios including “catastrophic fall of prices for energy sources”. Trend and momentum indicators in USD/RUB are comfortably positive, pressures on 48/50 offers should remain tight.

Today’s economic calendar: Swedish October Unemployment Rate, Norwegian October Trade Balance, Euro-zone and Italian September Trade Balance, Canadian September International Securities Transactions, US November Empire Manufacturing, Canadian October Existing Home Sales, m/m, US October Industrial Production and Capacity Utilization and US October Manufacturing (SIC) Production.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.