Market Brief

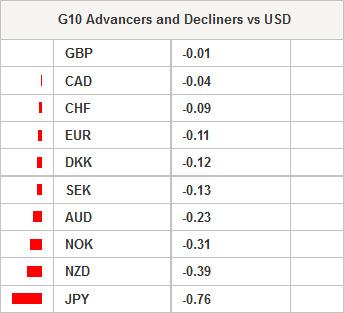

Japanese current account surplus increased to 963.0 billion yen in September, significantly more than 537.7 billion expected (287.1bn last); trade deficit narrowed from 831.8 to 714.5 billion yen. The sizeable depreciation in Yen and lower oil prices are most probably the leading explanatory factors in outstanding BoP print. USD/JPY and JPY crosses rallied in Tokyo, Nikkei stocks gained 2.05%. USD/JPY hit 115.45, stone’s throw below 7-year high 115.59. The pair is deeply overbought, yet pressures remain on the upside. Stops are eyed above 115.60/116.00. EUR/JPY consolidates gains at 142.59/143.36. The key resistance stands at 145.69 (Dec 27th high).

EUR/CHF legged down to 1.20218 yesterday. Downside pressures remain high as tensions on “Gold referendum” mount. The option markets are shifting toward “yes” pricing. We stand ready for SNB intervention should the pressures on 1.20 floor do not ease. In the gold markets, trend and momentum indicators remain on the downside. We see formation of bearish belt hold line suggesting the exhaustion of uptrend. Offers remain solid at $1,200.

Today, SEK-traders watch Riksbank October meeting minutes and October inflation data. The inflation expectations remain soft, the consensus is -0.1% deceleration in month to October (-0.2% y/y vs. -0.4% y/y in Sep). It is clearly too early to see the impact of October 28th aggressive 25 basis point rate cut on the macroeconomic data. USD/SEK extends gains in the continuation of ascending channel building since March. Trend and momentum indicators are comfortably positive, 7.45/7.50 levels are at the radar. On the downside, support is seen at 7.3119 (21-dma), then 7.2228 (50-dma & Apr-Nov uptrend base). EUR/SEK remains well bid above 9.18/23 (including 21/50 and 100-dma & July-Oct downtrend top), key support is seen at 200-dma (currently at 9.0882). The pair did not trade below its rolling 200-dma in more than a year.

The Russian Central Bank moved closer to a free-float mechanism by removing its predictable intervention policy framework and RUB basket band yesterday, therefore giving itself freedom to intervene unannounced when market moves in RUB threatens country’s financial stability. Unhappy to see the RUB liquidity played against the good of Russia, the CBR will fight speculative unwinds by adjusting supply. The shift toward free-float RUB triggered RUB rally at the week start (+2.43% vs. USD on Monday), yet the overall bias remains comfortably RUB-negative, now that the RUB will be increasingly subject to macro factors as inflation, current account balance, oil prices, and geopolitical tensions – all seeming to go against RUB. We expect a bounce back toward 48/50 offers. Russian trade data and official reserve assets are due today.

G10 economic calendar is light, little data flow out of the US due to Veterans Day holiday. Traders watch Swedish October Unemployment Rate, CPI m/m & y/y, Spanish September House Transactions y/y, US October NFIB Small Business Optimism.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.